Hathway Cable Detail

Hathway Cable is in portfolio of Akash Bhansali. He is one of the top investors in India. The company belongs to Media and Entertainment sector.

As per the Company website it is one of the India’s leading Cable Broadband service provider.It also provides Cable Television services through its wholly owned subsidiary – Hathway Digital Private Limited. The Company is part of Raheja Group of Companies.

Below is two main services provided by the Company

- BroadBand

- It provides high speed cable broadband services across 16 cities including 4 metros. It has .77 million subscribers as of now (writing of this post). Target consumers are Households and Small business.

- Cable Television

- It offers cable television services across 350 cities and major towns. It has 7.2 million digital cable subscribers.It is one of the largest MSO of India.Target consumers are Households and community establishments like Clubs or Hotels

- Internet Leased Lines

- This segment caters mainly to Business Users. They are fast SLA driven Internet service aimed at Corporate companies.

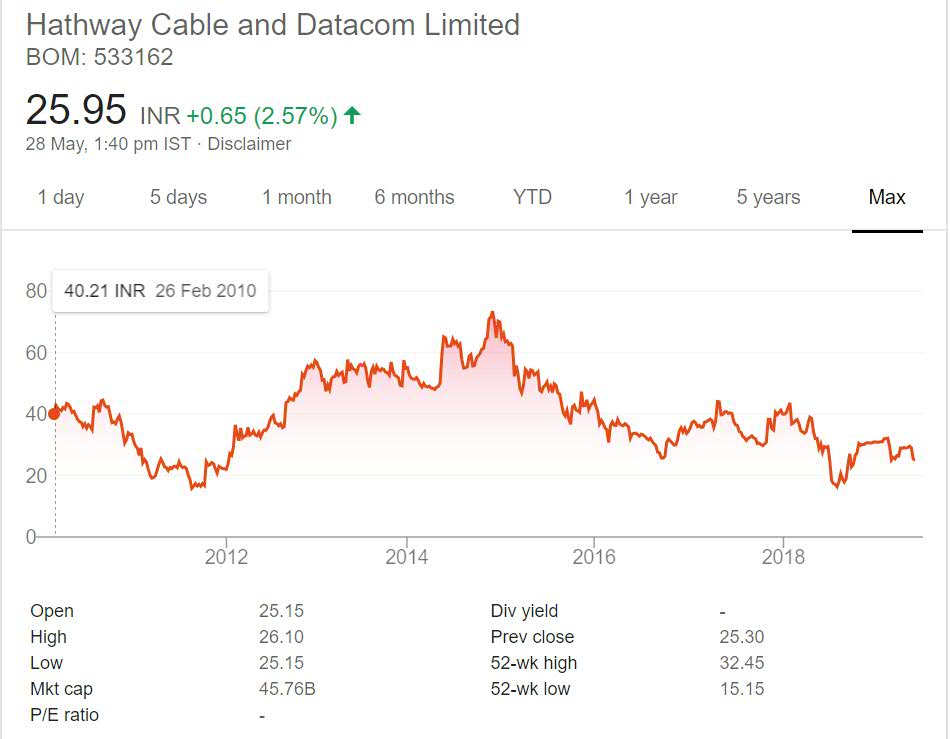

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Hathway Cable Stock Performance

The stock got listed in year 2010 at price 40 INR. If you look at absolute performance between year 2010 and current year it has not given any positive returns to investors. People have lost money in the long term.

The stock got listed in year 2010 at price 40 INR. If you look at absolute performance between year 2010 and current year it has not given any positive returns to investors. People have lost money in the long term.

The Company is not regular dividend payer which makes matter worse. Investors made some money during the bull run when prices zoomed past 60 price. But in recent years it is on steady decline.

Hathway Cable My Opinion

Hathway Cable is a Media and Entertainment Company. Cable television and Internet services became very popular in recent times. 10 years before you can see many cyber cafes opened in the market. It was very common site and profitable business back then.

Also cable television adoption was increasing at brisk rate. People wanted more channels and entertainment. The days of only two national channels were gone. The disruption in this field 10 years back closed many shops and opened many.

The sector is again getting changed. Cyber Cafes are closing each day. It has become rare sight now and some operate mainly for printing and coaching. People are using mobile phones for Internet access. The data rates have decreased and speed has increased.

Cable television has touch competition with YouTube, Amazon Prime and Netflix. These service providers are eating into share of Cable television. Most channels have App now so people are also consuming the content on their mobile.

This shift will impact cable televisions in long term. With Smart TV people are using Internet for viewing experience and giving away with Cable. Also Reliance is trying to enter the space Company operates in which will further impact the market.

I am not too optimistic in the space and will not be tracking this Company. This Media and Entertainment is growing sector but technology disrupts it too often. Now big companies are entering the space (Reliance, Amazon) which will make things tough for smaller players.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.