Getting Started with Options Trading

This article is aimed to provide basic details about Options Trading. It is one of the most complex trading types and should not be started without proper understanding of the concepts. There are many books and paid courses available which try to debunk the secrets and teach you the technique.

I aim to provide practical guide to Options Trading in this series of articles starting from the basics in this chapter to more advanced forms. You can watch the videos in Hindi or English to get started on the topic.

I have also provided the details here for quick reference.

English Video

Hindi Video

What is CALL and PUT?

These are the two most important terms you will hear. The simple way to understand them is to understand below table or below two lines. Later we will see how the below meaning changes depending on the trade you take

- Call means Bullish that is price will go higher

- Put means Bearish that is price will go lower

Now Call and Put are represented differently as mentioned below

- Call is CE

- Put is PE

What is Strike price and Lot size?

This is other important basic concept you need to understand before trading in Options. You can trade in stocks or indexes which are part of Futures and Options. For example you can trade in Nifty, Bank Nifty which two are indexes and State Bank of India or TCS which is stocks present in F&O.

Lets understand strike price first. If SBI is trading at 501 then you can buy at 501 under stock trading but if you want to buy CE or PE then you will notice that there is no 501 CE or 501 PE. The reason is that for Options you do not have CE or PE for each and every price. NSE has it for some standard prices which depend on price of Stock or Index. In this case there will be 500 CE or 500 PE then other CE and PE will be by difference of 10 or 5.

So for each stock the strike prices will be different depending upon the underlying stock prices. Same is true for the indices as well.

Now that we have discussed the strike prices in details lets try to understand Lot size. For Stock buying you can fix the quantity you want to buy but for Options you have to buy predefined quantity which is called lot size in other words. Lot size is different for different stocks and indices. If stock price is more then lot size will be less and if stock prices is less then lot size is more.

What is Premium and Expiry Date?

Now that we have understanding of Lot size and Strike price it is time to understand Premium and Expiry date. Lets understand Expiry date first. The last Thursday of every month is expiry date for Options of that month. Expiry date is very important concept.

If you buy a stock then it will be in your account and you can sell it whenever you want. There is no expiry for stock buying. But it is not the same with Options. Each CE and PE will have month name with them as well. For example for State Bank of India you will have

- SBIN SEP 500 CE

Here SBIN is Symbol for State Bank of India and September is the month in which it will be valid. It cannot be traded beyond that. You cannot trade it in October. In fact like I said it expires on 29th Sept which is last Thursday of September. That is you can not trade in it on 30th Sept.

Now lets understand the concept of Premium. We will take example of SBIN SEP 500 CE only. Each CE and PE have some value associated with it which becomes 0 on day of expiry if the price of SBI will less than 500 in this case. If the stock price of SBI is around 550 then the 500 CE value will be (550 – 500) that is 50. Before expiry each of the CE and PE will have a value which depends on the stock price. Since the CE and PE will not be valid after expiry on expiry day depending on the price values become 0 as explained above.

What is Time Decay and Volatility?

Time decay is single most important concept one should understand and master before diving into world of options. It is the fundamental building block which dictates the strategies and different approaches a person takes for trading. So you should understand it clearly before moving forward.

As mentioned above Every CE and PE has a Expiry date. You can not trade in that CE and PE beyond that date. It is typically last Thursday of every month in case of Monthly expiring options and Thursday of every week in case of Weekly expiring Options.

Now lets understand it with an example. If I ask you a Question

- What is chances of TCS moving by 5% today?

- What is chances of TCS moving by 5% this week?

- What is chances of TCS moving by 5% this month?

In one day chance of moving TCS is less compared to one week. Similar chance of TCS moving by 5% in a week is lower compared to that of month. This chance of moving one stock or Index determines the premium we have to pay to buy the CE or PE.

So if TCS is trading at 4000 at 1st October then the TCS OCT 4500 CE premium will be more because the chances of TCS moving to 4500 in entire October month is greater. Lets assume the premium to be 10. As the month progresses like on 10th Oct if TCS is at 4050 the chances it will move till 4500 is less compared to what it was on 1st October. So the premium will decrease even if TCS has moved positively by 1% and we have bought CE.

Now October expiry is on 27th Oct which is last Thursday. So if TCS is at 4150 on 20th Oct the chances that premium will decrease is higher. As the chances that TCS will move from 4150 to 4500 in 5 trading sessions between 20th Oct and 27th Oct is less. So we saw that premium decreases with time even if our direction guess was correct and TCS has moved by 3% in that direction.

This chances of moving beyond the strike price you bought CE and PE determines the premium. The decrease in premium value with time is called Time decay. Hope you understood the concept of Time decay.

Now Volatility is simple concept compared to Time Decay. Volatility is measure of price increase and decrease of the Stock or Index. So if stock has moved more in positive or negative direction or there is swift fluctuation between positive and negative movement then it is said to be Volatile. The premium increases with Volatility.

The reason is same as before. If stock is volatile the chances that it will make big move is more. So it is highly likely it will breach the CE and PE you bought. You may see while trading that premium decreases if stock moved by 5% or 10% at start of the day but remained at that level till the end of day. The reason is towards beginning the premium increased lot expecting big move on the day but as price remained the same volatility remained flat and premium decreased.

What is Options Buying and Options Selling?

Now this is very important topic and I will use an analogy to make it clearer to you. Options buying and selling are different from Stock buying and selling specially the selling part. Buying part is still the same but selling is very different from stock buying and you need to clearly understand that for clear understanding of Options strategies we will discuss in later tutorials.

Options Buying

Lets understand this with an example for clarity. For example you think Nifty will touch 18,000 tomorrow. It means you are bullish on Nifty. Now recall the CE or Call means bullish or prices will go high. So if you want to trade Options then you will want to Buy Nifty CE. Now focus on the calculation shown below for clarity on price you have to pay

- Premium of Nifty SEP 18,000 CE is 100

- Lot Size of Nifty is 50

- Total amount you have to pay is = 50 * 100 = 5,000 INR

The same concept holds good for PUT buying as well. The total amount you have to pay for buying is Premium of the Strike price multiplied by the Lot size of the Stock and Indices. Options buying requires less fund in your account.

Options Selling

Options Selling is confusing topic. In stock selling you can sell a stock only if you have that stock in your account that is only if you have bought the stock previously. The quantity you can sell cannot be greater than the quantity you have bought. For example to sell 10 Infosys stock you need to have 10 or more than 10 Infosys stocks in your account.

But the same is not true in case of Options Selling. This makes it confusing topic for beginners. Lets take example of previous SBIN SEP 500 CE. You can sell this CE even if you have not bought the CE before. Yes you read it right. You need not buy it before. You can sell this CE and then later buy it.

Now lets understand the amount of money required to Sell Options.

- Premium of Nifty SEP 18,000 CE is 100

- Lot Size of Nifty is 50

- SPAN Margin – 80,000

- Exposure Margin – 20,000

- Total money you have to pay is = 80,000 + 20,000 + 50 * 100 = 1,05,000 INR

Notice the difference in amount you have to pay for Options Selling vs Options buying. Note the SPAN margin and Exposure margin depends on various factors like

- SPAN and Exposure margin depends on Volatility of the Stock or Index. If the stock or Index is less volatile then these two will be less. It will be more for volatile stocks and indexes.

- They also depend on the strike prices marginally. So closer strike prices have minimal differences in margins requirement.

- If a stock is giving good movement on a day then chances are that margins will be on higher side.

There is one more thing you need to understand in case of Selling. As mentioned above CE buying means bullish and PE buying is bearish. But in case of selling the meaning get reversed

- Selling CE means bearish

- Selling PE means bullish

Options Buying Profit and Loss

Now lets understand profit potential of both trade types. We will see it with the example we have seen so far. Lets assume that someone has bought SBIN SEP 500 CE. The premium of CE was 10 at the time you bought it. The lot size of SBIN is 1,000. I took it as 1,000 for simplicity of calculation.

- Total premium paid by you = 10 * 1,000 = 10,000 INR

Now you have invested 10,000 INR in buying the Call. Now lets assume that SBIN has moved to 550 levels within the month of September before expiry and premium of 500 CE has become 50 for sake of simplicity.

- Total value of the CE now = 50 * 1,000 = 50,000 INR

Now lets calculate the profit you can make

- Profit made = 50,000 – 10,000 = 40,000 INR

Theoretically the maximum profit made in case of buying Call or Put can be unlimited as it depends on the move underlying stock will give in that month. But practical it is not unlimited. The probability of making profit is limited by movement made by underlying stock.

This is why under the Stock Options and Index Options series I have discussed probability of daily movement and monthly movement range for each Stock and Indices in F&O. You can refer those articles for details of probability a stock will move in a month and chances of making profit in that month.

The maximum loss you can have in buying options is total premium paid by you. So the loss is limited in case of buying options.

Options Selling Profit and Loss

Above we discussed profit and loss potential for Options buying. Lets discuss this now for Options selling. As discussed selling requires more funds in your account. We will now take example from buying for selling scenario as well.

Lets assume that someone has sold SBIN SEP 500 CE. The premium of CE was 10 at the time you sold it. The lot size of SBIN is 1,000. Assuming SPAN margin and Exposure margin together is around 1 Lakh.

- Total premium paid by you = 75,000 + 25,000 = 1,00,000 INR where 75,000 is SPAN margin and 25,000 is Exposure margin.

- Total value of the CE now = 10 * 1,000 = 10,000

Now you have invested 1,00,000 INR in selling the Call. Now lets assume that SBIN has moved to 480 levels within the month of September before expiry and premium of 500 CE has become 1 for sake of simplicity.

- Total value of the CE now = 1 * 1,000 = 1,000 INR

Now lets calculate the profit you can make

- Profit made = 10,000 – 1,000 = 9,000 INR

Maximum profit made in this case is limited. It cannot in any way exceed premium paid * lot size while selling the CE or PE. So that is the maximum limit of your profit which is same as maximum loss you can have on buying options.

Theoretically the maximum loss made in case of selling Call or Put can be unlimited as it depends on the move underlying stock will give in that month. But practical it is not unlimited. The probability of making profit is limited by movement made by underlying stock.

This is why under the Stock Options and Index Options series I have discussed probability of daily movement and monthly movement range for each Stock and Indices in F&O. You can refer those articles for details of probability a stock will move in a month and chances of making profit in that month.

Options Buying vs Options Selling

Lets understand the difference between both of the Operations. It will summarize concepts explained above and introduce new concepts to help you better. Traders are buyers as well as sellers. It is not that one is better or other is better but few things you need to understand about both of them.

All the Options strategies explained in later tutorials will depend on basic understanding of these two concepts as they are dependent on these two techniques only. These two are applied together to create them. So lets understand the difference between these two.

- Time Decay favors Sellers but it works against Buyers

- Loss is unlimited in case of Selling but profit is unlimited in case of buying. Unlimited here means big

- Profit is Premium * Lot Size in case of Selling which is limited. But in case of buying Loss is also limited and is Premium * Lot Size

- Buying CE is bullish and PE is bearish whereas Selling CE is bearish and Selling PE is bullish

- Volatility favors Buyers if direction is correct but it works against Sellers.

- Sellers can make money even if direction is wrong but movement is less than the Strike price they sold.

- Buyers can make money only if direction is correct and movement is more than Strike price they bought.

What is Options Chain?

Options Chain is very important concept. I have dealt with it before as well. In this article I am presenting some additional basic information about this concept. You can refer below article to download Options analysis excel sheet and understanding different terminologies like Short Covering, Long Unwinding etc. Since they are dealt in different article I am not covering it here.

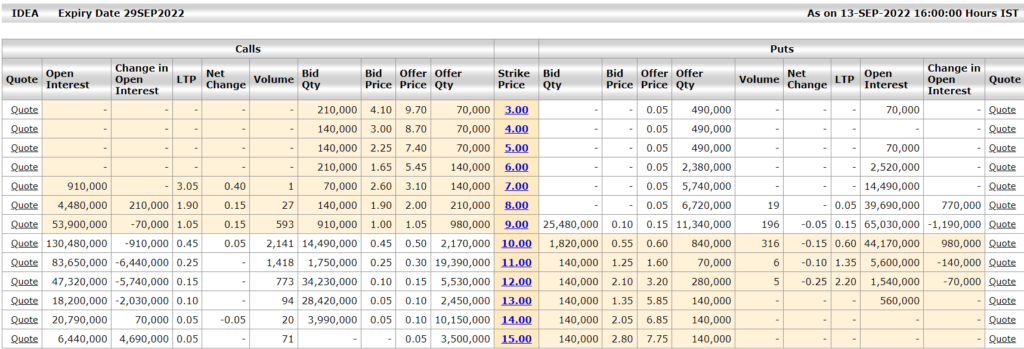

I will cover some basic stuff here based on the Idea option chain presented below. I have used Idea Option chain as it presents entire data in one frame.

Options chain present you below useful information which can be used in trading effectively

- Strike Price – Different strike prices present for a Stock or Index. These are the only ones which you can trade

- Open Interest – Total number of positions which are Open. By position I mean CE and PE. It can be either Buy or Sell. For example someone might have bought 10 CE but would not have sold it and someone might have sold 10 PE but not bought it. So these are considered as Open positions denoted by Open Interest

- Change in Open Interest – This denotes change in Open Interest today. If the change is positive means someone again made one position but not closed it. If the change is negative means someone with existing position have exited from that.

- Volume – Total number of trades made on that strike price. It is better to select strike prices which have some liquidity as it will help you liquidate your positions.

The strike prices with highest Open Interest act as Support and Resistance. On call side the highest Open Interest position is Resistance and Put side the highest open interest is Support. So looking at Options chain help you get idea about Support and Resistance, available strike prices for you to trade and volume of each strike position.

Which is better Options Selling or buying?

Many people ask questions which one is better Selling or Buying. The above comparison gives you idea about the both. Many traders have made money with Buying and many have made money with Selling. So there is no good or bad in this case. You need to pick the one which works for you.

Buying requires you to predict the movement direction but Selling required you to predict if movement will be range bound. Many people use combination of both this is where options strategies come in picture. That combines the goodness of buying and selling together. There is different strategies for different scenario.

List of Options Strategies

This section will cover different Options Trading strategies explained in simple language in both Hindi as well as English language. It will also cover some practical example where we will see the strategies in action.This section is aimed to both Beginners as well as Experienced traders. Beginners should read this section only after Basics else they will find it difficult to follow.

Below are the links to Options strategies. You can click on the links to read about them in details and understand the concept better. It is better to read and understand all of them as each one is different. You can apply them in different market conditions and make profit.

Basic Option Strategies

These option strategies are combination of single trade and are simple to setup and execute. Below are the list of basic strategies. You need to have clear understanding of basic techniques mentioned below before proceeding with other techniques. You should not skip directly to those sections without understanding of basic ones.

- Long Call Option Strategy

- Short Call Option Strategy

- Synthetic Long Call Option Strategy

- Long Put Option Strategy

- Short Put Option Strategy

Standard Options strategies

These option strategies are combination of two trades. More than one basic strategy are used to create standard strategies. They are medium in complexity and should be mastered for decent control on options trading. Below are list of standard techniques

- Long Combo Option Strategy

- Long Straddle Option Strategy

- Short Straddle Option Strategy

- Long Strangle Option Strategy

- Short Strangle Option Strategy

- Bull Call Spread Option Strategy

- Bear Call Spread Option Strategy

- Bull Put Spread Option Strategy

- Bear Put Spread Option Strategy

Advanced Options strategies

These option strategies are combination of more than two basic strategies we have already discussed above. Since they are combination of three or more strategies they are bit complex to understand and master. But the benefit is they have limited loss so risk is limited. This helps if your view goes wrong. Your account does not suffer in case of one wrong trade.

Option Strategies for Investors and Swing traders

These strategies are designed to help investors or swing traders who do not deal in Derivatives. They tend to buy and sell stocks to get profit. These techniques help them extra revenue or safe guard them from possible market meltdown so knowing these techniques is very helpful for them as well.

Volatility and Beta calculator

Volatility and beta calculator is based on last 15 years data for Indices as well as F&O stocks. The volatility and range movement is derived based on last 15 years data.It provides details about Nifty, Bank Nifty and F&O stocks based on their behavior in last fifteen years or so. The section provides information and graph about

- Daily trading range

- Monthly trading range

- Inter dependence of indices Bank Nifty and Nifty

- Inter dependence of Nifty and the Stock

This section will help people understand the indices and stocks better. Many strategies mentioned above are dependent on volatility details so these data can be used as an input to those strategies. Like which stocks are more volatile compared to others and which are less volatile compared to others. Below are the links to the sections for Index, Bank Nifty and F&O Stocks.

- Nifty volatility and beta details

- Bank Nifty volatility and beta details

- F&O stocks volatility and beta details

Conclusion

I have tried to provide complete guide to Options Trading in this article. It is completely free forever. I am not planning to take any paid courses or offer any paid classes or so. So please do not fall in trap of those offering paid services in name of MoneyPati.