NCC Overview

NCC stands for Nagarjuna Construction Company Limited. It started as a Construction Company. But with time it added many new verticals to its umbrella. As of now it is not a construction company only. Below are the verticals the company operates as of now.

Below are the business area company works on along with one key project from that area company worked on. The key project will give you idea of competency of the Company.

- Building and Housing – Key project is Raipur Cricket Stadium

- Roads – 1427 mts. Kalina-Vakola Flyover at Mumbai, Maharashtra

- Electrical – High Voltage Distribution System for APSPDCL at Tirupati

- Water and Environment – Krishna Drinking Water Supply Project

- Irrigation – Construction of Gandikota Dam, Kadapa District, AP across Penna River and earthwork excavation of GNSS Main Canal

- Railways – Construction of 3rd line between Habibganj and Sanchi, near Bhopal

- International – The Oberoi Resort at Al Khiran – Kuwait

- Power – Executing a project for Sasan UMPP, Madhya Pradesh in collaboration with Northern Heavy Industries Group Company Limited, China

- Metals – SAIL – ISP: Blast Furnace (in consortium with POSCO E&C)

- Mining – Removal of Overburden by deploying the HEMM at Medapalli Open Cast Project, SCCL, Ramagundam, Andhra Pradesh

Now lets see how this company has performed for investors over the years.

NCC Share Price Performance

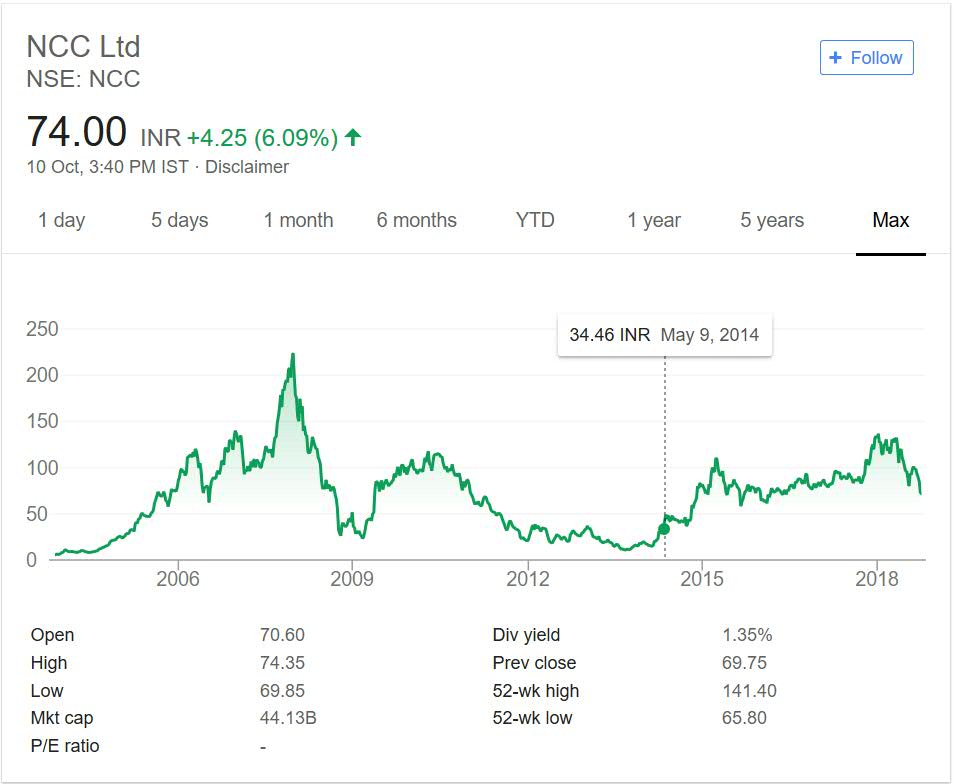

Below graph shows the price performance of NCC over the years. I have taken long time frame. Long time period will eliminate any cyclic fluctuations whatsoever from the prices.

If you see above the company has given exception returns from year 2003 to year 2008 period. It rose from below 10 levels to over 200 levels. But in the 2008 market crash the stock suffered and went below 50 levels.

It has started recovering from year 2014 till date. Note during this period most of the real estate stocks have not performed well. So it is a big positive for this stock. The stock has yet to pass the glory days of 2008. It has not crossed 150 mark since that time.

NCC does pay good dividend and at current market price it translate to more than 1%. People who have invested in low prices have reap good return from this company.

NCC My Opinion

NCC should not be considered as Real Estate play. Rakesh Jhunjhunwala has also bought stake in NCC. This makes it special candidate for research. You can also add this stock to your stock watch list.

Personally I do not like to track Real Estate or Construction companies. Most of them take loan for the development tasks. The only company I like from Construction sector is Larsen and Toubro (which is not a ideal Construction company and have wide range of operations).

But NCC is an interesting play altogether. The wide range of activities it performs make it insulated to slow down in one particular segment. Over the years it has performed well if bought at low point. So if you are tracking this company it should be important to enter at right level.

But for me it is in avoid list as the company has too many fluctuations in price and it is difficult to predict bottom of any company.

Conclusion

NCC is interesting company and if do not have issues investing in Real Estate or Construction companies then you can track this one. You can also consider exploring other Real Estate companies in portfolio of top investors and then make a decision.