Edelweiss Overview

Edelweiss is investment advisory company. It also provides brokerage services and has good presence in India. It has extensive branch setup in 200 locations. As per website of the company it has around 12 lakh customers.

It got listed on Exchanges on December 2007. The company deals in all areas of brokerage like Currency, Commodity and Equities as well. In year 2011 it also started Retail Finance and Insurance business.

The company has made a name for itself in the business vertical it operates. The ace investor Rakesh Jhunjhunwala has also invested in this stock. This makes it altogether special stock to analyze in details.

Edelweiss Stock Performance

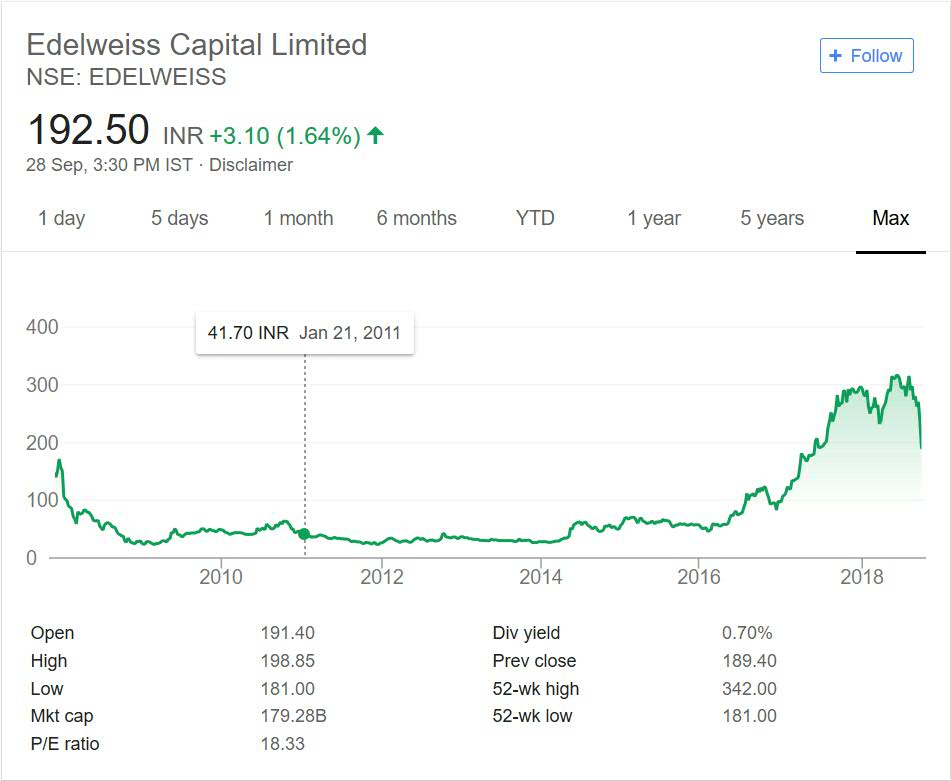

As mentioned above Edelweiss got listed on stock exchanges in year 2008 (Dec 2007). Below graph shows the share price performance of the company since inception.

The company got listed on exchanges wrong time. 2008 was year of crisis. As you can see the stock prices crashed from 180 odd levels to below 50. The prices remain below 100 for good 6 odd years. These years were the time of consolidation.

After year 2016 the company started moving up. It crossed the 100 mark in later part of year 2016 and then crossed 300 mark slightly. The recent correction in market has pushed it below 200 mark. If you take the time from IPO till date the return have not been impressive.

But if you consider the period 2011 or 2012 then the stock has given good returns.It also gives consistent dividend and has performed well in this front.

Edelweiss My Opinion

The asset management area and financial advisory business is still not that matured in India compared to the foreign countries. We still have under penetration for these services. It is evident that these Financial services will grow in future.

The company has also ventured into Insurance business as well. The sector will grow without any doubt but the problem is simple there are too many players in this area.

Even if you see brokerage area also there are multiple companies and competition is very stiff. All the verticals these companies operate on are very competitive. So selecting one company over other company is very challenging.

Rakesh Jhunjhunwala has stake in this company has made it special. But in same vertical you have companies from HDFC Group operating. Personally I prefer tested and tried management like HDFC. But it is matter of personal preference and investment pedigree.

Conclusion

Financial sector is definitely a good sector to bank on. The portfolios of top investors have either one or more than one company from this sector. You should really go through the portfolios and list out the companies.

It is better to add the companies in your watch list and then compare then for performance. It is better to track and analyze before making a decision.