Overview

Kalyani Group is one of the leading Industrial houses in India. It is an Indian multi-national operating in sectors such as Engineering Steel, Automotive, Industrial, Renewable Energy, Urban Infrastructure and Specialty Chemicals.

The market capitalization of its listed entities is approximately 10,000 crores. The group has joint ventures with some of the world leaders such as Meritor, USA, Carpenter Technology Corporation, USA, Maxion Wheels, Brazil and Alstom, France.

This is one of the lesser known Group of companies. It is not popular as other Groups like Tata and Birla. In this article we will discuss about companies from this group along with their performance over the years.

In case you are interested in other famous Group of companies list along with their performance like in this article then read below post of mine.

Read Top Corporate Group companies listed on NSE

Kalyani Group of Companies List

Below is the list of companies from this group.You can use this list to select stocks for your watch list preparation.

- Bharat Forge – This is the flagship company of the Group

- BF Investment Limited

- BF Utilities

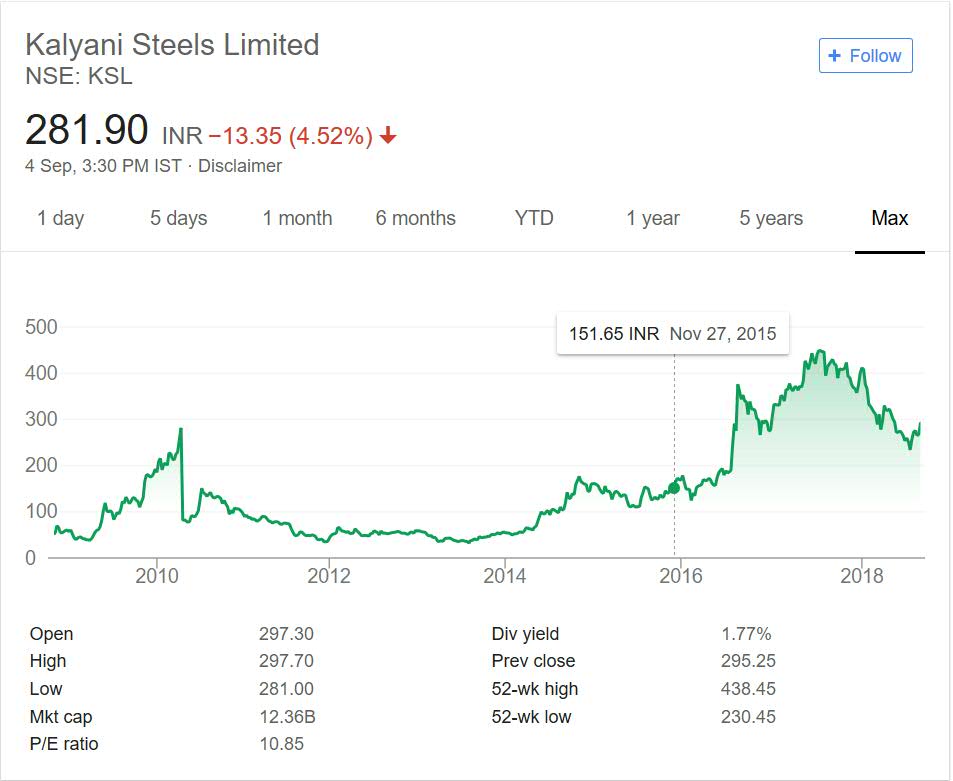

- Kalyani Steels

- Automotive Axles

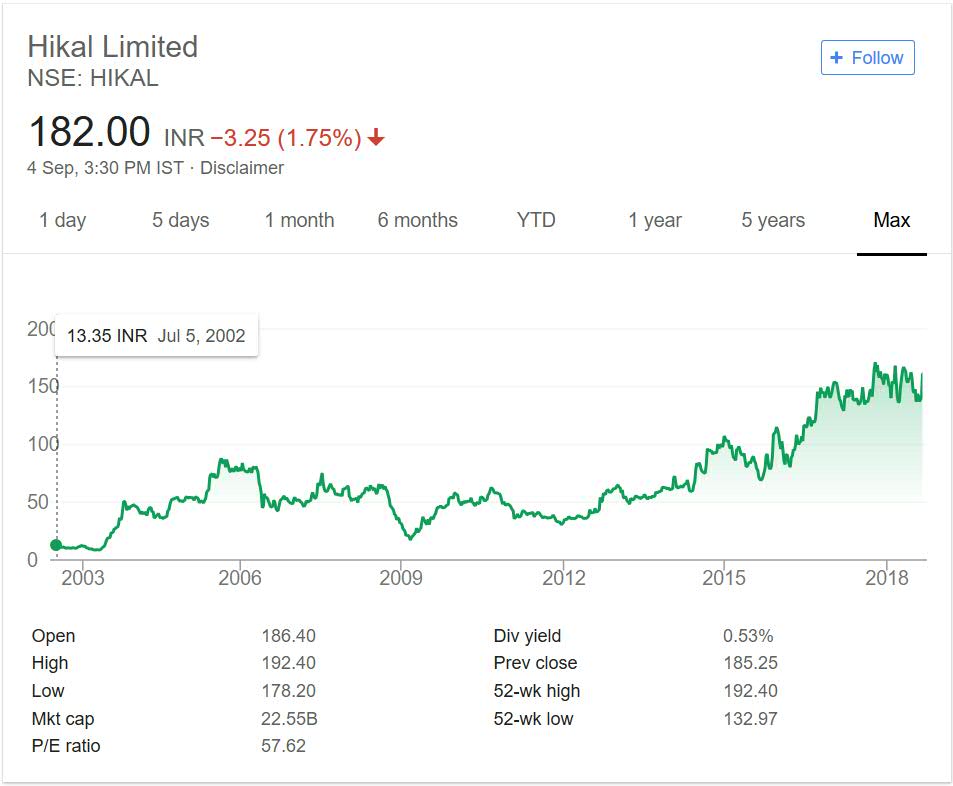

- Hikal Limited

Kalyani Group Companies performance

Stock price performance is the most important criteria to judge a company. We will see the price performance of these stocks over a period of time. A group is said to have successful if most of the companies are profitable for investors.

This also helps you decide whether you need to track and analyze the companies from the group and ultimately take a investment decision. We will discuss more on this later in this post after discussing the performance.

Below are the performance graphs for these companies over the maximum time frame

Kalyani Group of Companies details

I will be reviewing these companies in details in later articles. As of now below is short description about the companies which will help you know them better at least.

- Bharat Forge – This is the flagship company of the Group. It is in sector Forging and is largest company of that sector.

- BF Investment Limited – It is investment arm of Bharat Forge.

- BF Utilities – This is in Infrastructure segment creating flyovers etc

- Kalyani Steels – It is in steel sector.

- Automotive Axles – It is Automobile Component company (Auto Ancillary)

- Hikal Limited- It is in Pharma space.

Conclusion

As you have seen above majority of Kalyani Group of companies have performed better in long term except BF utilities. Most of the other companies have made money for investors specially Hikal, Automotive Axles and Bharat Forge.

The sectors these companies perform should also be taken note of while comparing the performance. If you plan to invest in these sector in which Kalyani Group has presence then you can definitely trak and analyze these companies.

Since these are from Kalyani Group so management pedigree and transparency is already present. Note this forms one of the most important factors in Fundamental analysis.

In next step of articles we will discuss yet other group of companies for you.