Sarla Performance Fibers Ltd Detail

Sarla Performance Fibers Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Textiles sector.

As per the Company website it is a 100% EOU engaged in the manufacturing and export of polyester and nylon textured, twisted and dyed yarns, covered yarns, high tenacity yarns and sewing thread. Below are category of products

- Textured polyester yarns

- Bulklon

- Textured Nylon Stretch yarns

- Textured sewing thread

- Covered Yarns

- High tenacity yarns

These products are used in Auto Industries to build interiors, Fashion Industry to create cloths and other wearable and in medical industry to create bandages.

The manufacturing and dyeing facilities are located in Silvassa and Vapi which are not far from Head office in Mumbai.

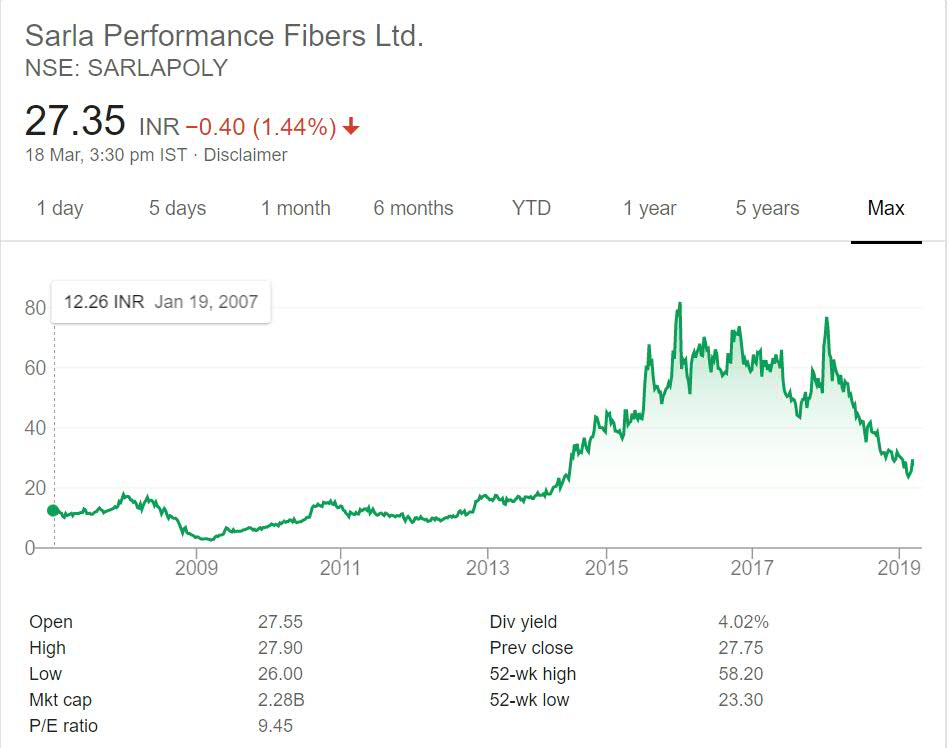

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Sarla Performance Fibers Ltd Stock Performance

The stock got listed in year 2007 just before global crisis of 2008. This was not good time to get listed on exchanges. The listing price was 12 INR. The Company has given two times return in past 10 odd years. The dividend yield is whooping 4% at current market price.

Dividend yield is very lucrative. After initial slow down due to global crisis stock has performed well over the years slowly giving positive returns.

Sarla Performance Fibers Ltd My Opinion

Sarla Performance Fibers Ltd is a Textiles Company. The products created by Company are in demand across various industries as mentioned in details section. Textiles is one fail safe sector as demand of these products will be there always.

This is too competitive sector as well with low margins. The competitive nature of business makes it difficult sector to bet on. The demand will be present but Company which will survive becomes tough ask. It is huge sector as well with lots of player creating unique products and some times overlapping products as well.

As of now I am not invested in Textiles sector and am planning not to invest in it. I am more interested to invest in a Textiles machinery sector instead. This sector company acts as product seller and maintainer of machinery required for Textiles factories.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.