Business Overview

Tasty Bite Eatables as the name suggests is packaged food processing Company. It was launched in US in 1995. It is one of the largest brand of Indian prepared food in US.

The Company also has presence in countries like US, Canada, Australia, New Zealand, Japan and UK. The Consumer business of the Company is divided into three parts

- Asian Noodles

- Indian Entrees

- Rices

It has also started Tasty bite food service. The food service is started in India. The product category can be divided into

- Ready to Eat

- Frozen

- Sauces

The factory and corporate office is located in Pune Maharastra.

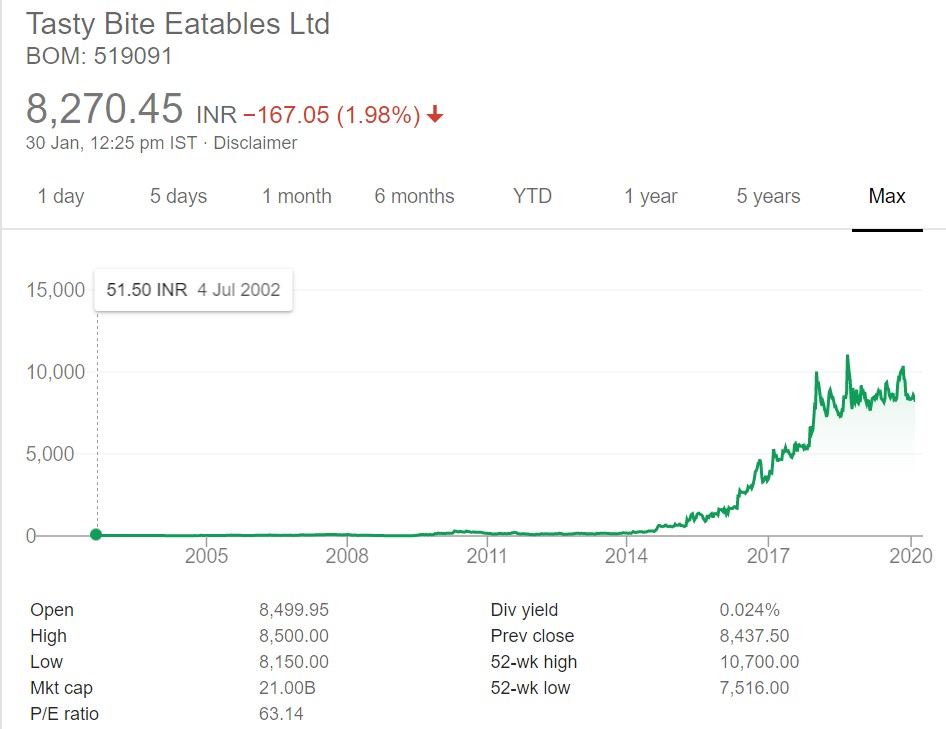

Stock Performance

Above is long term price performance chart of the Stock. The Stock was trading flat giving almost three times return from year 2002 to year 2014. It is only after year 2014 it had wild run. From levels of 150 it ran all the way to mark of 10,000 giving 60 times return in span to three to four years.

The stock has not corrected much after that breath taking run over last few years. Investors have made fortunes in this counter if invested before year 2014 and hold on to the stock for four years. The dividend yield is low but price performance have compensated for that.

For new investors it is better to watch for correction or consolidation for long after that mega run in stock prices. It is still an expensive stock to buy.

My Opinion

Tasty Bite Eatables majorly focuses on Overseas market. It has major presence in developed countries like US, UK and Canada. It is one of the top Indian foods brand in US. So Company will get benefited with rise in Indian population in these countries.

It will gain on INR depreciation as well. The popularity of Indian food overseas with trigger revenue growth for it. It has also started to focus on Indian market as well with Food services business segment.

The stock has ran up too much in past few years. So I do not see much value in it as of now. It is better to wait on side lines. It is interesting sector and stock to watch. People should track similar companies as well. As of now I do not advice to have a position in this stock due to recent run. In my opinion it will be in consolidation mode and may see correction with time.