APL Apollo Tubes Detail

APL Apollo Tubes is in portfolio of Ashish Kacholia. He is one of the top investors in India. The company belongs to Steel sector.

As per the Company website it is the largest producer of Electric Resistance Welded (ERW)Steel Pipes and Sections in India, with a capacity to produce 2 Million Metric Ton per annum.

The Company sells its products in over 20 countries worldwide. It has vast distribution network spread across India. It has warehouses and branches in 24 cities of India. So the company has Pan India presence.

The Company has some patented products as well like Double Door, Hand Rail, Narrow section, Elliptical tube etc. Having patented products is good for any Company as it helps in establishing monopoly for those products.

Company has manufacturing units in different parts of India which helps it cater local demand. It has manufacturing units in UP, Tamilnadu, Chhatisgarh and Karnataka.

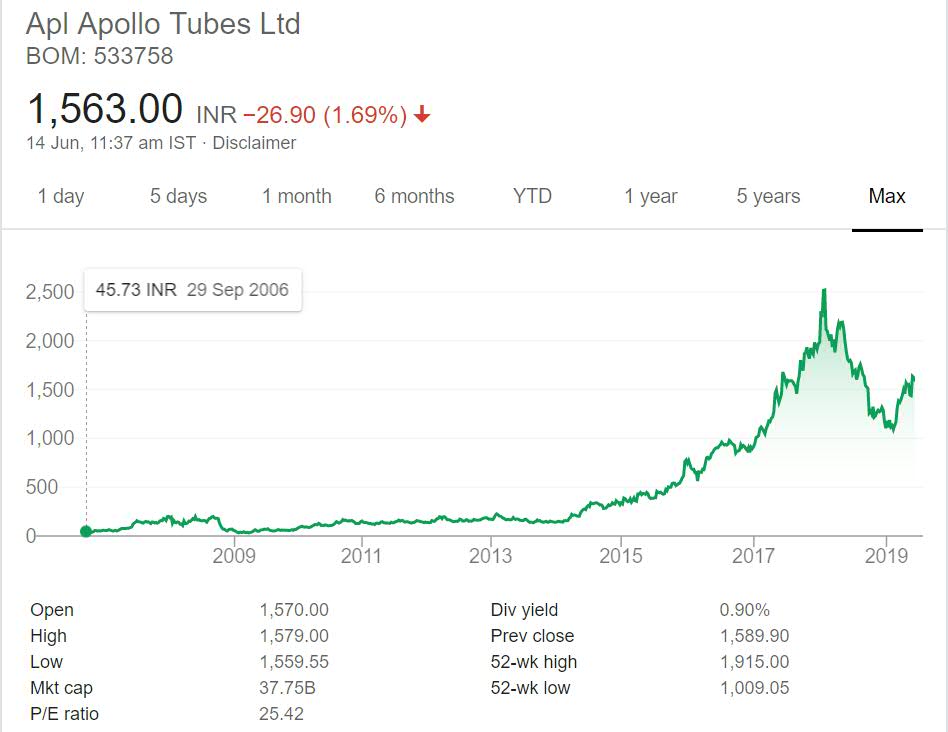

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

APL Apollo Tubes Stock Performance

The stock got listed in year 2006 at listing price of 45. It have positive movement till Global crisis but took around eight years to recover from the Crisis. The recent bull run was perfect for the stock as it zoomed from 150 levels to more than 2,000 (2,500 to be precise).

Over the years it has given excellent returns of over 30 times. The best part is Company has given consistent return over the years if we take out the years after global crisis. During this phase there was no capital erosion but it went into consolidation mode testing patience of investors.

It also gives excellent dividend of close to 1% which is added bonus for investors.

APL Apollo Tubes My Opinion

APL Apollo Tubes is a Steel Company. It is 5th top steel tube manufacturer in the World. It is also India’s top ERW steel tube manufacturer in India. These data shows that Company is leader in this product segment.

It has 40,000 retail presence and 700 distributors. This network makes it possible to reach corners of India. The products from the Company is used in Construction fields mainly. It is the only Indian company to commission the World’s First Fully Automatic DFT Machine.

Most of the Company products are used in Construction and Infrastructural development. India is developing economy so there will be lots of Infrastructural development which will help in rising demand for these products.

I personally have not invested in Steel based products. Steel is a cyclic commodity and steel prices are major raw material cost to these Companies. Any slow down in Infrastructure will hamper demand of products.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.