Uttam Sugar Mills Ltd Detail

Uttam Sugar Mills Ltd is in portfolio of Anil Kumar Goel and Seema Goel . He is one of the top investors in India. The company belongs to Sugar sector.

As per the Company website it is one of the leading integrated sugarcane processing company.It produce Refined Sulphurless Sugar, White Plantation Sugar, Ethanol and Power. The Company has four sugar units. Out of these four units three sugar units produce 100% “Sulphurless Sugar” using “Defecomelt” process instead of conventional “Double Sulphitation”.

Out of 4 plants 3 are situated in UP and 1 in Uttarakhand.These plants have an aggregate sugarcane crushing capacity of 23,750 TCD. The Company also produces power to lessen the operating cost. It also exports extra power generating revenue as well.

The total power generation capacity in four plants is 103 MW, out of which 55.5 MW surplus power is exported to National Grid. It also produces 75 Kilo liters of Ethanol per day. Different varieties of Sugar this Company produces are

- Liquid Sugar

- Natural brown Sugar

- Super fine Sugar

- Icing Sugar

- Bura Sugar

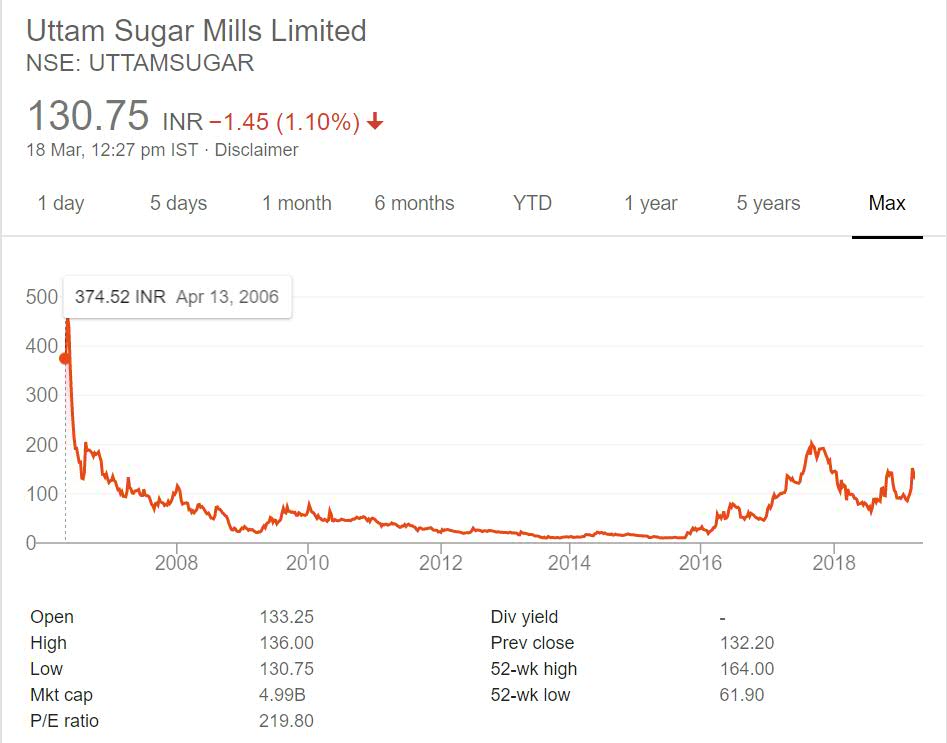

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Uttam Sugar Mills Ltd Stock Performance

The stock got listed in year 2006 at listing price of 374 INR. After initial rise above 400 it slipped to 100 mark leaving investors in despair. The IPO investors have lost great amount of money in this counter. The downfall continued till year 2015 end.

At that point Company started trading at 10 INR price point. Investors who invested at that point made good fortune in the counter getting more than 20 times return in very short span of time. As mentioned in previous research Sugar is cyclic sector. Most Sugar stocks have similar structure (that is they have too many ups and downs).

Uttam Sugar Mills Ltd My Opinion

Uttam Sugar Mills Ltd is a Sugar Company. Sugar as a sector is here to stay. The sector is dependent on production of Sugarcane (Agriculture item). Since Agriculture in India is largely dependent on Monsoon the output varies.

This uncertainty in raw material production and Sugar prices impacts every Sugar Company. This is the very reason Sugar sector is cyclic and most Companies have fluctuating performance.

The time to enter and exit these stocks is very important. If you are new investor or does not like to time the market then it is not the sector for you. I am also not invested in this sector. In case you are interested then you can compare the Sugar companies and select the best ones.

I have reviewed many sugar companies present in portfolio of ace investors. So you can start reading reviews of them first.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.