Timken India Overview

Timken India has acquired ABC bearing. So this post is now applicable for ABC Bearing as well as Timken India. Timken is multi national company based in US. It is global manufacturer of bearings and related components.It is one of the top 5 bearing company in the world.

It manufactures and markets bearings, gear drives, belts, chain, couplings, lubrication systems and related products, and offers a spectrum of power train rebuild and repair services.

Bearings have varied application. They are used in places where you have cylindrical or roller (round moving items). For example you may have seen ball bearings in your car or bike or bicycle. So automotive industry is one heavy users of bearings.

Now lets look at the performance of Indian subsidiary and parent. We will see stock price performance of both and see whether investor have got return or not.

Timken India Stock Performance

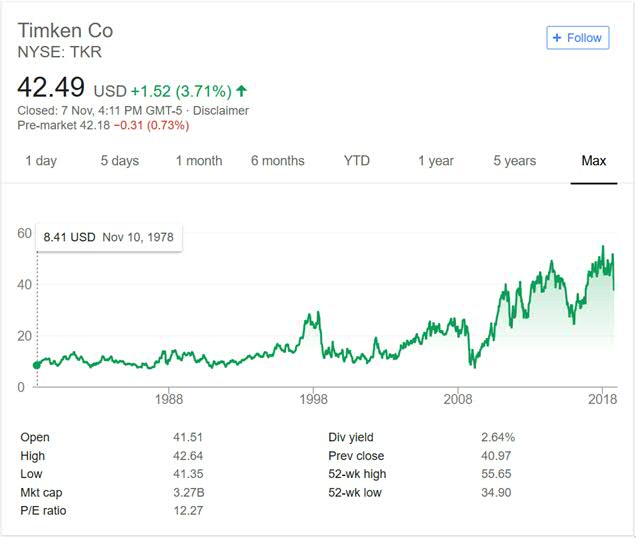

Below is the stock price performance for Timken company listed in US. We will first see performance of global company and then Indian company. Note if parent company is doing well then Indian company will also perform and vice versa.

The parent price chart is increasing with time. It has risen most after 2008 period. Before that stock had long consolidation period. The prices increased till 1998 in slow and steady manner. During next ten years from 1998 to 2008 it had bearish phase.

Parent company has performed well after 2008. Same story is seen in Indian company price chart. The company had steady but slow rise between 2008 and 2014. After 2014 it had good growth.

The dividend of parent company is quite good (around 3%) at current price. The dividend of Indian company is less than 1% but looking at parent it can improve with time.

Looking at both charts it is clear that company has not made investors poor. It is slow and steady money maker for Investors.

Timken India My Opinion

ABC Bearing is in portfolio of famous investor Vijay Kedia. As mentioned above Bearing space is very less crowed. The major foreign players are listed in India as well.

There are some small Indian players listed. With ABC bearing acquisition you may like to explore other small Indian player which may get acquired by large Foreign player. This will reward you as an Investor.

So instead of suggesting one company I would rather advice you to investigate the sector. Since there are not too many players you can add them to your stock watch list and follow them.

With industrial growth in India (Manufacturing as well as Automotive) this sector will have good growth in future. The sector looks promising and lack of players will help you to spot a winner easily.

In next article I will review yet another interesting company in portfolio of top investors in India.