Vardhman Holdings Ltd Detail

Vardhman Holdings Ltd is in portfolio of Anil Kumar Goel. He is one of the top investors in India. The company belongs to Finance sector. It is holding Company for Vardhaman Steel and Vardhaman Textiles. In this post I will discuss Vardhaman Textiles, Vardhaman Steel is discussed in separate article.

As per the Company website it produces Yarn, Garment, Fabric, Fiber and Sewing thread. The steel division is now de-merged to separate unit and Vardhaman Holding now oversees just Textiles part.

Below is the business areas along with capacity in each of them

- Yarn – Produces over 580 MT per day. Processes over 50 tons of yarn per day and 15 tons fiber per day

- Garments – 5,000 shirts per day

- Fiber – 20,000 MT per annum

- Fabric – 180 million meters greige fabric per annum.Processes over 114 million meters fabric per annum

- Sewing thread – Over 43 MT per day

It offers the widest range of specialized greige and dyed yarns in cotton, polyester, acrylic and a variety of blends. We also manufacture value added products like Organic Cotton, Melange, Core Spun Yarns, Ultra Yarns (Contamination controlled), Gassed Mercerized, Super Fine Yarns, Slub and Cellulose Yarns and Fancy Yarns for hand knitting.

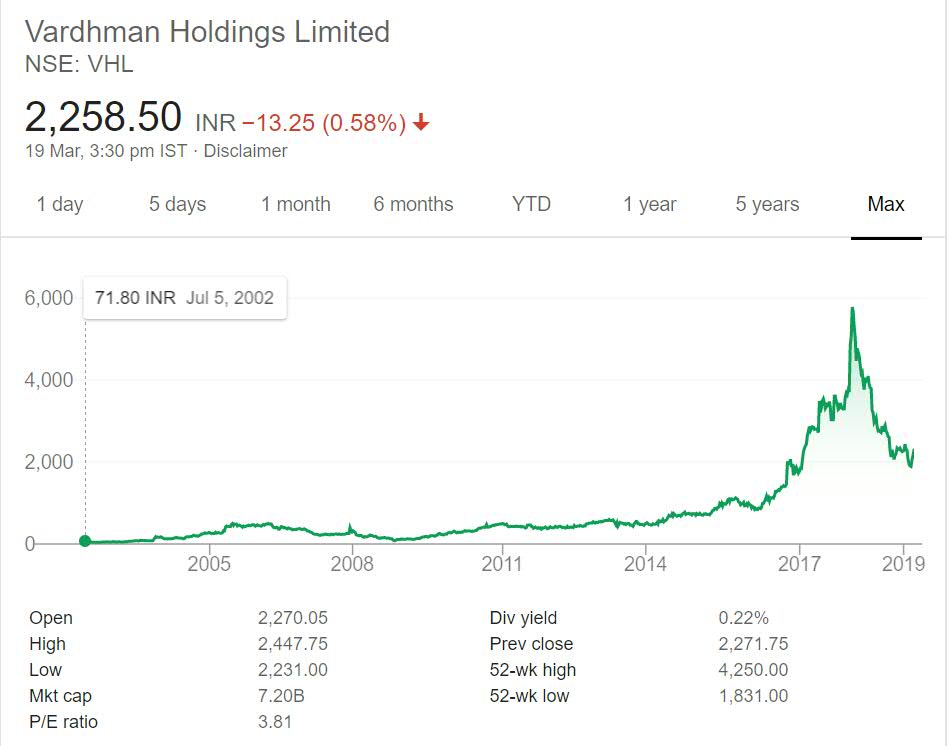

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Vardhman Holdings Ltd Stock Performance

The stock has given 30 times return in past 16 years. This is good return for any stock. Majority of price action came in recent times with stock jumping from 500 levels to 5500 levels in span of two years or so. Before that Company gave around 6 times return from year 2002 to 2014.

It ha been a steady performer over the years. Investors should wait for sometime so that it cools off after the frenzy run of 400 to 6000 odd levels in short span of time. It ha corrected to some extend during recent sell off as well.

Vardhman Holdings Ltd My Opinion

Vardhman Holdings Ltd is a Finance Company. You can view it as holding Company for two major Vardhaman group of Companies. I have reviewed both the Companies one in this article and second one in different article. I have given link to that article above as well.

Both Companies have performed well on stock exchanges. This in turn have helped the holding Company. It also gave stellar returns to investors in past few years. If you want to invest in Finance Companies then it is better not to invest in holding Companies. You can invest in Banks or Housing Finance companies.

The fortune of holding Companies are tied with that of Group Companies performance. If group companies are doing well then holding Company will perform well. If any of the Group company struggles then holding Company will struggle. I personally do not like to invest in holding Company for this reason. But some holding Companies have given good returns along with consistent dividend.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.