Overview

Bajaj Group is one of the most reputed Business groups of India. You may have heard the name Bajaj Pulsar and other bikes from Bajaj company. These bikes are produced by company name Bajaj Auto. Bajaj Auto is the flagship company of Bajaj Group. But it is not the only company from Bajaj Group. There are more lesser known companies making great wealth for investors over the years without being too much in lime light. In fact in close analysis they seem to out perform the flagship company in terms of profitability for investors.

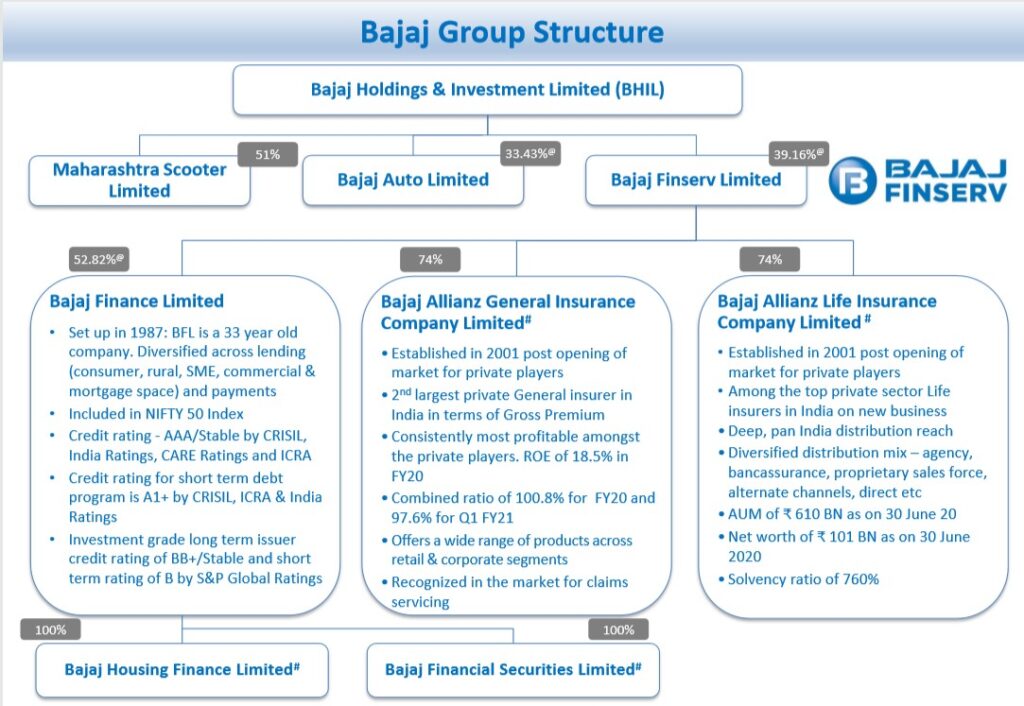

Bajaj Group Structure

This step is taken care of from preparing list of companies from well known groups. You can use this list to prepare your stock watch list for investing. Below is the corporate structure of the Bajaj Group. So if you are investing in Bajaj Holding and Investment then it means you are investing in whole group.

- Bajaj Auto – Deals with two wheelers. It is one of the largest company in this segment.

- Bajaj Finance – A Micro finance company

- Bajaj Finserv – Bajaj Finance is subsidiary of Bajaj Finance.

- Bajaj Holdings – Bajaj Holdings is investment arm of Bajaj Group

- Maharastra Scooters – It produces Scooters and is part of Auto segment,

Bajaj group company performance

I have listed all the companies from the group and their performance for last twenty years. In case some of the companies are not available for 20 years in that case I have taken the tenure from IPO listing data. The IPO listing close price is used to calculate the returns as many investors do not get IPO at offer price.

| Company | Return % |

|---|---|

| Bajaj Auto | 1502% |

| Bajaj Finance | 105,239% |

| Bajaj Finserv | 955% |

| Bajaj Holdings | 3750% |

| Maharashtra Scooters | 6943% |

The return of Bajaj Finserv is from year 2008. Note the group has positive returns for all the stocks. This is great feat by any measures. Bajaj Finance being the largest wealth creator for investors over last couple of decades with stellar 1 lakh percent returns. Based on the performance it can be considered as one of the top performing corporate groups for Investors.

Barring Bajaj Finserv other companies are good dividend players as well. So anyone invested in those companies are benefited by price appreciation and dividend increase with time as well.

Bajaj group company market cap

Many investors are interested in market capitalization of a company to make their investment decision. Large cap companies are well discovered compared to mid cap and small cap. So there is great possibility along with risk involved with small cap investing compared with large cap investing. I am listing down the Bajaj group companies based on the market cap so that you can get an idea. We have seem with Tata group that some companies are still small cap whereas all companies from HDFC group are largecap.

| Company | Market Cap |

|---|---|

| Bajaj Auto | Large Cap |

| Bajaj Finance | Large Cap |

| Bajaj Finserv | Large Cap |

| Bajaj Holdings | Large Cap |

| Maharashtra Scooters | Small Cap |

English Video

Hindi Video

Bajaj Group company details

Bajaj Auto – Riding two and three wheeler

Bajaj Auto is one of the leading Auto Companies of India. It is World’s fourth largest three and two wheeler manufacturer of India. It is flagship Company of the Bajaj Group. It is also part of Nifty as well.It exports to 70+ countries and a significant share of revenues come from Exports. It exports to several countries in Latin America, Africa, Middle East, South and South East Asia.

Below are list of brands in different vehicle types created by Bajaj Auto

- Electric Scooter

- Chetak

- Motorbikes

- Dominar

- Pulsar

- Avenger

- Platina

- CT

- KTM

- Three Wheeler Vehicles

- RE

- Maxima Wide

- Maxima C

- Maxima Z

- Quadricycle

- Qute – First Quadricycle of India

Most of these products are also available in overseas market as well.So it can be seen as money making machine over the years. The dividend yield is also incredible with close to 4% dividend yield. It has been a regular dividend payer over the years. This generates revenue to the investors and people have made money in this counter.

It is one of the leading Companies in India. It commands more than half three wheeler market share in India. It also commands more than eighty percent three wheeler export market share.It also has good market share in Two wheeler segment. The Company has tough competition in this space with Hero Motocorp as both of them cater to same customer base with price ranging more or less the same. Other major player catering to same customer base is TVS motors.

It is really the three wheeler segment where it has monopoly kind of situation. Also the recent launch of Electric Scooter and Quadricycle will give boost to Company revenues.Quadricycle may become good option for low budget taxi as well as personal vehicle though the Company is promoting it as low budget taxi only not personal vehicle. But it is relatively new and Company is trying to woo the segment.

The Electric Scooter looks promising and with popularity of Scooty this one may become popular. I think this segment can be potential growth driver for the Company in coming days as people are focusing on eco friendly commute.

Bajaj Finance – The Microfinance NBFC

Bajaj Finance limited is one of the leading Financial Companies in India.It is in lending business. It is one of the three Companies from Bajaj Group which is part of Nifty.The Company has below business objectives

- Lending in Consumer, Rural, SME, Commercial and Mortgage space

- It lends in Consumer Durable space like Consumer Electronics items which proved to be difference maker between this Company and other lending Companies.

The Company has two subsidiaries both of which are not listed

- Bajaj Housing Finance Limited

- It is 100% wholly owned subsidiary.

- It offers Home Loan Solutions.

- Provides loan to Individuals and Corporates

- In short Demat and trading account brokerages

- Bajaj Financial Securities Limited

- It is also 100% wholly owned subsidiary.

- It offers Capital Market Solutions.

- Equities, Mutual funds, Corporate deposits, Bonds etc

- In short Demat and trading account brokerages

The Company provides interest-free EMI finance options in more than 50 categories, ranging from consumer durables to lifestyle products to groceries. This is the unique selling point of the Company. It started as two wheeler and three wheeler Auto Finance Company but has changed itself and now have presence in major loan segments.

Bajaj Finance has revolutionized the loan or lending business. It ventured into the Consumer business and Consumer Durable with interest free loans which was not focused more by other players in this niche. With early movement in the niche and having commanding position in the same it has benefited and continue to do so. This segment propelled growth of the Company in recent times which is reflected in stock prices a well.

Bajaj Finserv – Insurance company of the group

The Company was formed in year 2007 to focus on Financial Services space. It was formed as demerger from the flagship company Bajaj Auto. So it is holding Company for Financial services of the Bajaj Group. It is part of Nifty as of this writing.It is umbrella Company of companies listed below. It carries out the business using these Companies.

- Bajaj Finance Limited

- Has 53% share holding it this Company

- It is listed entity and is part of Nifty as of this writing.

- Works in Lending like (Consumer, Rural, SME, Commercial and Mortgage )

- It also stated Demat services as well

- Bajaj Allianz General Insurance Company limited

- Has 74% share holding in this Company

- It is not listed entity

- Works as the name suggests in General Insurance space

- 2nd largest private general insurance player in India based on Gross premium

- Bajaj Allianz Life Insurance Company limited

- Has 74% share holding in this Company

- It is not listed entity

- Works as the name suggest in Life Insurance space

- Both Bajaj Allianz General Insurance and Bajaj Allianz life Insurance are joint ventures with Allianz which is Global Gaint in the space.

It also has wind farm assets in Maharastra. The installed capacity of it is 65.2 MW.

Investing in this Company is proxy play to Insurance growth story or Insurance penetration story of India. The Insurance penetration in India is very low compared to other developed countries. So with time people are assuming that Insurance penetration will be higher.

So there is scope of Growth in this sector. There are very few companies listed which are present in both Life Insurance and General Insurance business. So it is play to both Life Insurance as well as General Insurance business. Along with Insurance business the Lending business of Bajaj Finance is yet another revenue stream for the Company. So it also grows with growth of Bajaj Finance. I have covered Bajaj Finance in other article so you can read details of it in that article.

Based on the above things it is one good bet to play the growth of Insurance sector as well as lending business. I would like to see more dividend yield in future and hope Company provides the same. It is sound Company with good management and has growth opportunities in sectors it operates which makes it one of the interesting companies for Insurance sector investors.

Bajaj Holding and Investments – Umbrella company of group

Bajaj Holding and Investment Limited is the Holding Company of Bajaj Group of Industries. The Company has stakes in three listed Companies of Bajaj Group of Companies.

- Maharastra Scooters

- It has 51% stake in this Company

- Bajaj Auto Limited

- It has 33% stake in this Company

- Bajaj Finserv Limited

- It has 39% stake in this Company

So the Company has decent stakes in Auto business of the group as well as Financial business of the group. I have already analyzed these Companies in details in other posts.In case you are interested to know the details of these Companies then you should go through those articles. Bajaj Auto and Bajaj Finserv along with Bajaj Finance are all part of Nifty and are listed entity.

The Growth of underlying Companies helps the holding Company. Also the underlying companies also have exposure to cash reserves of holding company which they can use for further growth.The dividend yield of the Company is also good like most other holding Companies. I would like to see the dividend yield top the 2% mark which is good for holding Companies.

Holding Companies are analyzed differently then other Companies. One important aspect of analyzing holding Companies is to evaluate all the underlying Companies of it and share holding it has in those Companies.So if underlying Companies will grow so will the holding Companies. Generally major income of holding Companies is through the dividends paid by underlying Companies.

So you should also consider whether the underlying Companies are good dividend payer or not.You should also check whether the underlying Companies will grow with time or not. The dividend yield of the Holding Company is also important.

Bajaj Holding does pay less dividend compared to many Holding and Investment Company. Also apart from Bajaj Auto the dividend yield of other Companies are not that great. There are better holding companies present in the space and one can evaluate them before making a decision.

Maharashtra Scooters – Smallcap of the group

Maharastra Scooters may seem to be unfamiliar name. But if I tell you this is the Company behind famous Scooter brands of past like Bajaj Super and Bajaj Chetak then you may recognize it.These two were most popular Scooter brands of that time. That time Motorcycles were not that popular. But with time Motorcycles became the first preference and Scooters lost their shine.

As of now the Company has discontinued production of all three brands of Scooter like Priya and the two mentioned above. It does not do any Scooter manufacture as of now.It has now ventured into manufacturing of pressure die casting dies, jigs and fixtures which is required in two wheeler and three wheeler. The Company is subsidiary of Bajaj Holdings limited.

Maharastra Scooters as mentioned above does not have any concrete business. The products created by this Company are mainly absorbed internally.The major growth trigger for this Company is the share holding in Financial Arm of Bajaj Group. Due to this share holding the Company is valued by investors.

So it is a kind of Holding Company with its own manufacturing of some auto parts. The returns generated by this Company is due to performance of Financial business of Baja Group.So before making any business decision you should keep in mind above facts.

Conclusion

Before investing money we select or hand pick companies.Most we pick up known companies or companies we have heard for. This limits our scope of research.To broaden the search and including more companies in analysis the easiest approach is to select companies from stable of well known Management houses. In this way you are including only quality company. This quality check removes garbage companies from your list immediately.

So you are safe from one side. The initial list preparation is very important for any investor. As based on this initial list he will analyze and select the companies to invest in.With this aim in mind I created list of companies from different Management groups who have proven track record over the years. Screening and evaluating Management is most important part of Fundamental analysis and perhaps most difficult one.

Bajaj Group has 3 companies present in Nifty50 out of 5 companies listed on exchanges. It is only behind Tata group in number of companies present in Nifty and tallies with HDFC group. The companies which are not present from the group in Nifty are the holding companies only. Based on the investor returns and performance of all companies in the group it can be considered as one of the top corporate groups in India for investors.