Hikal Limited Detail

Hikal is in portfolio of Ashish Kacholia. He is one of the top investors in India. The company belongs to Pharma sector.

As per the Company website it is the first Indian life sciences company to receive the Responsible Care® certification granted by the International Council of Chemical Associations (ICCA). The business operations of the Company is divided into three categories

- Pharmaceuticals

- API (Active Pharmaceutical Ingredients)

- Custom Manufacturing

- Intermediates and Advanced Intermediates

- API for both Human health and animal health

- Manufacturing facilities located in Bengaluru and Gujarat

- Crop Protection

- Custom synthesis and advanced manufacturing of Agro chemicals, Biocides and Specialty Chemicals

- Manufacturing facilities located in Mahad, Taloja and Panoli

- Specialty Chemicals

- Manufacturing facilities in Mahad and Panoli

- Supplies specialty biocides and antimicrobial actives

- These are used as additives for additives for leather, paint coatings, paper, water treatment, personal care, building materials, and textiles industries.

- Research and Technology

- New product development

- Contract and Custom development based on Client requirements

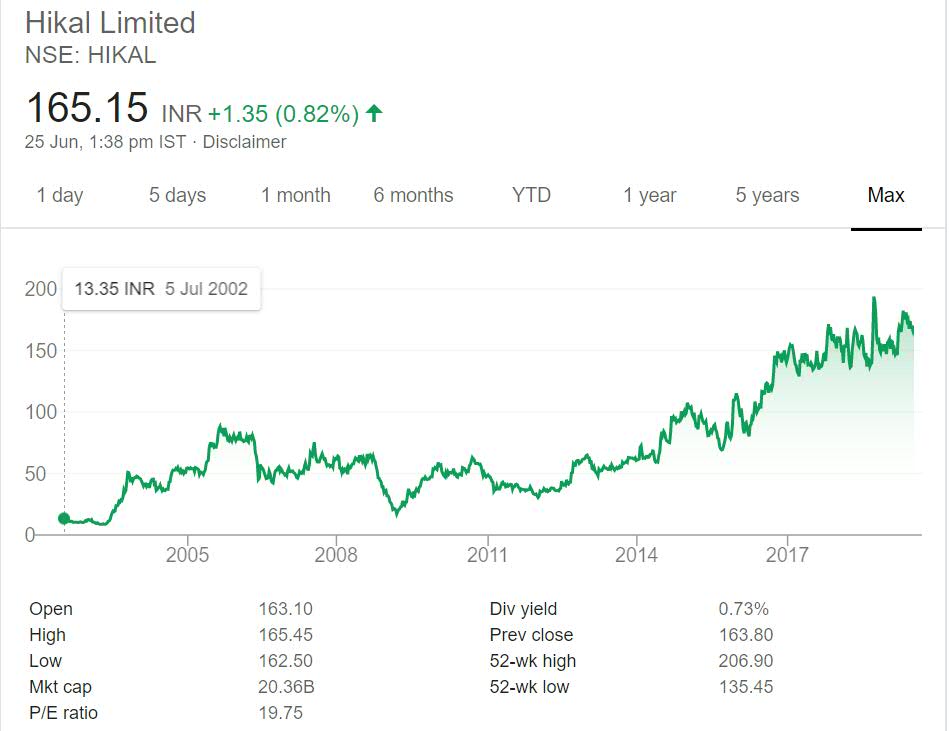

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Hikal Limited Stock Performance

The stock has given stable returns year after year except the time of global crisis and brief period of 2006 and 2007. It is a slow moving stock but has performed consistently over the years. If you consider absolute returns in above long term price chart then it has given close to 10 times return.

The stock is now consolidating between 150 and 200 range and anything below 150 will be great buy price. But before buying one should make his or her analysis on it. It also gives decent dividend of close to 1% which is excellent by any standards.

Hikal Limited My Opinion

Hikal is a Pharma Company. It is in business of API formulation for both Human as well as Animals. It also have exposure to Crop protection as well as Specialty Chemicals. The Company management have taken approach of safe and sure growth which is reflected by their slow and steady stock price performance.

They also do contract manufacturing of both Pharmaceutical division as well as Crop protection division. This serves as additional revenue stream as Customers in US and Europe. Contract manufacturing will gain practice in near future as India manufacturing cost is less than that of Developed countries. Also the turmoil in China will help Indian Companies as well.

The API formulation business both Human and Animals is excellent business. Also Crop protection is growing area as well. These two fields along with Specialty chemicals if played well will help Company grow from here.

This is interesting Company to keep track on as they are well diversified into all three growth segment. It is important to see how well the Company leverages its position or expertise to fuel growth in future.

I have already invested in Pharma sector and is not planning to increase my exposure as of now. But I will keep track on this Company.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.