Khaitan Electricals Detail

Khaitan Electricals is in portfolio of Akash Bhansali. He is one of the top investors in India. The company belongs to Electrical Appliances sector.

As per the Company website it is in business of Electrical appliances manufacturing. The name was one Synonyms with Fans. It was the most popular fan brand in India. Below are the products created by this Company

- Domestic Fans

- Ceiling Fans

- Exhaust Fans

- Pedestal fans

- Table fans

- Wall / Cabin fans

- Industrial Fans

- Air Circulator fans

- Exhaust fans

- Cooler Kits

- Coolair fans

- FHP motor

- Blue motor

- Submersible pumps

- Pumps

- Cooler

- Water Heater

- Instant Water Heater

- Storage water heater

- Gas water heater

The Company has Pan India presence with branches in major cities of India. It has two manufacturing units one in Hyderabad and one in Faridabad with combined production capacity of over 4 million fans per annum.

The Company exports products to Africa, Middle East and neighboring countries of India.

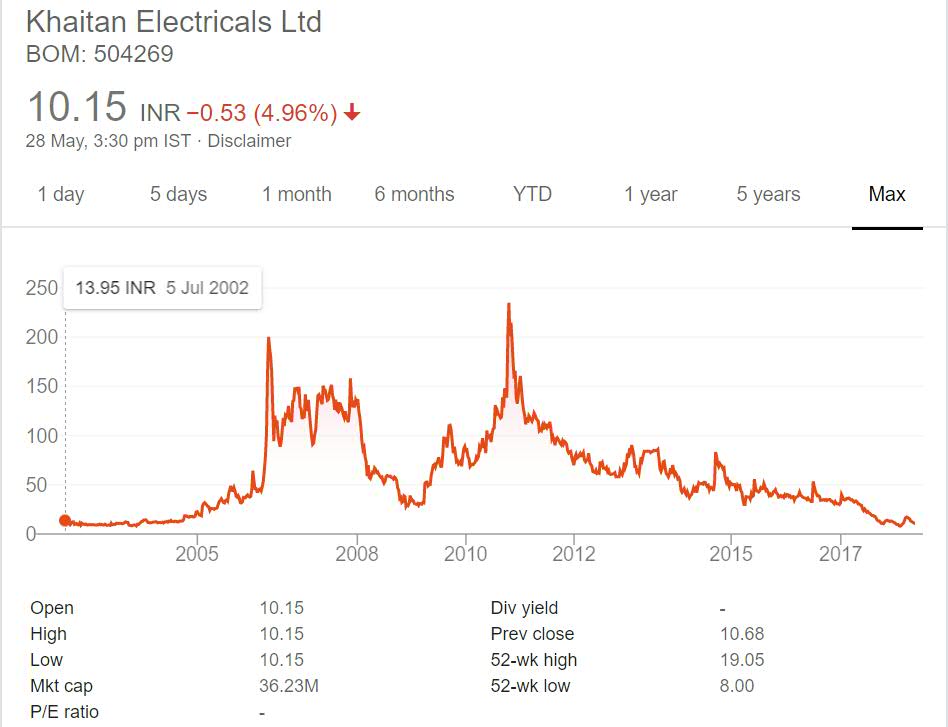

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Khaitan Electricals Stock Performance

The stock is on continuous decline after year 2011. It has not performed positively after that year. The decline is steady and with each passing year it is making new lows. It has performed well for investors before 2011 giving good returns.

The stock also recovered beautifully after global crisis but past few years or decade is disastrous for the Company. Investors have lost huge wealth in the Company. There is no fast decline but slow decline shows bad performance year by year.

There is no consolidation phase for the stock which makes things worse. Consolidation happens in results are in line with previous years or quarters.

Khaitan Electricals My Opinion

Khaitan Electricals is a Electrical Components Company. It was one of the top names in Electrical Components industry with Fans being synonymous with Khaitan name. It once enjoyed similar brand name like Videocon.

But with new Chinese players and Indian players in market it is facing tough time recently. Companies like Symphony and Bajaj are eating into the Cooler market share of the Company. Similarly Fans have new players in market like Crompton and Bajaj.

With these new competition in market Company is facing difficulties. In last decade there is no positive progress from it. It it trying hard to regain the value but with newer players it seems to be difficult.

The sector is good as there will be continued demand for Fans and Coolers. But Company was unable to tap on the demand and bank of first mover advantage it once had. I will not be tracking this Company and will not be investing in this sector as of now. This sector is facing challenges from Chinese counter parts which will impact Indian players adversely.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.