Business Overview

As of this writing Lakshmi Vilas bank Board approved a merger with second largest housing finance Company India Bulls housing finance. The merged entity will be called Indiabulls Lakshmi Vilas Bank.

Since the Bank is merged with Indiabulls it is not good practice to write individual analysis of this Bank as of now. You should look Indiabulls Housing Finance as well.

Since merger has taken effect recently it is better to wait for some period before making a decision.

The Reserve Bank has initiated Prompt Corrective Action (PCA) against Lakshmi Vilas Bank (LVB) due to high level of bad loans, lack of sufficient capital to manage risks and negative return on assets for two consecutive years

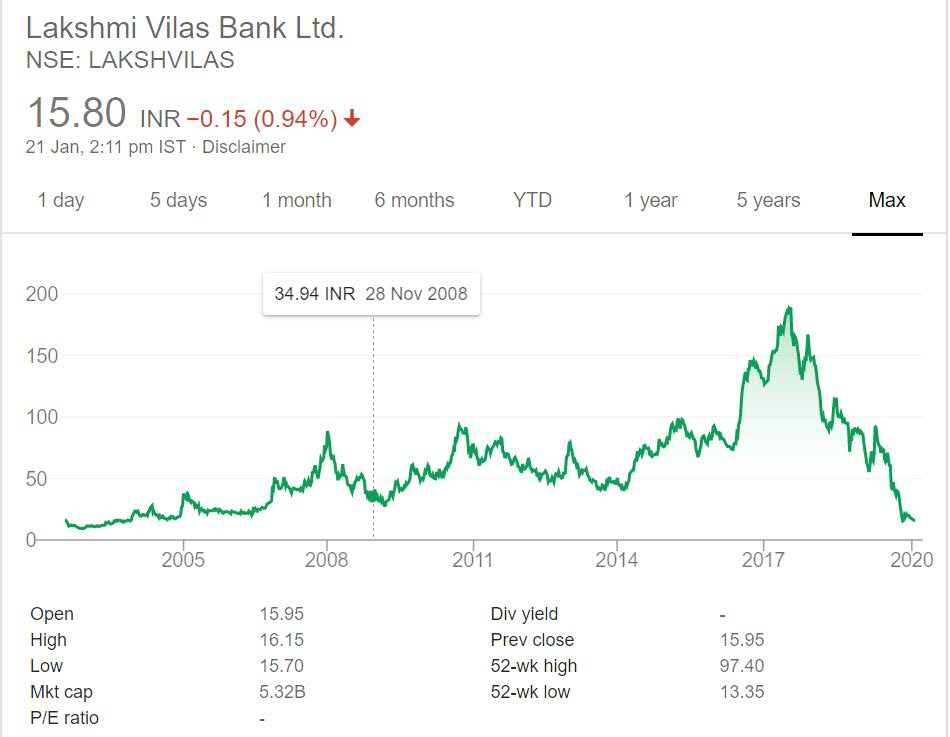

Stock Performance

Above is the last time price performance chart of the Stock. The stock has nosedived after post merger announcement. Market has not taken the news positively and that is reflected on the stock prices.

It was decent performance before year 2018. Post that year investors have lost money in the counter due to reasons mentioned in Business overview section. The stock has not paid dividend recently as well.

My Opinion

Lakshmi Vilas Bank is one of those private sector banks which was in questions recently due to bad loans. The Company it merged with Indiabulls Housing finance is also struggling due to recent NBFC crisis.

The merger is new and investors should wait for outcome of the merger. It will be interesting to see how well two struggling companies act post merger. Note Indiabull housing finance have given good returns to investors in past.

I would avoid both the Companies as of now as there are better alternatives available in market. Moreover any Company with Corporate Governance issue or facing probes should be avoided. As you are putting your money on outcome of the probe.

This is not good investment style. So for me it is strict no track stock.