Overview

I generally do not trade in Bajaj Finance. I prefer Index counters more. However on 8th July it fell 10% and came on my radar. Note the Bajaj duo (Bajaj Finance and Bajaj Finserv) were the biggest losers on Nifty that day. On that day I added this counter on my radar and also missed one trade opportunity.

Note I am not SEBI registered Analyst and this is not recommendation. This is my online trade log for reference and others can also use it as learning process.

Trade Details

I used couple of tools for this trading.

- Bajaj Finance Open Interest Excel Sheet (download link)

- Support and Resistance as shown in below image

I was planning to take position of Bajaj Finance July 3600 CE at 40 on 8th itself. But later corrected that to 30 which was my mistake as counter never hit 30.

Next day (9th July) Bajaj Finance rallied 5% and I missed the Opportunity. Following day (10th July) towards the end it again corrected close to 5%. I did not miss the opportunity this time and made entry at 40 for July 3600.

I wanted to carry on the position next day as I was under impression that it will again bounce at least 1% or 2 %. Note the script was bouncing from levels below 3,400 for past couple of days (refer the image above).

Also the positive day volume was more than negative day volume even if movement was less. This tells that script is in positive bias as of now.

Profit Details

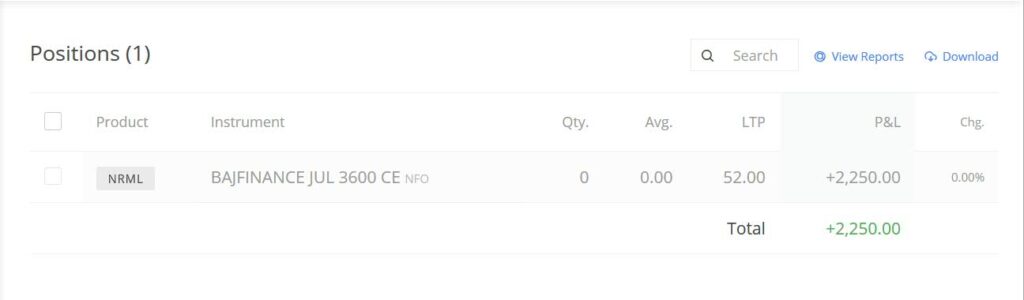

Below is profit details proof for visitors and my own record. Below is my investment and profit details

- Bought Call of 3,600 at 40.

- Total money is (250 *40) = 10,000 as lot size is 250 for najFinance

- Sold the Call of 3,600 at 49

- Total money made = (250*49) = 12,250

- Total Profit = 12,250 – 10,000 = 2,250

- Profit percent = (2,250 / 10,000 ) * 100 = 22.5%

Lesson Learnt

Below are lessons learnt from this trade which will help me in future trades

First Lesson

The first opportunity should not be missed.It diminishes profit potential if played later and may even result in loss sometimes. I should have bought on 8th itself.

Second Lesson

I wanted to buy at 40 initially on 8th and seeing the fall wanted to make sure I buy at lowest price. This does not work sometimes and you should be open to buy at 5% above price if profit expected is more. So instead of changing the price to 30 I should have kept 40 intact.

Third Lesson

It is good habit to track biggest loser and biggest gainer on Nifty. It may give good trade opportunity the following day. So instead of playing on fixed Stocks it is better to explore others on a given day to increase number of trades.