Anjani Portland Cement Detail

English Video

Hindi Video

Anjani Portland Cement is in portfolio of Subramanian P. He is one of the top investors in India. As the name suggests the Company is in Cement Sector. I have reproduced what Company has to say about itself from its website. It will give you brief idea about the Company and its operations.

Anjani Cement is a popular brand in south India for its quality and commitment to service. Starting with initial production capacity of 0.3 million tonnes per annum in 1999, the Company has now achieved a quantum shift in its production capacity to 1.2 million tonnes per annum. The second plant powered with the latest and modern technology and infrastructure has started operations in 2010.

South India is main market for Anjani Cement. Andhara Pradesh is major market of the Company but slowly it has penetrated in other states like Tamil Nadu, Orissa and Karnataka. It has plans to penetrate deeper into these three states.

It has also started to foray into markets of Maharashtra, Kerala and Goa.So Anjani Portland Cement is trying hard to penetrate in other states and become a major player in South Indian landscape.

Now lets look at the performance of the Company on stock exchanges. As per founding principles of technical analysis stock prices reflect Company and Index performance over the years

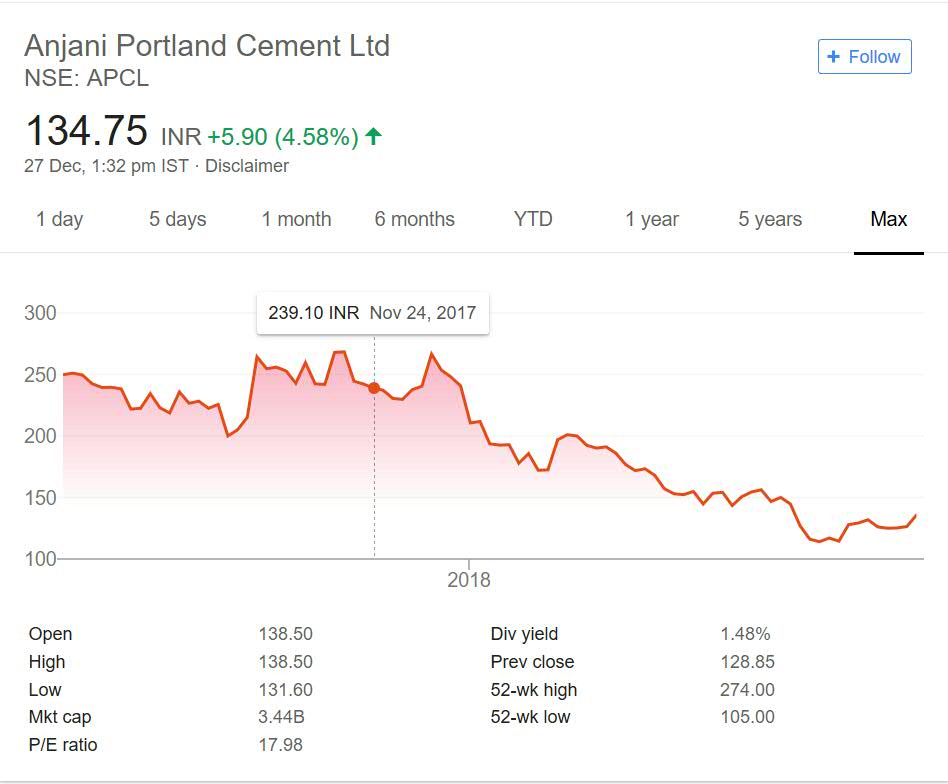

Below image shows stock price performance of Anjani Portland Cement since IPO days. The Company got listed recently so it will not give clear picture of performance but at least we have idea.

Anjani Portland Cement Performance

Anjani Cement got listed in April month of year 2017.The timing was good. India witnessed bullish run that time. It made debut at price of 250. After initial dip to 200 mark it went past 250 mark and fluctuated between 240 levels and 300 levels for next few month.

It was a promising start for the Company on exchanges. People were positive about it. But off late in year 2018 prices suffered due to Sell Off in markets. It reached close to 100 mark. So there was 50% or more decline in the prices since IPO days.

Note during this sell off period most stocks have suffered. Based on these prices Company should not be judged as of now. Time period should be long enough to judge Company based on stock price performance.

Anjani Portland Cement My Opinion

Cement is a growth sector. There are many good stocks in this sector. It has produced multi baggers and compounders in the past. Nifty also has Giants from this sector. You can have one cement stock in your portfolio. But question is which stock you should pick.

There is no doubt about potential of Cement sector. But it is too crowded sector to say the least. There are national players, regional players and state level players. Each competing with other to gain market share and retain their existing market share.

So in this scenario should you be investing in newly listed company or old established player. I would suggest you to explore companies in this segment and compare them over the years.

The South Indian cement space is crowded. Anjani Cement has to perform and gain market share. If not then investors will be unable to make money in this counter. For now I would suggest you to add these companies in your stock watch list and compare them over the period of time.

Disclaimer – I have one company from Cement space in my Portfolio as of this writing.