Crisil Overview

Indian credit rating industry mainly comprises of CRISIL, ICRA, CARE, ONICRA, FITCH & SMERA. CRISIL is the largest credit rating agency in India, with a market share of greater than 60%.

There are only 3 rating agencies ( Crisil, ICRA and CARE) listed on Stock Exchanges. Rating Agency business is very consolidated business area in World. There are 3 rating agencies capturing around 95% of World market.

The three credit rating agencies are Standard & Poor’s (S&P), Moody’s, and Fitch Group. Together these three have 95% market share ( Standard & Poor’s (S&P) – 40% , Moody’s – 40% , and Fitch Group – 15% ).

Thus Rating Agency business is one of the most concentrated business area in the world. Rating Agencies are key part of Country’s economy. They give credit ratings. The credit ratings help to understand whether the company will be able to pay back the loan or interest on loan in timely manner or not.

You may have heard about Credit Score which increases chances of getting better loan. You can think of Credit Rating as similar in nature.

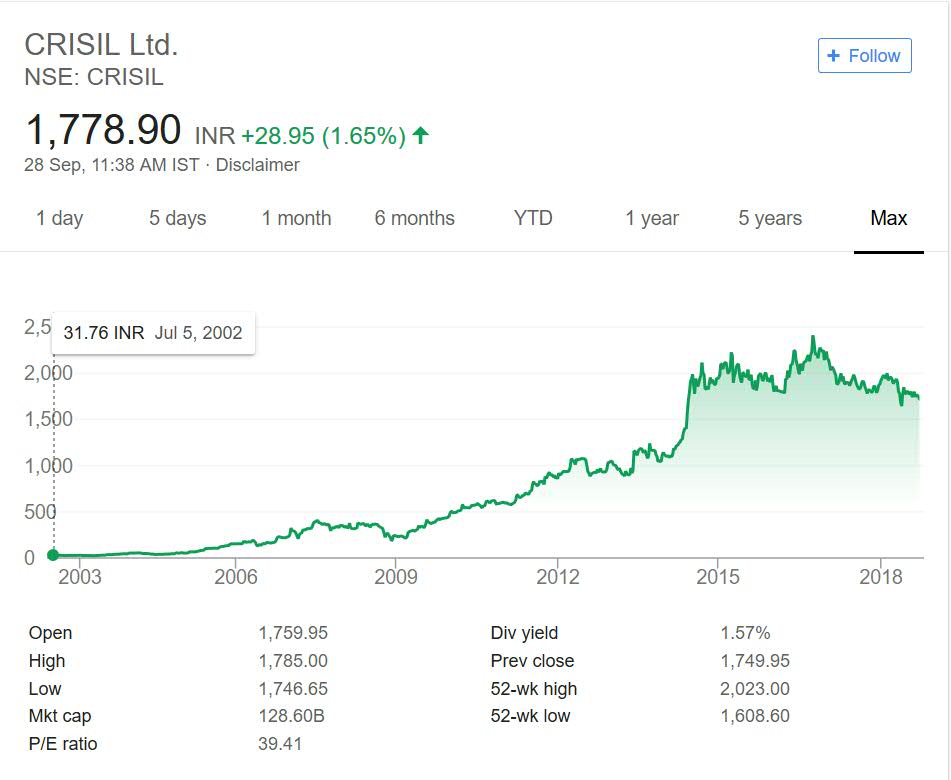

Crisil Share Price Performance

Above we said Rating Agency is high entry barrier concentrated business area which is dominated by selected few. These are conditions for good money making companies. Lot of investors look companies which satisfy above criteria.

So lets see how these companies perform. I will share performance of Crisil and S&P both that will give you idea of performance over longer period of time.

As you can see Crisil has performed well over the years. It is only after 2015 he stock went into long consolidation phase. This is understandable as the company raced towards 1000 marks during previous 5 years starting from 2009 to 2014.

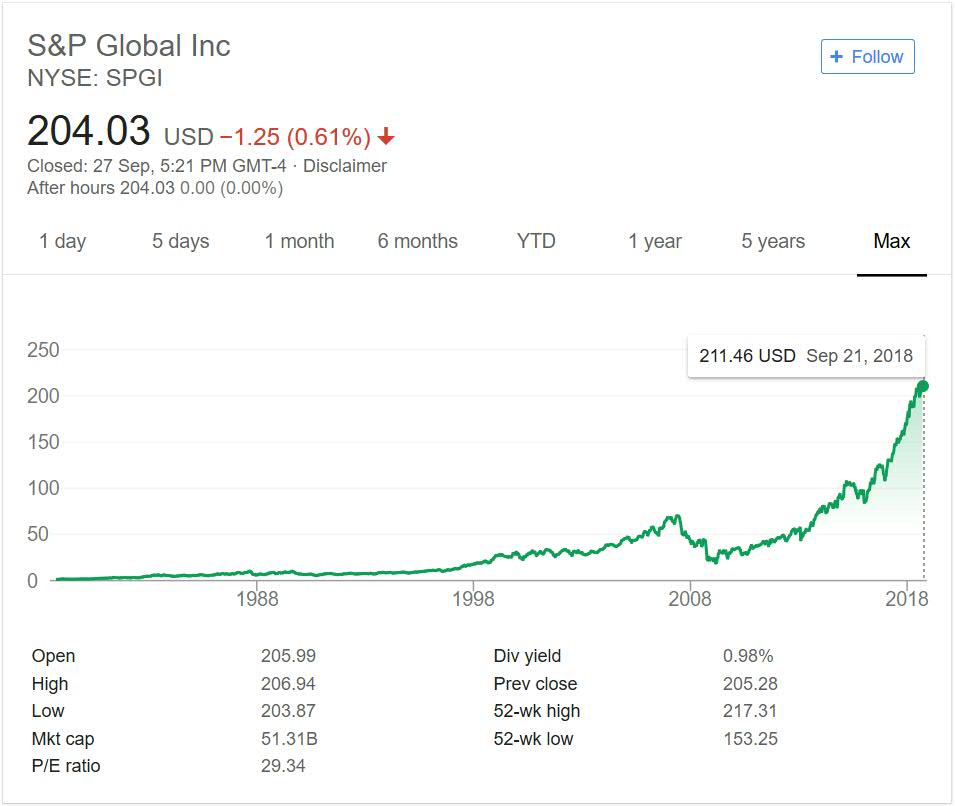

Now lets have a glance on S&P performance as well. Note it is listed in US and not India.

S&P price graph shows slow and steady movement towards higher level. The price movement was steep after year 2009 and it is continued till this date as well. Based on these price movement so fat these companies have made money for investors.

Crisil My Opinion

Crisil is one of the crown jewels in Rakesh Jhunjhunwala portfolio. It is one of the major company in which he has invested huge sum of money. Rating Agency companies are one sector where not too many retail investors put money.

The reason is simple they do not get too much coverage or limelight so people are generally unaware of them. I myself have one rating company in portfolio for quite sometime now. This is a highly monopoly type of business with less number of players.

So the monopoly nature of business will help them grow as economy of our country grows. The number of instruments to rate will increase and so will the business of these companies. This is the rationale behind my own selection.

Since the competition is less in India as well majority of business will go to the main players. Main players can even buy the smaller ones to keep the monopoly.

Conclusion

As mentioned above India also has three Rating Agencies. You can add them to your stock watchlist if you are interested in the sector itself. You an track and understand the business functionality or their operations to understand the company better.