Schneider Electric Detail

Schneider Electric is in portfolio of Akash Bhansali. He is one of the top investors in India. The company belongs to Electrical Components sector.

As per the Company website it is engaged in the business of manufacturing, designing, building and servicing technologically advanced products and systems for electricity network.

It has four manufacturing units in India. Two manufacturing units are situated in Vadodara and one each in Kolkata and Chennai. It is part of Schneider Electric based in UK which is 180 years old organization.

Below are the list of product categories from the Company

- Transformers

- Two variants Oil transformers and Power transformers

- Components

- Sub Station automation, Controllers and RTUs, Communication elements (like Ethernet switches), Engineering Tools for Power automation and Simulation tools

- Ring Main Units

- Smart Grid components. It helps in improved energy availability, Optimized network performance and time and cost savings.

- Automation

- Medium voltage switch gear and transformer for energy automation

- Specific solutions for utilities, oil and gas, mining, data centers, and critical buildings, covering all power distribution needs for energy management.

So it manufactures a wide range of products that includes Transformers, Medium Voltage Primary & Secondary Switchgears, Protection Relays, electricity distribution management systems, software suite for self-healing smart grid, e-House & smart cities applications.

The key end markets include Power Generation, Transmission & Distribution, Oil & Gas, Metro, MMM and other Electro Intensive segments, etc.

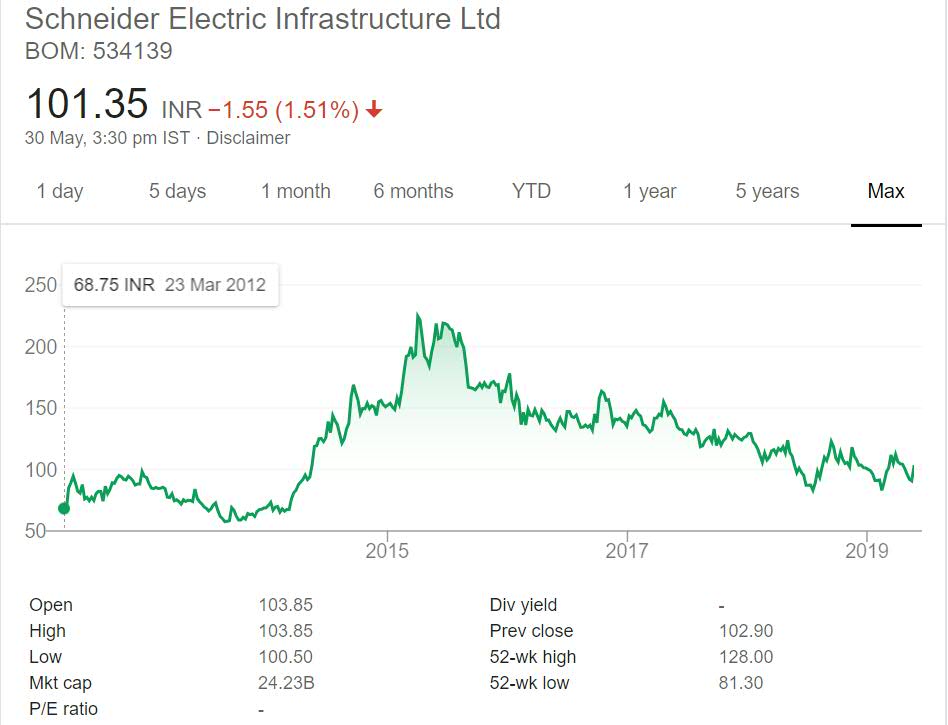

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Schneider Electric Stock Performance

The stock got listed on exchanges in year 2012 at price of 68 INR. After listing it moved towards 100 price mar but again started to correct and got back at listing price. Major jump came after year 2014 partly due to Government focus on Rural Electrification aiming to bring electricity in every village.

That was awesome time for investors as stock gave close to 3 times return as it zoomed past 200 mark in year 2016. But since then it has been in correcting mode. It has corrected slowly and is now trading near 100 mark.

The stock prices are now stabilizing near 100 mark. There is no dividend yield history for the stock which makes things look not so good for investors. I prefer companies giving regular dividends to investors.

Schneider Electric My Opinion

Schneider Electric is a Electrical Components Company. The Company mainly manufactures electrical components to be used in Power Generation and Power distribution. It aims to eliminate human intervention and to automate/ manage these process.

Automated self healing Smart Grids are need of hour. In a vast country like India these type of technologies will help provide better power services to people as Smart Grids will be able to handle voltage fluctuations and heal themselves from these type of harsh conditions.

This will eliminate any power fluctuations due to harsh conditions which is always good. So Company may see growth in this area due to Government focus and spending on Electrification drive.

The only problem is Power sector is largely Government controlled. So any innovation or changes require Government Intervention. The Smart City and Improvement in Power distribution and Generation will need budget allocation from Government. So this is mostly a news based or event based stock as of now. I have not invested in this Sector as of now and will not be tracking this Stock as of now.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.