Lupin Overview

Lupin is one of the largest Pharmaceutical company in India. As per the company website it develops and delivers a wide range of branded & generic formulations, biotechnology products and APIs globally.

The Company is a significant player in the Cardiovascular, Diabetology, Asthma, Pediatric, CNS, GI, Anti-Infective and NSAID space and holds global leadership position in the Anti-TB segment.

Below are some facts about the company based on Company website

- 8th largest generics pharmaceutical company both in terms of market capitalization and revenue

- 4th largest pharmaceutical player in the US by prescriptions

- 3rd largest Indian pharmaceutical company by global revenues

- 6th largest generic pharmaceutical player in Japan

- 5th largest company in the Indian Pharmaceutical Market

Above facts establish Lupin as one of the marquee name in Indian Pharma Industry. We need to see company performance on stock exchanges. It is important to see how the company has performed over the years given the growth it stats on website.

Also it is interesting to see the impact of recent FDA issues on Company performance more importantly stock price of the company.

Lupin Stock Performance

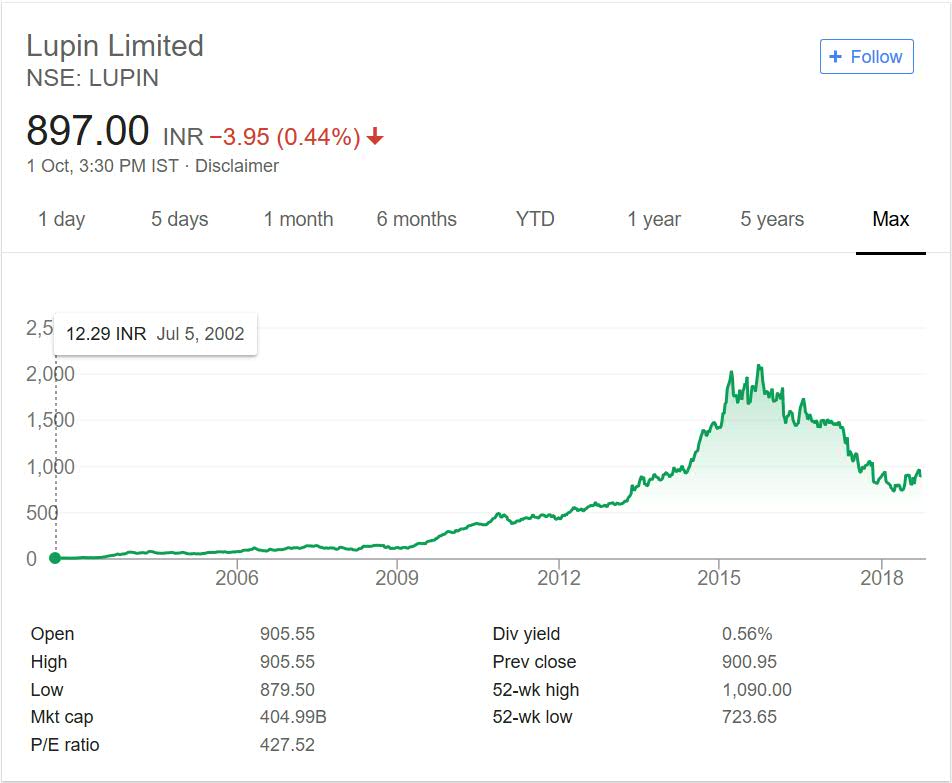

Now lets see how well this company has performed for the investors. Below is the price graph for the company over a period of time.

If you see above the company outperformed every year starting from 2002 to 2016. There was not a single year where company has not given positive returns in this long 14 years.

In this 14 year period it moved from 12 odd level to 2000 level giving investors a handsome profit. The company also pays regular dividend which added to investor money. All in all it has rewarded investors in every possible manner during this time frame.

After 2016 due to US FDA observations company has not performed that well. This got reflected in prices and company traded below 1,000 for quite sometime. Barring this period company has outperformed most companies listed on stock exchanges.

Lupin My Opinion

Lupin is leading Pharmaceutical company of India. The ace investor Rakesh Jhunjhunwala has good stake in this company. In fact it is one of the main companies in his portfolio. This fact establishes credibility of the company.

There are many pharma companies listed in India. The global pharma giants like Pfizer, Merck and Abbott are also listed in India. This makes Pharma space very competitive.

Rakesh Jhunjhunwala has also invested in another pharma company Jubilant Life Sciences. You should also explore portfolio of other top investors of India and see which pharma companies they are bullish on.

You can then add those companies to your stock watch list and then compare them. Personally I am tracking Lupin and some other pharma companies. Pharma space will get benefit with INR depreciation and rising exports. So this space looks good.

Conclusion

Pharma sector has some excellent companies which have given great returns in past. This sector is facing issues due to US FDA observations in recent years and some companies are impacted by it.

But recent happenings does not make them bad companies or this sector as dead one. You should explore the sector and decide the companies which meets your requirement.