Business Details

Pee Cee Cosma Sope started out as a cottage industry. It got listed in year 1989. The Company is in FMCG sector with major product being Detergents and Soaps.

It has network of over 500 distributors and 1.5 lacs retailers. It has major present in North, North Eastern and Central India namely UP, Rajasthan, Gujarat, Madhya Pradesh, Chattisgarh, Bihar, Jharkhand, Meghalaya, Assam and parts of West Bengal and Orissa.

The major products from the Company are

- Laundry Soap

- Detergent Powder

- Detergent Cake

All the product categories have similar brand names. Doctor is common name used in all the above categories.

English Video

Hindi Video

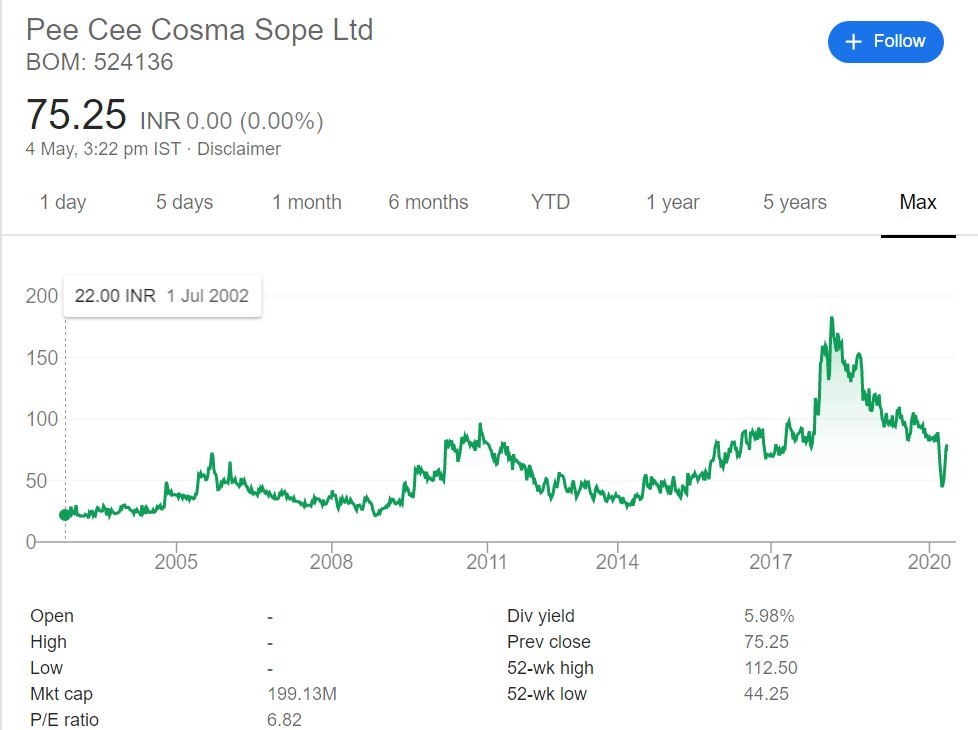

Stock Performance

Investors have made money in this counter. If you see absolute returns it is around three times in last two decades. The dividend yield at current levels it more than 5% which is excellent by any standards.

The price appreciation can not be termed great but dividend yield is. Based on price action it can be concluded that Company has maintained the performance levels and has slightly improved with time.

My Opinion

Pee Cee Cosma Sope limited is in manufacture of Detergents. This segment is dominated by multinational giant Hindustan Unilever. There are many smaller players as well which are fighting to win market share in this evergreen sector.

Detergents will always be in use. The segment will grow with time. The Company is very conservative in approach. It has one target segment and is expanding foot prints slowly in different parts of India. It is focusing hard on new geographies as well.

I would like to see it venturing into online world. The products are not available on leading eCommerce websites. So this is one area it should focus on.

This is a stock to track into. The safe and sure approach of Company is good thing and if it can gain market share along with new vertical launches then it will be good investment opportunity for it.

I am already invested in FMCG sector.