HPL Electric and Power Ltd Detail

HPL Electric and Power Ltd is in portfolio of Ajay Upadhyay. He is one of the top investors in India. The company belongs to Power sector.

As per the Company website it is India’s leading electric equipment manufacturer. It has presence over 5 verticals like Metering solutions, Modular switches, Switch Gears, LED Lighting and Wires and Cables. Below are some stats about the Company

- 25% market share in Electronic Energy meters

- 50% market share in On load change over switches

- 5% market share in Low voltage switch gear

- It is also 5th largest LED manufacturer

It also has wide range of offline presence as well.

- More than 2,000 dealers and distributors

- More than 27,000 retailers

There are seven manufacturing facility of the Company. The Company has presence in Solar field as well. Under this head it has below products Meter, Solar Lightening solutions, Switch Gears and Wires and Cables.

It is good to see Company exploring new verticals like Solar Power which is touted by many as future of Power Company as India being tropical country can get immensely benefited by it.

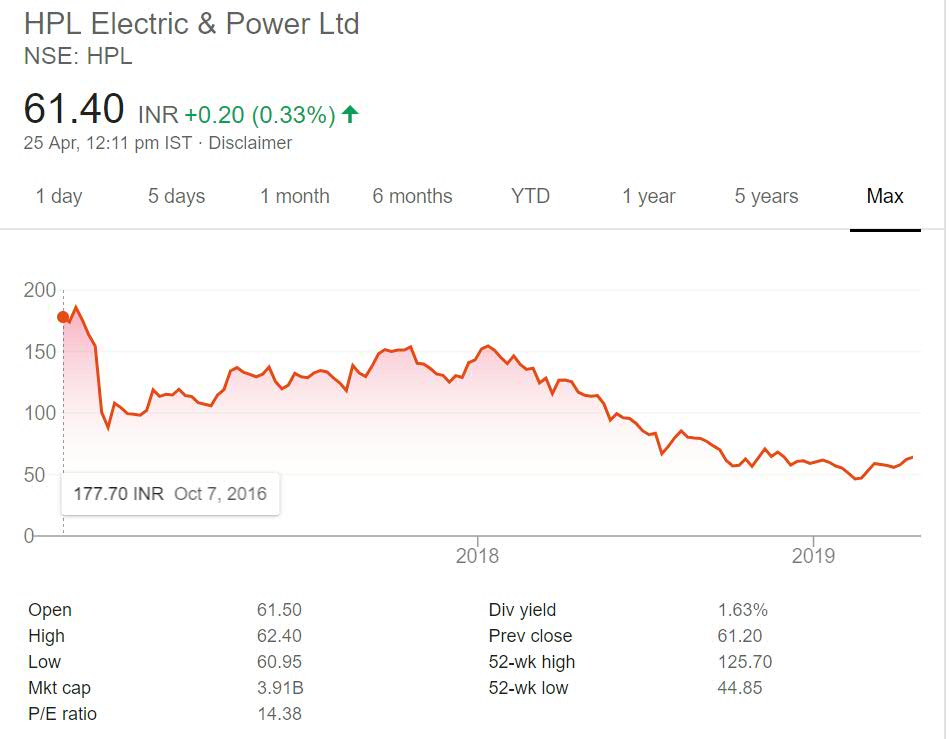

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

HPL Electric and Power Ltd Stock Performance

The stock listed during bull phase of market in year 2016. The listing price was around 175. But soon after listing it saw heavy sell off which pushed the price below 100 mark. Since listing Company has not touched listing price.

It has not made money for IPO investors. In fact IPO investors have suffered good loss in this Counter. It is now trading at heavy discount to listing price. The only soothing thing is dividend yield which is greater than 1.5% at current market price.However short term price performance should not be major decision maker for you.

HPL Electric and Power Ltd My Opinion

HPL Electric and Power Ltd is a Electrical Company.It provides wide range of Electrical accessories and products for different target segments. It also holds good market share in few product categories.

It also has international presence. It is mainly present in African countries, Europe and South East Asia. It exports to more than 35 countries in these regions. Africa being one of the major focus area for this Company.

The recent Solar push and electrification of all villages should drive sales for the Company. Meter penetration is still low in India. This is yet other growing segment for the Company.

I would suggest to wait for the Company stock prices to stabilize. I have not yet invested in any Electrical Component Company. I will track this Company so as to get more information about it and competitors.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.