Mandhana Retail Ventures Overview

Mandhana Retail Ventures Limited in short MRVL started in year 2011. So it is pretty new company. Company entered into global exclusive Trademark License Agreement on the even date to design, manufacture, retail and distribute men’s wear, women’s wear and accessories under “Being Human” trademark until March 31, 2020.

Note the Being Human is associated with Salman Khan the famous Bollywood star. The company should get benefit from Fan following of Salman Khan. The company operates in a competitive field but the Being Human logo should benefit it as per general perception.

Mandhana Retail Ventures Stock Performance

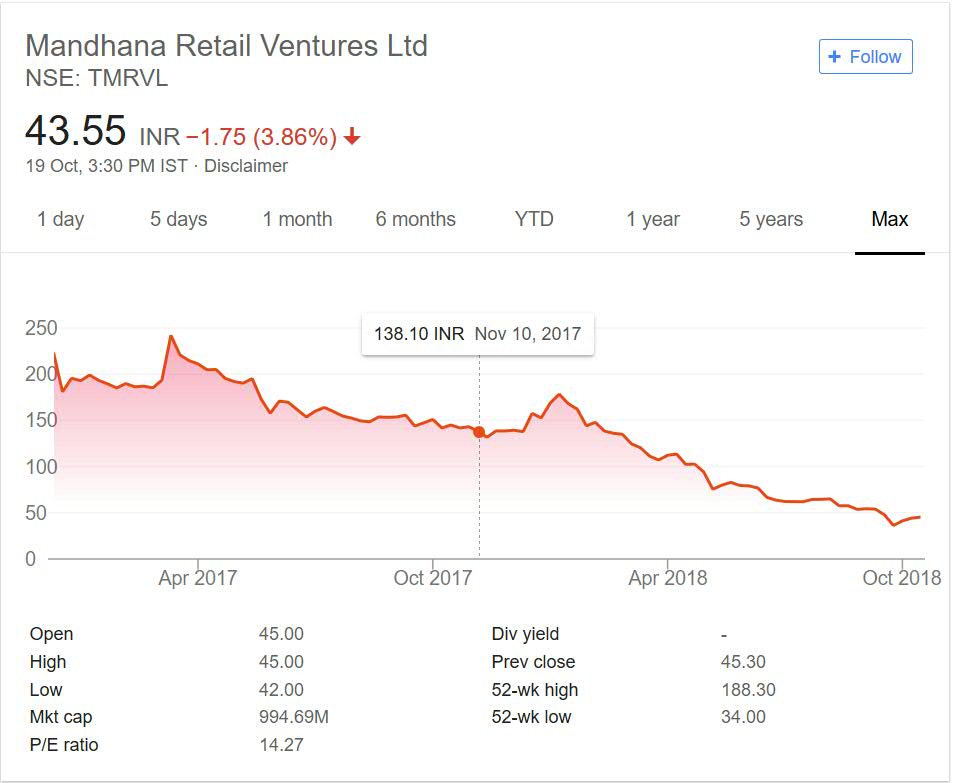

As mentioned above this is new company. It made debut on stock exchanges in year . Below graph shows the price from IPO till date. So it will give you an idea how well the company has performed for IPO investors.

The company got listed on stock exchanges above 200 mark. It then moved past the IPO mark and moved closer to 250 mark after couple of months. But since then the stock price has not moved up.

Till year 2017 it hovered around 150 to 200 ranges. The price gradually was moving downwards. After year 2017 the performance degraded a great deal. It has now moved down below 50 mark.

So in this 18 month period the price of company has moved down from 200 levels to 50 odd levels. It can be termed as wealth destruction for initial IPO investors or those who invested in year 2017 hoping to ride the initial frenzy.

Mandhana Retail Ventures My Opinion

I am not that convinced in the company. The product quality of a Company drives sales. On the company website nothing is mentioned about product. Company presents the brand power of Salman Khan as major selling point.

But brand power of Actors get faded with time. It also goes down with movie being hit and flop. So banking on a person brand image will not drive the Company in long run.

This fact is reflected by share price degradation of the company. The turn around can happen if product and brand power both are given importance. One interesting fact about company is that Rakesh Jhunjhunwala has stake in this company.

You may also want to explore other Retail companies in portfolio of leading investors of India.That will help you identify few more players in this niche.

Conclusion

Mandhana Retail Ventures Limited is an interesting company. It is banking on star power and operates in Retail segment which is touted for growth in coming years.

It is important to see the quality and response from market on the products in long run before making a decision. As per share price performance it is not in good shape as of now.