Navin Fluorine International Ltd Detail

Navin Fluorine International Ltd is in portfolio of Ajay Upadhyay. He is one of the top investors in India. The company belongs to Chemicals sector.

As per the Company website it is one of the largest and the most respected Indian manufacturers of specialty fluorochemicals. It belongs to the Padmanabh Mafatlal Group – one of India’s oldest industrial houses.

The Company has four strategic business units

- Refrigeration Gases

- Used in Air Conditioner, Refrigeration and Fluoropolymer resins

- Inorganic Fluorides

- One of the largest manufacturer of Anhydrous Hydrofluoric (AHF) and Aqueous Hydrofluoric acid. Applications in Oil and Gas, Pharma and Agro Chemicals

- Speciality Fluorides

- Pharma, Crop protection and Fragances

- Contract Research and Manufacturing Services

The Company exports 40% of its production to different Countries in North America, Europe, South East Asia.It has manufacturing unit in Surat, Dahej and Dewas.

The head office is located in Mumbai and it has sales office in major cities of India. It does not have any sales office in Eastern India though.

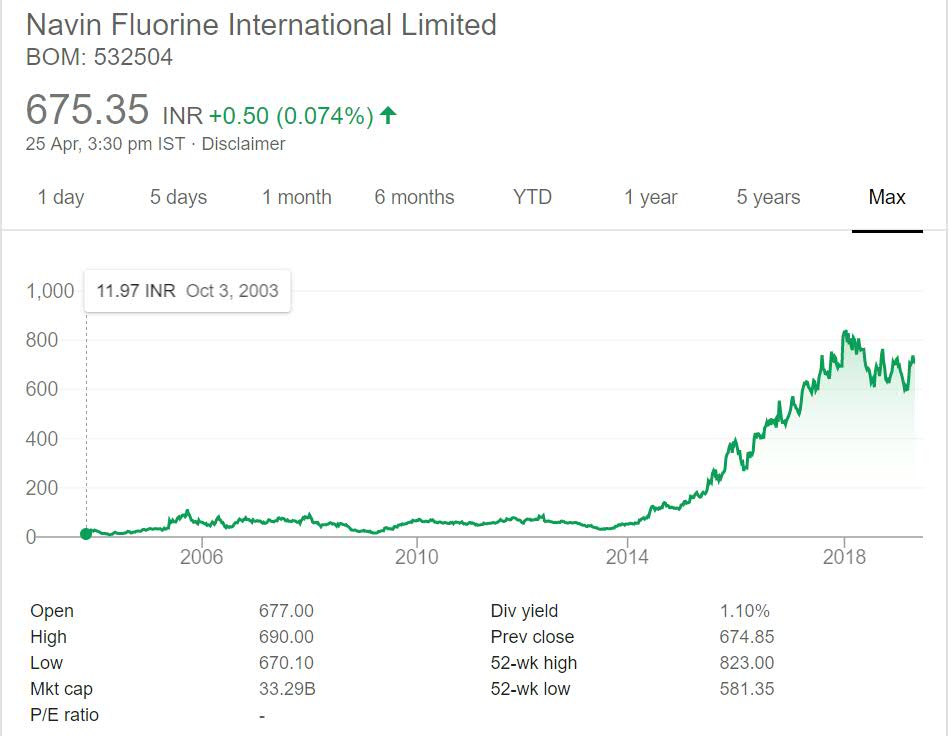

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Navin Fluorine International Ltd Stock Performance

The stock performance can be divided into two parts.One from year 2003 to 2014 and other from year 2014 till date. The stock traded almost flat giving some positive returns to investors during first ten years. This was not a good period to invest.

But last few years were great for the Company. It zoomed or gave 10 times return in past few years (that is from 2014 till date). It was complete rerating of the stock. The dividend yield is also good at more than 1%. The stock has made money for the investors.

Navin Fluorine International Ltd My Opinion

Navin Fluorine International Ltd is a Chemicals Company.It mainly deals with Fluoride based chemicals. Fluorides have wide range of applications most common one is Refrigeration.

Along with production of specific molecules it has custom service for customers as well. It does custom chemical syntheses of fluorinated compounds for the pharmaceuticals, agro chemicals and speciality chemicals industries.

It is good to see specialized focus from the Company. Small companies with niche set of products which have demand should be preferred by investors.This one fits in the bill. However it has ran too much in last few years and I am expecting cooling period.

One should always remember it is entry price in a Company which matters and determines your profit. So you should track the Company and compare with others present in this niche before making a decision. I already have Chemical stock in my portfolio and do not want to invest in more as of now.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.