GHCL Limited Detail

GHCL Limited is in portfolio of Ashish Kacholia. He is one of the top investors in India. The company belongs to Chemicals sector.

As per the Company website it has established itself as a well-diversified group with its footprints in Chemicals, Textiles and Consumer Products segments.

The business operations of the Company can be divided into four parts as mentioned below

- Chemicals

- One of India’s largest producer of Soda Ash light, Soda Ash dense and Sodium Bicarbonate

- 25% of the country’s annual domestic demand of Soda Ash

- Sells Soda Ash under brand name Lion

- Textiles

- One of the largest home textile manufacturers and exporters in India

- It is an integrated set up commencing from spinning of yarn to weaving, dyeing, printing and processing till the finished products like sheets & duvets take shape and are primarily exported worldwide.

- Brands are Rekoop, Cirkularity, Meditasi and Nile Harvest

- Consumer Products

- Sells Edible Salt and Industrial Grade Salt

- Also markets Spices, Blended Spices and Honey

- iFLO is the brand under which Company operates in

- Trading

- It imports Chemicals and sells in India

- Some of the products are Melamine, PVC Resin, Zeolite and Bentonite

It has presence in major cities of India and also have subsidiary office in US. The warehouses are located near port areas for better distribution of products imported for trading.

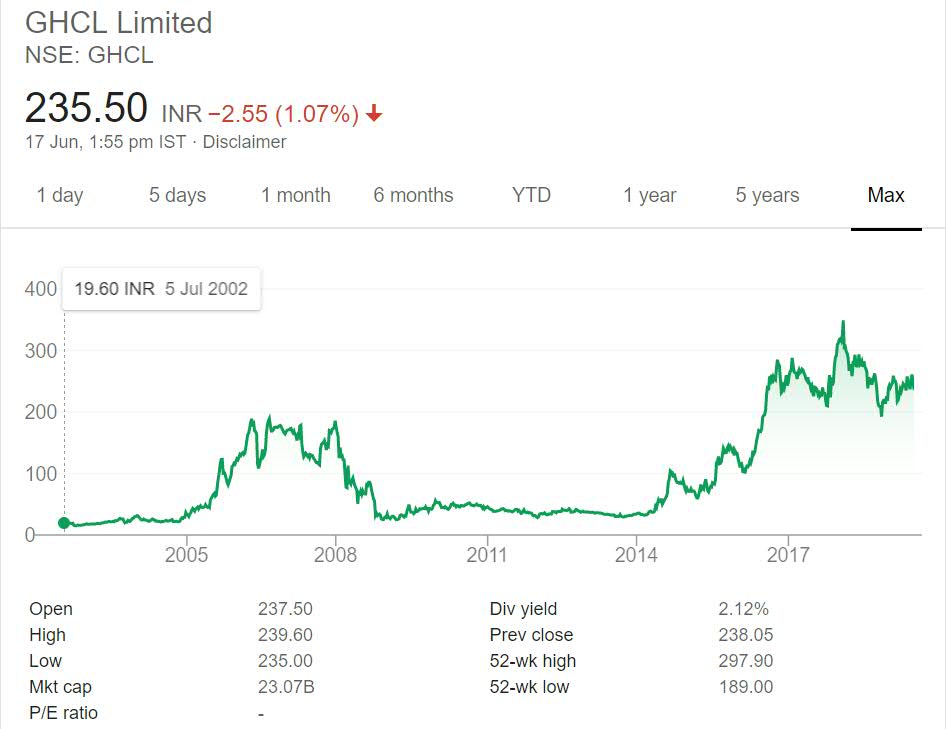

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

GHCL Limited Stock Performance

The stock long term price chart can be divided into three parts one before global crisis, two after the global crisis and three post global crisis from year 2014. The first and last period of stock price performance was good.

It gave 10 times return in first 6 years which is excellent by any standard. The second time frame was consolidation phase as it traded flat all these years and never really got back to levels before 2004. In fact it traded well below 100 mark.

It is only in year 2016 it crossed previous high. So for now you can think of 200 range as strong support. The dividend yield of the Company is also high at more than 2%.

GHCL Limited My Opinion

GHCL Limited is a Chemicals Company. The Company has monopoly on Soda Ash. Soda Ash is an important raw material for industries like bakery, pharma, fire extinguisher manufacturing, cleaning agents etc.

Along with Chemicals sector it is also present in Textiles and Consumer Products sector. Consumer products is growing sector in India. The textiles is evergreen sector as well. Chemical division is also growing sector. So the Company operates in two growth sectors and one evergreen sector.

But the sectors are not related. They all are different from each other. I prefer Companies operating in similar niche. I like the market share of 25% which Company has in Soda Ash and is planning to increase the market share as well.

This can be interesting Company. I would advice to keep a track on this Company. I have already invested in Chemicals sector. As of now I will track this Company as it will be play for Textiles and Consumer products sector.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.