English Video

Hindi Video

GameStop Story in Easy Words

Before diving into GameStop story I will like to explain few technical terms like Short and Short Squeeze. These terms will be used later in the article so better to understand them first.

- Let’s assume that cost of 5 Apples is 10 INR

- Mr A has 5 apples with him.

- Now Mr B thinks the prices of Apples will go down in future.

- So Mr B said that he will buy 5 apples from Mr A

- Mr B then sells the Apples expecting the prices will go down. (This is shorting). Note Mr B does not have any apples with him as of now.

- Mr B thinks when prices will go down he will buy apples for cheap and give it to Mr A. So he will make money. For example if prices of Apples go to 1 INR then 4 INR is his profit.

- Now Mr A and his friends realized Mr B plan. They bought all the Apples so that Mr B has to buy Apples at higher price as he needs to return those to Mr A

- If Mr A and his friends do not sell then Mr B will have to buy at higher price. (short Squeeze) .

In above story Mr B is Big Hedge Funds and Mr A is common traders who got united on Reddit platform under the Sub reddit (community) Wall Street Bets.

WallStreetBets and their Leader

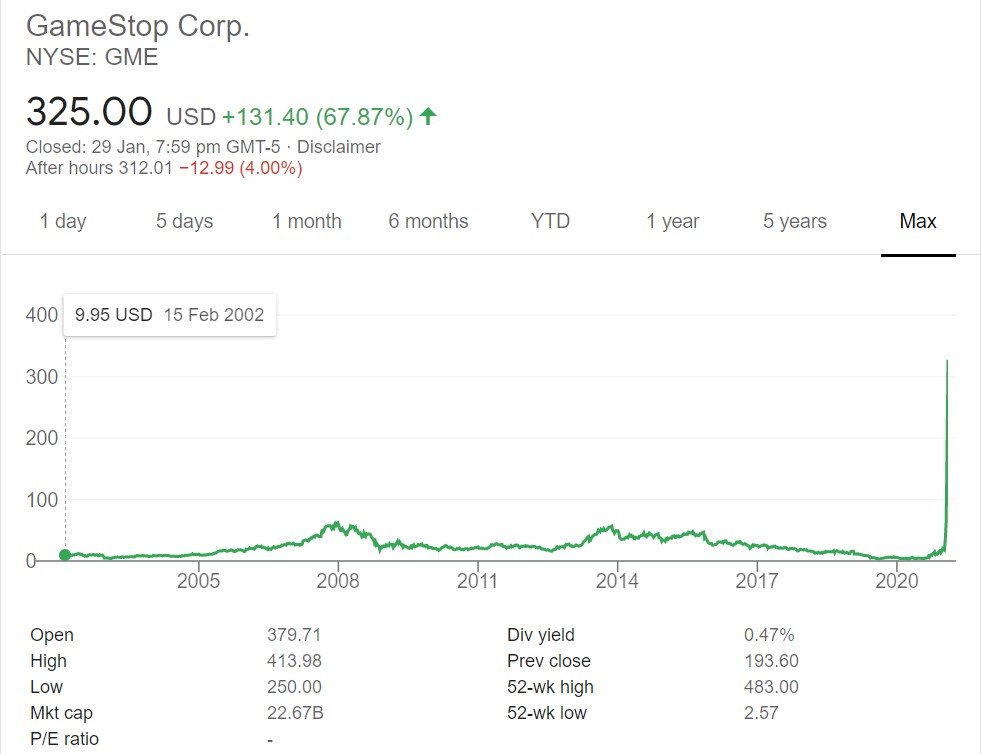

Now coming to GameStop it is Gaming Company listed in US whose stock performance is given below. As you can see the 52 week low price. Hedge Funds had huge shorts on this Company expecting the prices to plummet more and they can buy at lower levels making huge profits in between.

But the Hedge Fund game was spoiled by Reddit user (He is claimed as Leader of the movement and posted many screen shots of the Trade as well). As you can see the stock price appreciation in last two months is almost a straight line.

The stocks is in derivatives as well so people are buying Call options adding injury to Hedge Funds more. They are also buying it and holding it drying the supply of stocks and further raising the prices.

Indian version of WallStreetbets

There are many sub reddits (Communities) on the social media Reddit where Indian Traders and Investors gel together. They are also planning to imitate something similar to GameStop or GME feat in US.

They are planning to pump stock prices high so that everyone in the Community can make profit. There is ongoing discussion to select an stock which can be propelled to next height. Below is the link to most popular sub reddit on which the discussion is going on.

The sub reddit is named Indian Street Bets and trying to replica similar success as other sub reddit.

Indian Stock which can be GameStop

There are two things to consider while creating Indian version of GameStop or have success close to it. GameStop has Derivative trading so the Shorts and Shorts Squeeze comes into picture.

There are multiple threads and discussion on how to use a Cash Segment stock which defeats the very purpose of making Hedge Funds cry for shorting a stock heavily. So you can not replicate it with Cash segment stocks.

Also Indian market rules are different compared to US rules and there is less chance of replicating it here. But if it all is replicated here then the best candidates are stocks mentioned below.

For a stock to be like GameStop it should be trading low in price and people should be very bearish on it. These are two main criteria of the stock. Also there should be Shorts created on the Stock by big players (due to negative market sentiment).

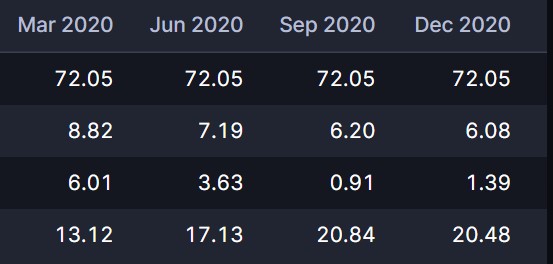

Only stock ticks all the boxes similar to GME in Indian context is Vodafone Idea. The reason I said so is. The FII and DII holding is going down with time and Public share holding is increasing. Also the share prices is very low to around 11 INR which is in reach of maximum Retail share holders.

Is it Ethical or Legal?

The market is all time high in month of January. The market crashed in March 2020. There was and still is Covid 19 rage all around the world. People are losing jobs and economic growth is stalled around the World.

In that gloomy situation markets are making new highs. People claim the reason is Liquidity in market and future growth projections etc. But many are not buying that theory and believe Big Funds are buying and forcing the prices to go high. All the retail investors who thought market will under perform lost money month after month.

Have you also noticed sometimes after good results also stocks are beaten down and after worse results also stocks perform. There are good stocks which do not perform and some stocks sky rocket for no reason what so ever but after certain period they are doomed leaving Retail investors dry and dusted.

WallStreetBets are making it as revenge story against Hedge Funds and people are rallying behind them. Retail Investors have always been at receiving end and this time they are wining so people are getting united.

Now is it stock price manipulation I do not think so personally. The reason is manipulation is when you trade or invest in stock based on Investor news or some other developments. This is just coming together and making profit. The same thing is done by Large Funds.

Large Funds have good amount of money so they do not need mass to rally behind them but Retail Investors do not have money power so they have to come together for price manipulation.

The only solution to this problem is to use tight laws and regulations to make sure Retail Investors interest is also preserved and stock price manipulation is not performed. But in ideal scenario this can not be done.

Stock price manipulation is real and it happens behind close doors. This time it is happening in lime light on social media platform.