Sandhar Technologies Detail

Sandhar Technologies is in portfolio of Akash Bhansali. He is one of the top investors in India. The company belongs to Auto Components sector.

As per the Company website it is one of the leading automotive components and systems supplier engaged in diverse range of manufacturing of safety and security systems for automobiles across segments.

Below are the list of products from the Company

- Automotive locking and security systems

- Automotive Vision Systems

- Stampings

- Operators Cabins & Structural Parts

- Zinc, Aluminium and Magnesium Die Casting

- Automotive Optoelectronics

- Polymers

- Painting, Plating and Coating

- Commercial Tooling

- Helmets

- Assemblies

- Fuel Pumps, Filters and Wiper Blades

Below are list of Joint Ventures of the Company

- Indo Tooling Private limited (JBM Auto Limited)

- In business of tooling activities

- Jinyoung Sandhar Mechatronics Private Limited (Han Sung Imp Co. Limited)

- Assembly of AVN panels, and switches

- Sandhar Daewha Automotive Systems Private Limited (Daewha Fuel Pump)

- Manufacture and assembly of oil fuel modules, fuel filters, starter motors, and wiper blades

- Sandhar Amkin Industries Private Limited (Amkin Group Private Limited)

- Manufacture of safety helmets and other headgears for two-wheelers.

- Sandhar Han Sung Technologies Private Limited (Han Sung Imp Co. Limited)

- Manufacturing of high precision press parts, insert moulded contact plates, and switches

- Sandhar Ecco-Green Energy Private Limited (ECCO Green Energy)

- Solar power installation for captive use

The clientele of the Company includes Komatsu, Tata Hitachi, Bosch, Forza, Tata Motors, Hero and Honda etc. It has 31 manufacturing facility in India, two in Spain and One in Mexico.

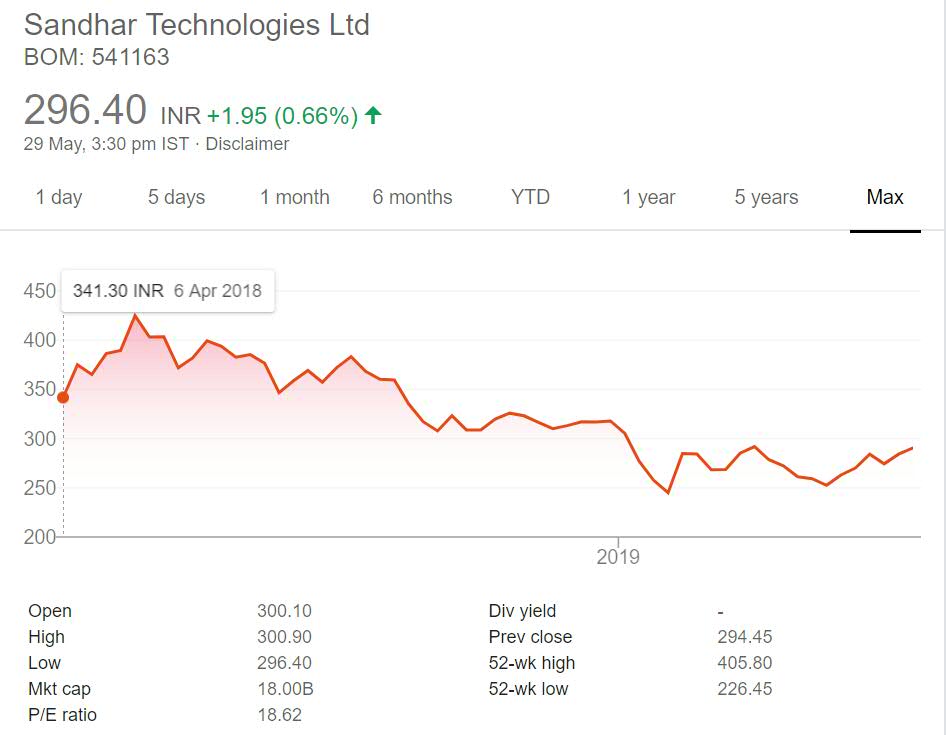

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Sandhar Technologies Stock Performance

The stock is newly listed on stock exchanges. It got listed in year 2018 at listing price of 341 INR. Soon after listing it performed well reaching above 400 price point. But after initial good run it started declining slowly due to slowness in Auto sector.

As of now it is trading near 300 mark (or near the IPO price). So in past one year IPO investors have not made any money in the counter. It is worth mentioning that Auto Sector and Auto Components sector is going through rough phase currently. So this price correction should be viewed in that aspect.

Short term price performance should be used to gauge performance or quality of any stock. Long term price performance should be used.

Sandhar Technologies My Opinion

Sandhar Technologies is a Auto Components Company. Auto Components sector is dependent on Auto sector performance. If Auto sales numbers are good and Companies are performing then Auto Components Companies will perform.

Auto Sector is now in slow phase. But this is a temporary phenomena in market.The demand will pick up. The best thing about this Company is that majority of products are aimed at Safety. This product segment will not be impacted by switch to Electric Vehicle.

Electric Vehicle will disrupt Auto Components market. There will be growing demand of new items like Batteries and some components like Petrol and Diesel Engines will phase out. The shift will be gradual. Having said that some Components Companies which are in business of products not impacted by Electric vehicle shift will remain relevant.

I have already invested in Auto Components sector. I have not invested in Auto Companies though. I will keep this Company on my radar and track it to get more details about it.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.