Overview

TVS the name has emerged as cost effective fuel saving bike brand. TVS Motors has fast risen as an alternative to Bajaj Auto and Hero MotoCorp. There are many national and international bike players in India.

On national front Bajaj, Hero and TVS are the leading company volume wise. If you consider premium segment then Royal Enfield is also one of the major players.

Despite the competition TVS has grown over the years. The growth of the company has also benefited the Investors. TVS Motors is part of TVS Group of companies. TVS Group is one of the largest Auto Ancillary company of India.

This group through joint ventures with Multinational companies have founded many companies catering the area of Auto Ancillary. The aim is to in house all the component manufacturing required for Auto production and serve other major players as well.

This strategy has played well for TVS Group. Most of the companies from this group has performed well over the years. The Investor friendly approach from the company has rewarded share holders as well. Despite all these people are not aware of many companies from this Group.

They are not covered extensively by media houses. So most of the people know only TVS Motors. Other companies from this stable though profitable and rewarded investors are hidden from General public. Remember the dream run by TVS Electronics during Demonetization time.

Before that event people were not aware of this company. Though it was part of reputed 6 billion group of companies.

TVS Group of companies list

The aim of this post is to list down companies from TVS Group. You can include these companies in your initial Stock watch list. Analyzing individual companies and understanding their business will give you insight whether you should invest in them or not.

As stated above most companies are from Auto Ancillary segment barring may be couple of them. So if you are planning to invest money in this segment then you should look into these companies. The management pedigree is top class as the group has proved itself over the years.

I will be analyzing these companies in details in future articles so stay tuned for individual company analysis.

| India Nippon Electricals |

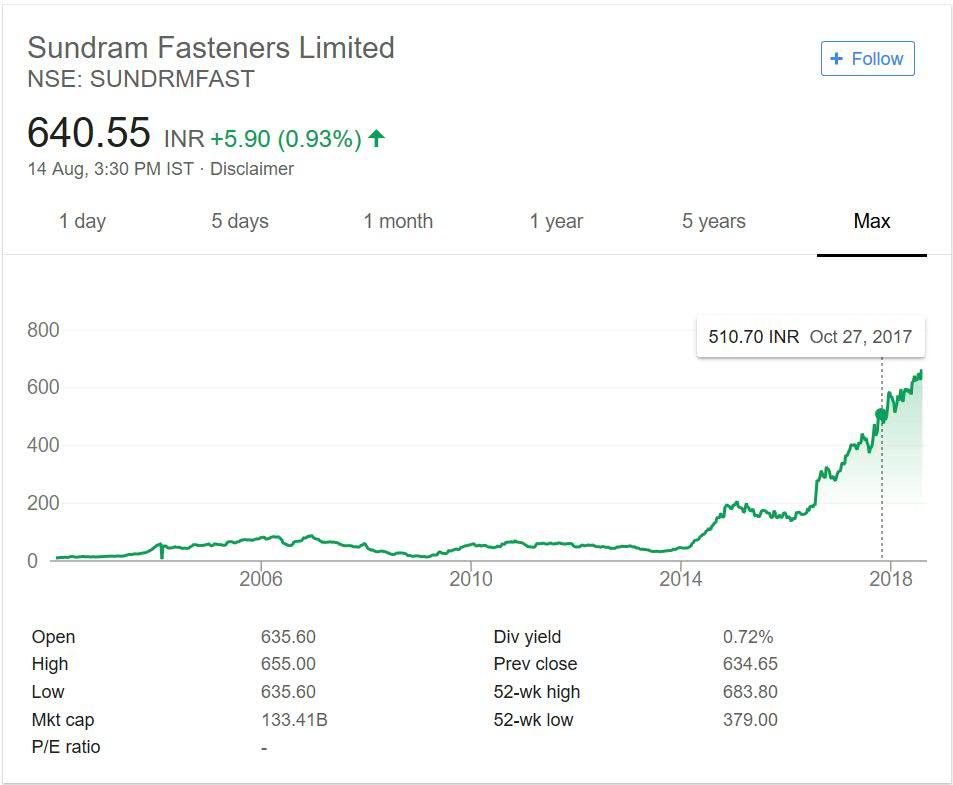

| Sundram Fasteners |

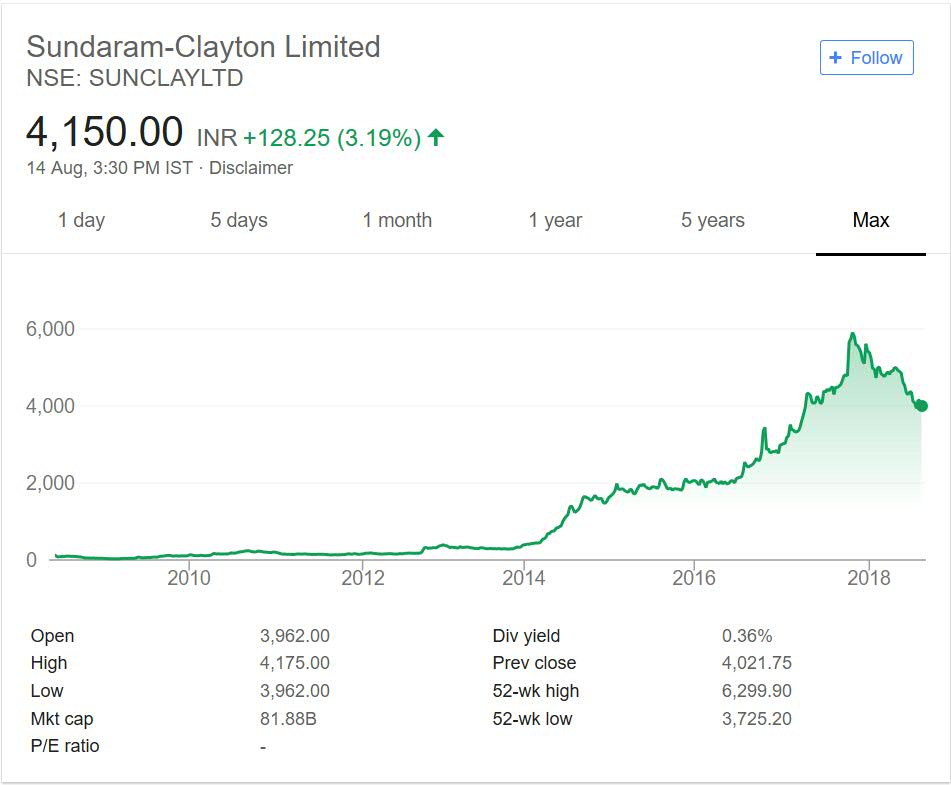

| Sundaram Clayton |

| TVS Srichakra |

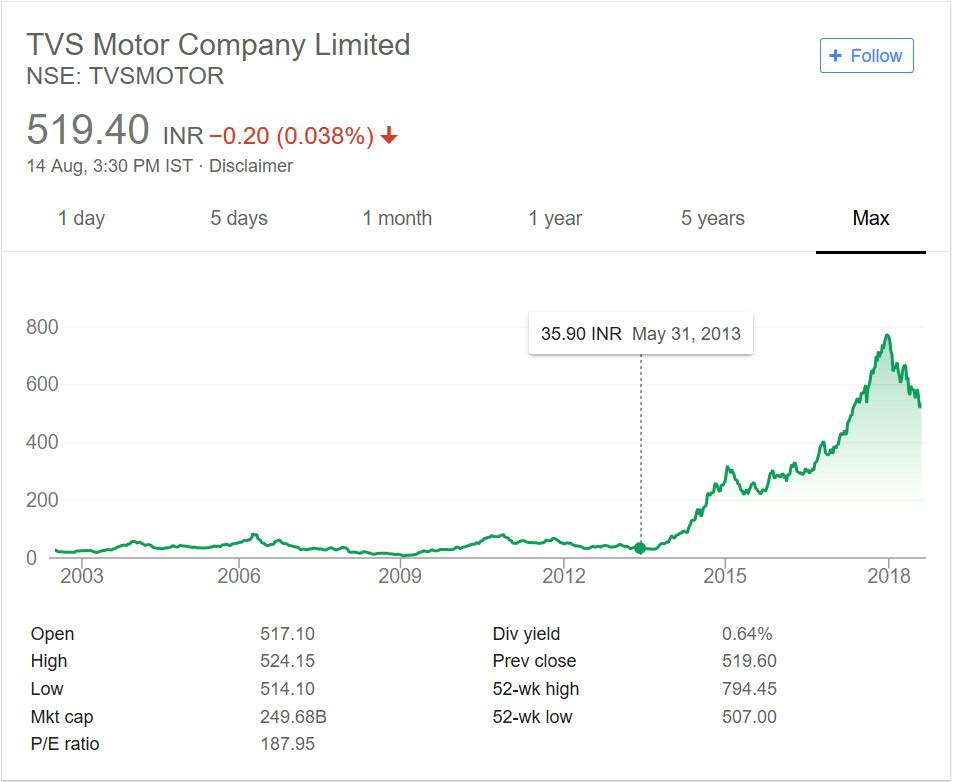

| TVS Motor Company |

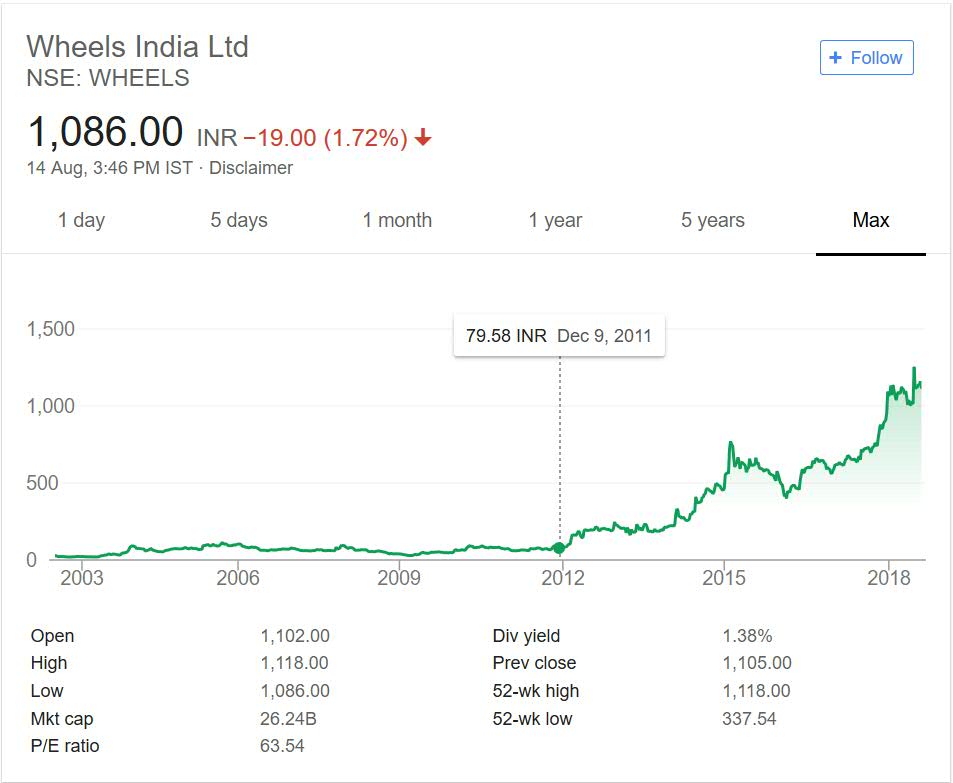

| Wheels India |

| TVS Electronics |

| Sundaram Brake Lining |

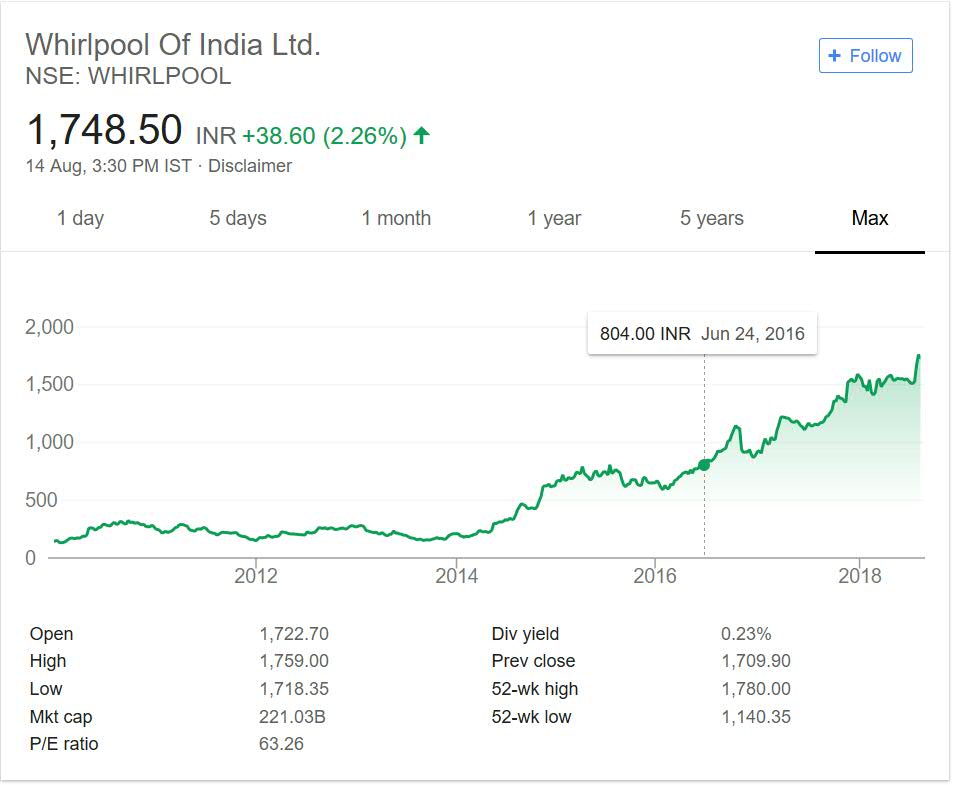

| Whirlpool India |

TVS Group of companies performance

TVS Group of Companies details

| India Nippon Electricals – Auto Components company creates Ignition systems |

| Sundram Fasteners – Auto component company creates Fasteners |

| Sundaram Clayton – Creates Aluminum and Magnesium castings for Auto Industry |

| TVS Srichakra – Tyre company |

| TVS Motor Company – It is in Two wheeler space. |

| Wheels India – It creates wheels for Auto and also caters Railways |

| TVS Electronics – It creates POS devices. |

| Sundaram Brake Lining – Friction material company caters Auto industry |

| Whirlpool India – Consumer products company like Refrigerator etc |

Conclusion

TVS Group is mostly focusing on Auto Components segment. They have niche players in that segment. If you see most of the companies have given splendid returns over the years.

The brand have grown strong in past ten years. The initial phase of a company is tough. That tough phase is won by this group. It may turn out to be a Auto behemoth in near future benefiting investors as well as Indian Economy.

You can include these companies along with others I have covered in articles describing other Group of companies to frame your Watch list.