Business Details

Jay Shree Tea is part of Birla Group. It is second largest Tea producer of India. It also has Tea Gardens in all tea producing regions in India. This diversification helps the Company fight with climatic problems in any one region of India.

The Company has around 9 Tea Gardens in different parts of India including Assam, Darjeeling and South India. It is second largest producer of Tea in India. It sells below tea types in market

- Green Tea

- Black Tea

- Masala Tea

- White Tea

- Blends

It also has nice website with product listing and buying options. This was a pleasant surprise for me as well. The website was well designed and prices in USD. Tea from this Company are special category and are pricey. It has registered office present in Kolkata.

English Video

Hindi Video

Stock Performance

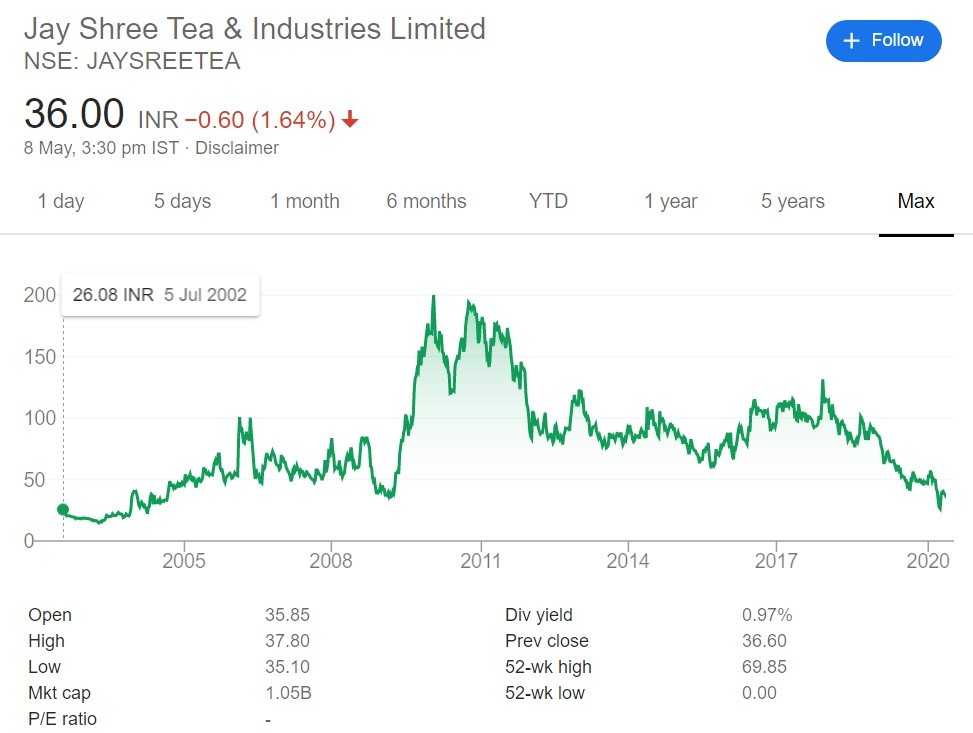

Above is long term price performance chart of the Company. As you can see it has not given any returns in long term if we take the absolute start price and the end price. The dividend yield at current market price

It has not performed in recent years. The performance in previous one decade was better compared to recent one decade.

My Opinion

Jay Shree Tea is from Birla Group. So it is part of big corporate group. The Company is in business of Tea. Tea can be termed as necessity item. It is commodity items as well. There is no pricing power to a Company. Though there are different variants of Tea available in market which can attract premium pricing.

The Company is present in Evergreen sector as tea will be consumed by India as well as World. There is growing interest of people in Tea. The health conscious group has also started consuming Green tea.

Tea as commodity will be consumed but consumption growth will be slow due to saturated Tea consumption market. So Companies in this sector will have slow static growth but if they are well managed then they will not be pain to investors.

One can invest in these companies at lower levels but they should not hold for long term. These are cyclic plays as well. For retail investors these are tough to time entry and exit for cyclic stocks so I suggest retail investors not to invest in them.