Why IPO Analysis?

IPO is Initial Public Offering. Every year new Companies get listed on Stock Exchanges like NSE and BSE for people to trade into it. For example recently IRCTC got listed on Exchanges.

IPO are one of the ways you can make quick money in Stock Market. I know many investors who put money in IPO and sell it on listing day making handsome profit in the time frame of few days. Every year you have good amount of IPO floated in market. This gives excellent opportunity for IPO investors to make money.

I have also started investing in IPO for quite sometime now. Though I am not very active in this but with time I am planning to be more proactive in this.

Now I am planning to invest money in IPO and sell that on listing day or may be after sometime or hold it for long time depending upon quality of stock and my own analysis. For example I held on to HDFC AMC from IPO days. I got shares as part of IPO application and till now I have those shares with me.

English Video

Hindi Video

How to apply for IPO?

You may have heard term like IPO is open for certain company and you can apply for it now. Typically there is 3 day window in which you can apply for an IPO.

Every major Bank be it ICICI or HDFC or SBI or any other major bank allows you to apply for IPO given that you have DEMAT account. The application can be made online as well. You can buy IPO from your netbanking.

Personally I prefer the net banking method for application as it is easy and without any troublesome. I use money in my bank account for the application and later mark the amount as invested for better tracking.

In case you face any issues in online application then you can post your queries as well on forum and I would love to solve them.

IS IPO investing profitable?

The short answer is Yes it is profitable. The long answer is It is profitable if you invest in right IPO. You should not invest in every IPO under the sun. This is why I am starting this segment.

I will analyze each and every IPO which is open in the market on the second day (if I am not too busy to analyze on that day then I will on next day). That analysis will help in my own decision making. Based on that decision I will apply in IPO or not.

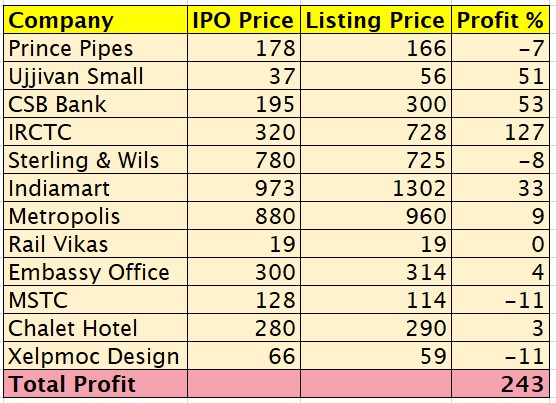

Now lets see some data about past IPO in year 2019 and see if those have made money or not. Based on that you can make your own decision.

Above is Stock list whose IPO floated in year 2019. If you see closely most of them have given small losses. Highest loss is close to -11%. But the profits are more. IRCTC gave whopping 127% profit and two other stocks gave more than 50% profit on listing day.

So if you applied for IPO of above stocks and sold them on listing day closing price then you can easily make 250% profit as per the statistics. Having said that it is important to understand the listing strategy as well. In coming paragraphs I will list out the details on how to invest in IPO for better profitability.

IPO Investment Strategy

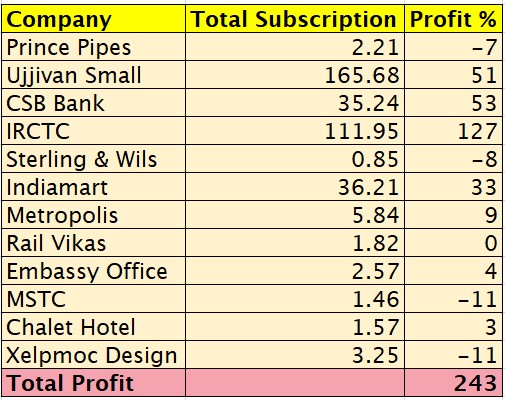

Now lets try to understand or formulate a simple strategy on how to identify stocks for which IPO application should be made. Below table shows one very simple investment strategy for IPO’s.

If you quickly glance above you can identify that listing gains is directly proportional to Subscription Status of IPO. If an IPO is subscribed too much then chances of listing gains increase significantly.

Low IPO subscription status indicate low interest from Investors. This translates into loss or very minimal profit on listing day. So subscription status of IPO clearly indicates if one can make money on listing day in an IPO or chances of making money is low.

Now in below section we will see how can this Subscription Status data can be used for our benefit.

IPO Investment Tips

Below are some of the tips Investors should use

- IPO investment has Three day window.

- Never invest on First day or Second day.

- You should invest on Third day

- Invest only if Subscription is more than 4 times

- You should invest in Afternoon of Third day.

- This investment time will help you get more clear idea about Subscription status

- You should only apply for more than 1 lot if the subscription status is more than 10 times.

- If you only plan to invest for Listing gains then you should sell as per that only plan

- You can carry forward your position only if you are confident in the Company for long term investment.

Conclusion

IPO Investment is one way to identify new investment opportunities as well as make some money by playing for listing gains. So it act both as trading and investment plan.

In recent times few great Companies have hit floor and investors have made money in those counters. IPO investment helps you get Companies at lesser price if you want to plan long term investment.

For example you will not get IRCTC or DMART at IPO price post listing. This shows how beneficial it was for long term investment if they applied in the IPO.