Man Infra Overview

Man Infra is one of the leading construction companies in India. It was primarily in port development but has ventured into real estate construction as well.

As per the website of the company it created India’s first premier private port project for Nhava Sheva International Container Terminal at Jawaharlal Nehru Port Terminal, Navi Mumbai in 1997.

Subsequently, we have successfully worked on five ports viz., Jawaharlal Nehru Port Trust, Mundra Port, Chennai Port, Vallarpadam Port and the Pipavav Port.

Man Infra has successfully executed construction of high rise building with 3 Residential Towers of 55 storey which is one of the tallest towers’ in western suburb of Mumbai.

Most of the residential projects are based in Mumbai area. It is considered as one of the leading Real Estate developer in Mumbai. Lets us see how well the company has performed on stock exchanges.

As per the website description the company has good list of completed projects as well as upcoming projects. It is 50 year old construction company. So experience is there and it has tested different economic situations. Also the company is new only 7 years to Residential Real Estate development.

Man Infra Stock Performance

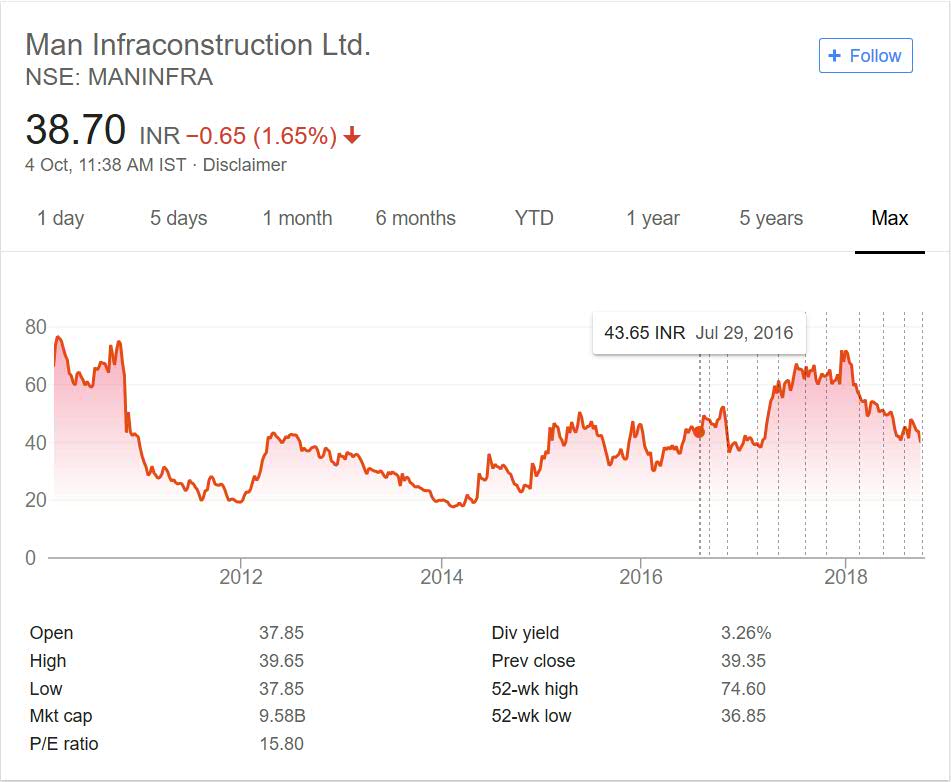

Below graph shows the stock price performance of Man Infra. The price performance over the period of time shows how well the company is performing for investors. The growth of company should get reflected in share prices.

If you see above Man Infra started its journey from just below 80 marks and it remained at this position for sometime. But ever since it has not touched that mark ever.The highest point in Man Infra exchanges journey is the beginning time only.

The lowest point of stock is 20. It touched this point in year 2012 and year 2014.Since year 2014 the stock has performed well for investors. It has given positive returns.

One thing is worth mentioning that the company pays handsome dividend.If you look closely you can see at that current market price company pays 3% dividend which is excellent by any standard.

The investors who have timed their entry in the stock have made money else it was a sorry story for most investors. The 52 week high price is still less than IPO price. This does not reflect good picture for initial IPO investors.

Man Infra My Opinion

Man Infra is in portfolio of Rakesh Jhunjhunwala. In fact Rakesh Jhunjhunwala has two real estate companies primarily operating in Mumbai region. The other company is Anant Raj Limited.

Personally I do not like Real Estate companies as most of them have huge debts on their books. Also the problem is one bad project execution and companies performance go wayward.

There are many top investors in India who have Real Estate Companies in their portfolio. You can browse those portfolio and see the companies they have in their list. It will give you some idea about the stock picking.

Personally as mentioned above I do not have any tracking position in stocks from this sector. But you can track companies and add it to your watch list as many top investors have stocks from Real Estate and Construction company in their portfolio.

Conclusion

Real Estate sector is not performing for quite sometime. It has given negative returns of most of the investors. But a sector in doldrums can turn around and make positive gains for investors.

Many top investors have invested due to this turn around story only.