I am receiving questions about Yes Bank more often then not. The questions increased after ace investor of India Rakesh Jhunjhunwala bought stake in this Company at 67 INR.

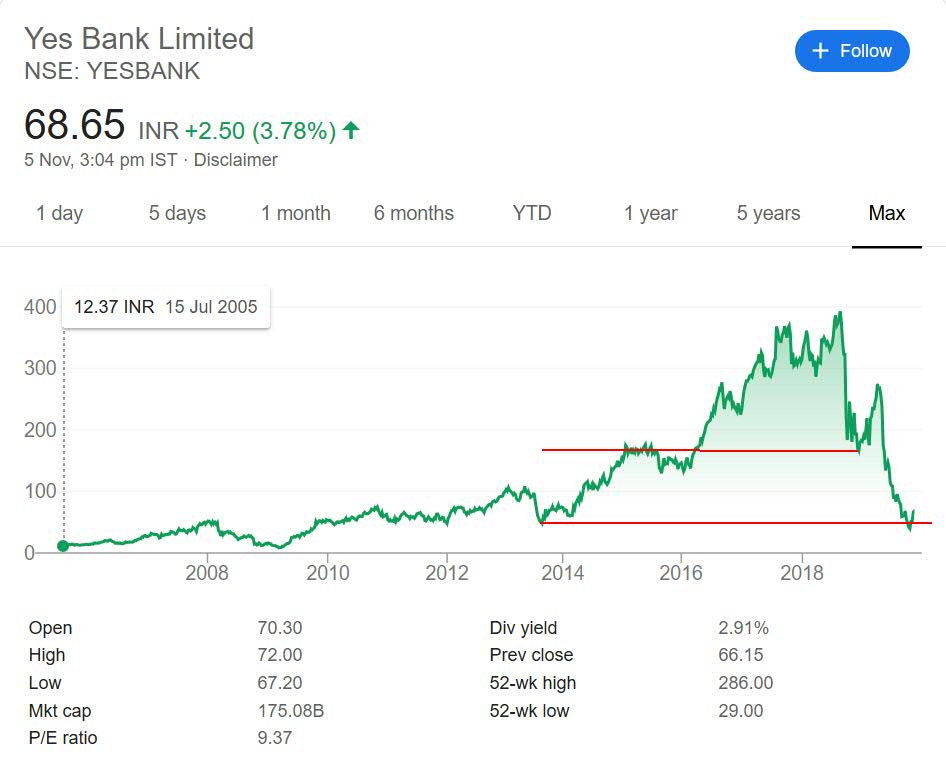

This stock was once market darling giving excellent return. The past track of the stock is good as below chart shows. If you leave the slide at end of 2018 (Aug month) to be precise. The overall performance is excellent along with dividend yield.

Yes Bank – Long Term Performance

Lets consider time frame from year 2005 (12 INR) to 2018 high 393 INR. The stock gave approx 32 times return in 13 years along with good dividend yield. So investors have made money in this counter.

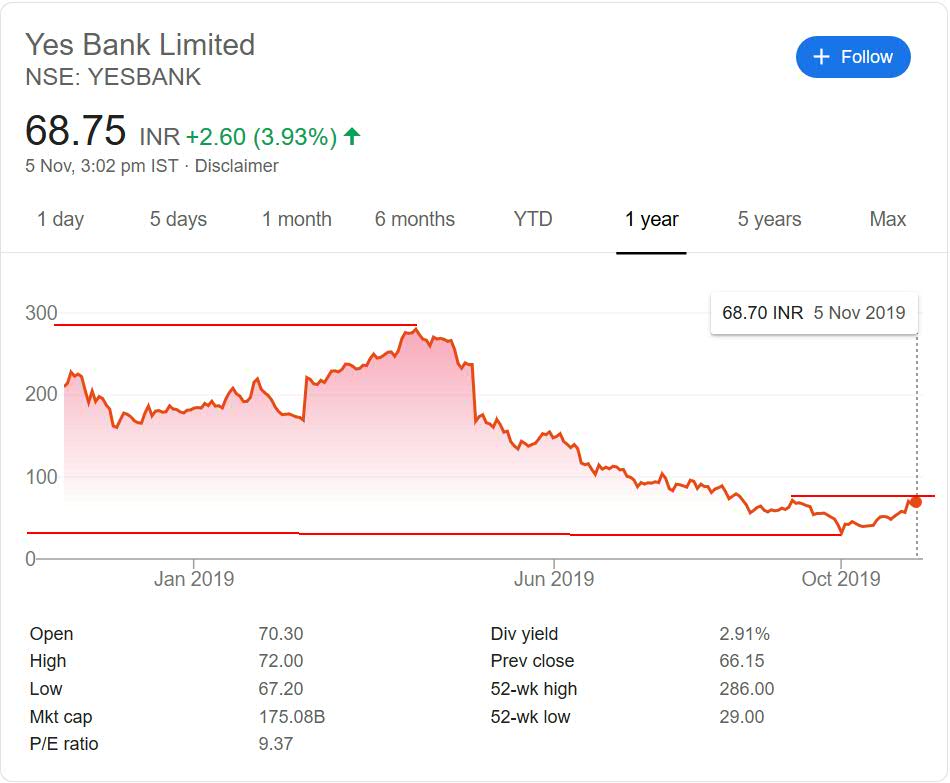

Yes Bank – Last 1 year performance

In last one year it has came from 300 odd levels to 30 levels. It made 30 as low in Oct month. In last one month it has jumped up and is trading near 65-70 range as of today.

So the return is approx 50% in one month which makes people think that they can make quick money as stock will turn around from here.

Yes Bank – My Opinion

Above I shared price performance along with Rakesh Jhunjhunwala buying stake in this Company. So people get tempted buying the Company thinking of past performance as well as ace investors entry.

I agree these are tempting points backed by last one month price action in it. But for investment we need to ask few questions to us

Questions to be asked before Investment

- Is this the best stock in Private Sector bank space?

- Is this the safest stock in the segment?

- How much return I can have in it?

- Is everything sorted out in the Company?

- Should I put money on news flow only or based on event whose outcome is not yet confirmed?

I asked these questions to myself and came with answer that it is not wise decision to invest in this stock. The reasons are simple

Retail Investors vs Ace Investors

- Rakesh Jhunjhunwala put 87 crores in this Stock. This is huge amount for Retail Investor but not for Ace investor.

- The risk taking capacity is more for Ace investors.

- Capital protection should be of utmost importance for Retail Investor.

- Holding period differs. He can hold stock in loss for more than 5 years but are we ready for it

Conclusion

Personally I will not invest in this Counter. There are better and safer alternatives in the market available where one can make investment. For investment it is important not to do guess work or follow any ace investor without understanding difference between risk appetite of him and yours.

This is just my opinion feel free to make your investment decision. I am not SEBI registered analyst and as of now this stock is not in my portfolio or I do not have any trading position.