Punjab Alkalies and Chemicals Ltd Detail

Punjab Alkalies and Chemicals Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Chemicals sector.

As per the Company website it mainly deals with Caustic Soda. Below are the product from the Company

- Caustic Soda Lye

- Used in Paper and Pulp, Soap and Detergents, Textiles and Dye stuff industry and Aluminium industry

- Caustic Soda Flakes

- Liquid Chlorine

- Water treatment plants, Paper manufacturing, Stable bleaching powder and CPW and PVC.

- Hydrochloric Acid

- Metal pickling, Water Demineralisation in power and fertilizer plants

- Sodium Hypochlorite

- Textile bleaching, Laundry trade and Dis infection of drinking water

- Hydrogen Gas

- Optional fiber units, as coolant in power plants, as a fuel and Hydrogenation of vegetable oils

The Company has head office in Chandigarh.

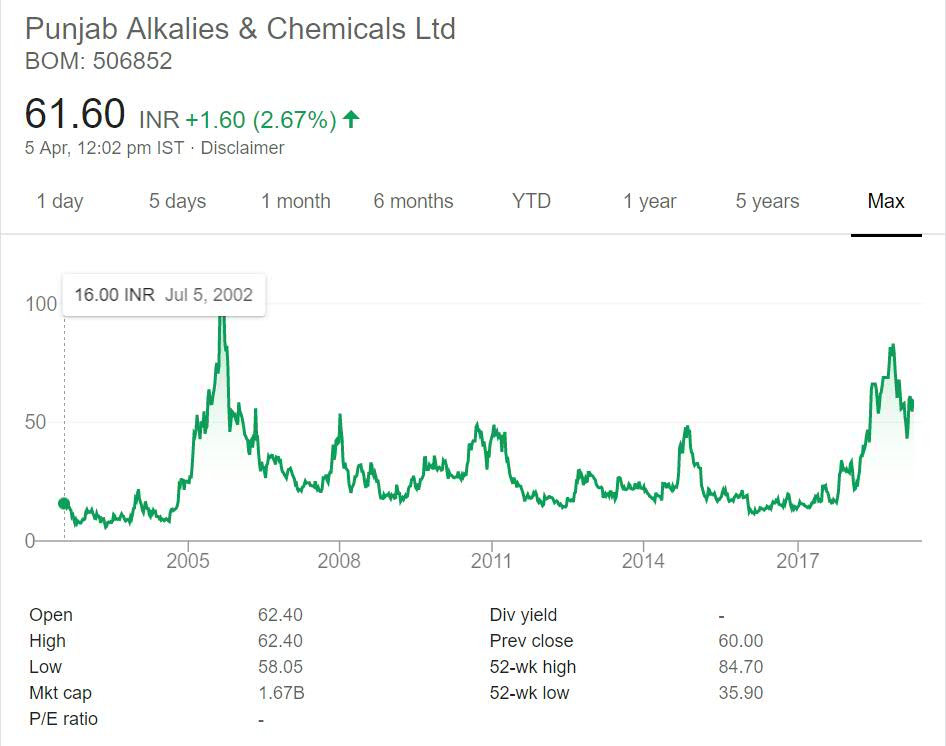

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Punjab Alkalies and Chemicals Ltd Stock Performance

The stock can be categorized as Cyclic stock based on long term price performance. If you closely see it has ups and downs throughout the journey we have presented above.

The stock makes bottom at around 30 odd levels and then bounces off from that level to 50 odd levels giving decent returns to investors. This is not a hold long term type stock which I prefer to invest in. It is more of cyclic business which you should enter and exit on proper levels.

Punjab Alkalies and Chemicals Ltd My Opinion

Punjab Alkalies and Chemicals Ltd is a Chemicals Company. I have mentioned the product mix from the Company above.

Looking at past performance the Company is unable to improve on previous performance incrementally. I do not prefer to hold and keep cyclic stocks in portfolio. There are exception to this rule but those stocks do get appreciated in value during the cycles.

But this one keeps coming back to original lower levels during each down cycle. So it is more of a trading stock keeping cyclic movement in mind. You should not average it in down cycle and each will have same price point for bounce.

If you are comfortable playing with this type of stock price performance then you can track it. I will not track it as I do not prefer cyclic trading stocks for portfolio.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.