Let me give you details of the dividend paid by the Company for last 15 years. So basically you are beating Fixed deposit returns every year with ease. If you consider the stock price appreciation over the years in the counter then it is icing on the cake as well.

It has paid dividend each and every year. The dividend has increased year after year as well except only this year. The stock price of the Company has also increased in this duration as well.

So let me first share the dividend paid by the Company over the years.

| Ex-Date | Dividend (%) | Dividend (Rs) |

| 19-09-2022 | 300 | 30 |

| 20-09-2021 | 380 | 38 |

| 17-09-2020 | 375 | 37.5 |

| 9/9/2019 | 340 | 34 |

| 4/9/2018 | 240 | 24 |

| 6/9/2017 | 170 | 17 |

| 14-09-2016 | 125 | 12.5 |

| 3/9/2015 | 125 | 12.5 |

| 16-09-2014 | 120 | 12 |

| 13-09-2013 | 110 | 11 |

| 17-09-2012 | 100 | 10 |

| 14-09-2011 | 85 | 8.5 |

| 15-09-2010 | 76 | 7.6 |

| 15-09-2009 | 64 | 6.4 |

| 17-09-2008 | 15 | 1.5 |

| 13-02-2008 | 30 | 3 |

| 14-09-2007 | 18 | 1.8 |

| 14-02-2007 | 10 | 1 |

Now that you have idea about the dividend history of the stock it is time to name the stock as well. The Stock is Balmer Lawrie Investment Limited. It is holding company of Balmer Lawrie which is Government of India Enterprise.

Balmer Lawrie investment does not have any business operations of its own. It is just holding company of Balmer Lawrie. So it gets income in form of Dividend paid by Balmer Lawrie. It does not have any major expense as such so you are getting a debt free holding company in form of this company.

It distributes the income in form of dividends. As you can see it has paid regular dividend over the years and on current price the dividend has been above 7% over the years most times. In between the stock also has price appreciation which effectively increases your dividend yield if you have invested at lower level.

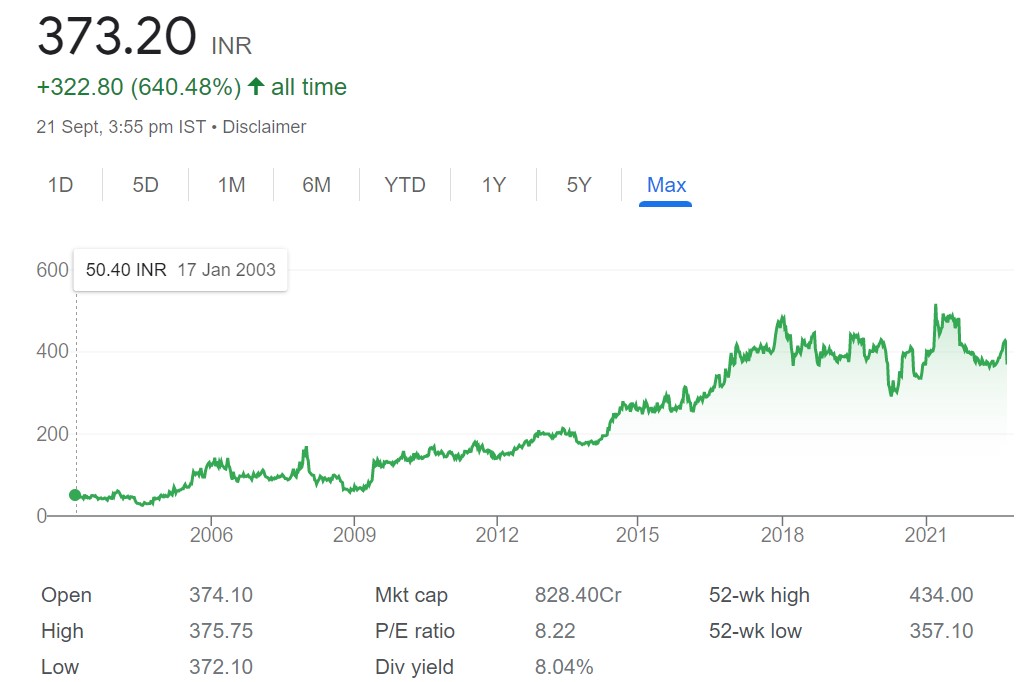

Note the Company is below 1,000 Crore as of now. So I have termed it as Microcap company. As mentioned above it has 0 employees. Below is the stock price performance over the years. It has given around 7 times return in these years and dividend as increased over the years.