Geojit Financial Services Overview

Geojit Financial Services is a investment management services company. It has different divisions. It has recently acquired Share Khan brokerage firm. In a single move it expanded its network and brokerage firm presence. Note Share khan is leading brokerage firm of India.

Geojit Financial Services has registered itself as Non Banking entity (NBCC). It has expanded the services to include Insurance and Portfolio management services along with brokerage services we discussed above.

It is in field of General Insurance and as of now does not deal with Life Insurance.Any thing except life comes under General Insurance. For example Vehicle Insurance is part of General Insurance only.

Note Geojit Financial Services was earlier known as Geojit BNP Pariwas. BNP Pariwas is one of the largest financial companies of Europe. It is also one major share holder in this company. Geojit has significant presence in middle east. This differentiates it from other companies in this field.

Now lets see how this company has performed for share holders. The portfolio of company gives indication that it will be moving towards full fledged financial services company.

Geojit Financial Services Stock Performance

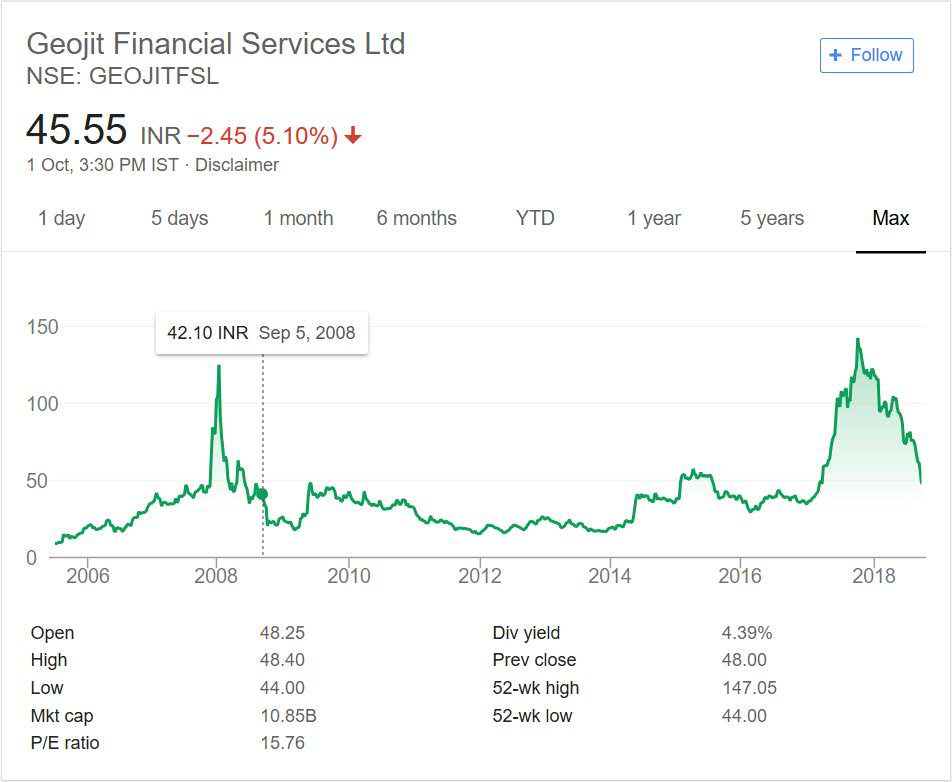

Below graph shows the stock price performance of Geojit Financial Services. The company has performed well for investors or not. Note Financial Services sector was hot cake in recent times and most quality companies have performed well.

Above chart you can see the company gave exceptional returns between the period 2005 and 2008. It then crashed like most stocks in year 2008 and 2009. After that the company was in slow decline mode for 3 years.

It then started moving upwards from year 2014 and in last couple if years it has outperformed. But then it again corrected heavily. So the entire journey is see saw type of journey. The stock prices rose and fell between the period.

One interesting part of the company is Dividend. At current market price it gives more than 4% dividend. This is good for investors who have put money at low levels.

Overall if you see at long term you may not have made money except the regular dividend part. It is also interesting to note that if people has invested at low level then at times company has given exceptional returns.

Geojit Financial Services My Opinion

There are few interesting facts attached with Geojit Financial Services. The first interesting fact is that company has BNp Pariwas as major share holder. This justifies the high dividend company pays. BNP Pariwas is global giant in Financial Services.

The second is big bull Rakesh Jhunjhunwala is part of the Board and is one of the largest share holder in the company. These two facts make this company interesting. With recent acquisition of Share Khan and good presence in Middle East are positives for the company.

But the share price performance has not reflected this fact. You should add this company to your stock watch list if you are interested in Financial Services sector.Portfolio of many top investors have Financial Services companies present.

I personally track this company so that I can compare it with other companies present in this sector.

Conclusion

Financial Services Sector is very interesting sector. You will find lot of companies catering different segments of this sector. There are many marquee names operating in this sector. You should compare the companies before making a decision. As mentioned above you can also analyze portfolio of top investors to get an idea as well.