Federal Bank Overview

Federal Bank is private sector bank sector bank with headquarters in

Aluva, Kochi, Kerala. As per the bank website

The Bank was incorporated on April 23, 1931 as the Travancore Federal Bank Limited, Nedumpuram under the Travancore Companies Regulation, 1916. Late K.P. Hormis, the visionary banker and founder took up the reigns in 1945 and built the bank a nationwide institution.

The Bank’s name was changed to The Federal Bank Limited on December 2,1949. The Bank was licensed under the Banking Regulation Act, 1949, on July 11, 1959 and became a scheduled commercial bank under the Second Schedule of Reserve Bank of India Act, 1934 on July 20, 1970.

Today the bank is present in 25 States, Delhi NCT and 4 Union Territories and the bank is listed in BSE, NSE and London Stock Exchange. It is considered as one growing bank and has positioned itself well in market.

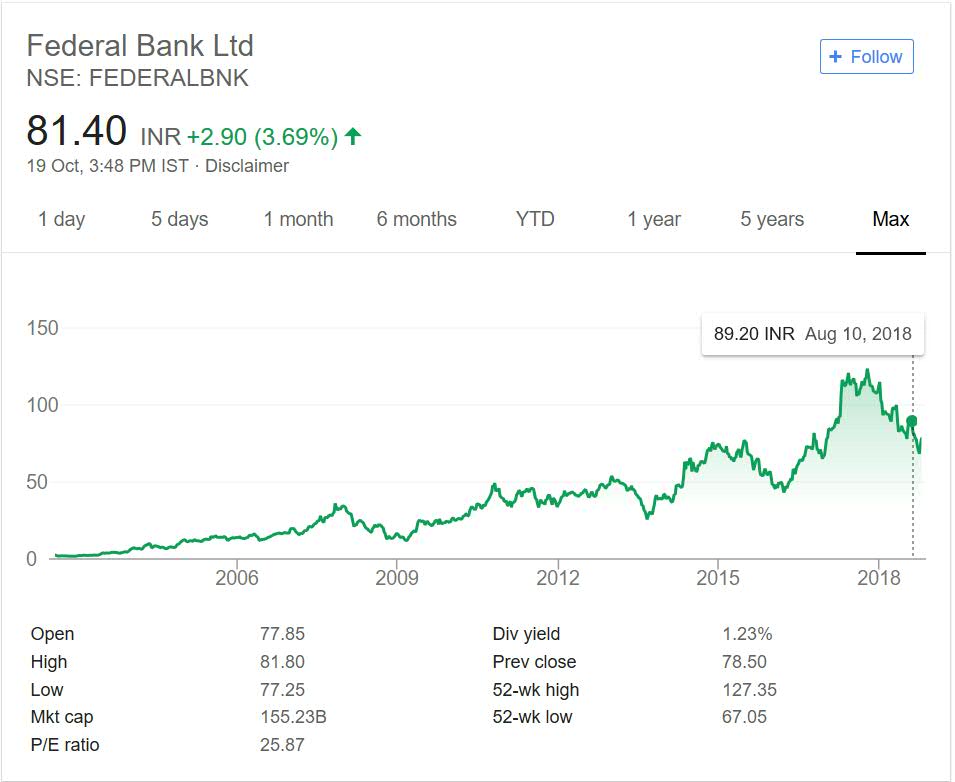

It is also part of Bank Nifty as well. I have shown the price performance of the bank over the years. This will help you get an idea about share price performance of this company.

Federal Bank Stock Performance

Below graph shows stock price performance of Federal bank for last 15 or more years. This long time period is taken to remove any periodic fluctuations in prices.

The company was trading between 1 and 2 INR mark in year 2002. From that point it has moved to above 100 in year 2018. So the company has given excellent returns in past 15 odd years compounding the money of investors multi fold.

The dividend yield of the company is more than 1% at current price. This makes it excellent return yielding company along with dividend paying company. If a person has put money in year 2002 then the person is getting same investment as dividend even if the prices do not increase.

The journey of this company has been on incline plane from start. There were minor hiccups here and there like in year 2008 and 2014 time period. But the company has recovered from those fluctuating points and performed well after that.

Federal bank My Opinion

Federal bank is present in the portfolio of Rakesh Jhunjhunwala. This is an excellent company based on the returns it gave to investors. But there are many outstanding companies present in Private Sector space.

You should compare them and then make a decision on which companies to track or add in your stock watch list. You can also explore portfolio of other top investors of India.

If you are planning to invest some money in Private Sector Bank then you can consider adding and evaluating these companies and select the best one out there. Based on the past performance and holing of prominent investor like Rakesh Jhunjhunwala this company is definitely worth a look.

Conclusion

Federal bank is an excellent private sector bank giving good returns to investors over the years. It is worth tracking this bank for long term investment and further evaluation.