Mirc Electronics Detail

Mirc Electronics is in portfolio of Ashish Kacholia. He is one of the top investors in India. The company belongs to Consumer Durables or Electronics Goods sector.

As per the Company website it started as Television manufacturer. You may recall Television Ads of Onida television. This is the Company behind Onida television. It has since then diversified its operations and is now complete Consumer durable Company.

The wide range of product portfolio includes Flat panel TVs (LED LCD TVs), Air Conditioners, Washing Machines, Microwave Ovens, DVD Home Theatre systems, Mobile phones, Projector systems and LED lights.

It has world class manufacturing facilies at Wada (Maharashtra) and Roorkee (Uttrakhand) with a capacity of over 3.4 Million Televisions and 2.4 lakhs Washing Machines respectively.

The Company is targeting middle east and north Africa market by creating specialized products for these markets. The aim is to increase export of the products in these regions.

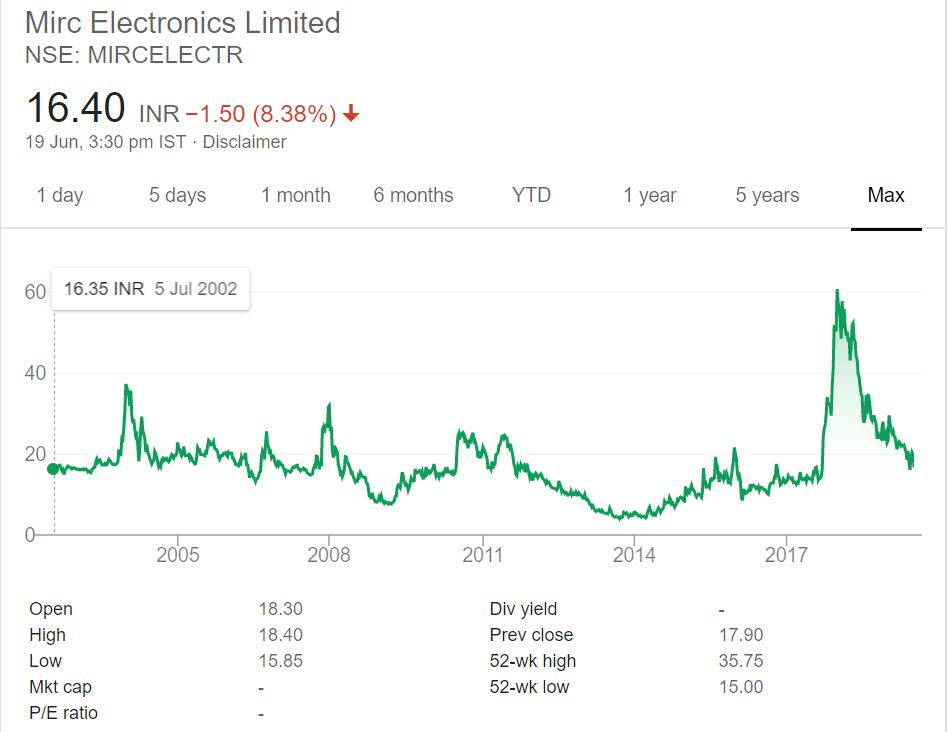

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Mirc Electronics Stock Performance

The stock has not given any returns to investors in above long term price chart. The current market price is same as that of 2002 market price. Anyone who has hold the stock till date has not made any money on the investment. So this has performed badly for investors.

Stock has mostly traded around 20 mark. From year 2011 to 2014 it has performed poorly giving negative returns. The move in year 2018 was based on hype and have fizzled out in recent days.It has come back to 20 odd levels once again. Based on long term price performance Stock is not buy and hold type stock.

Mirc Electronics My Opinion

Mirc Electronics is a Consumer durables Company. It provides products like Television, Air Conditioner, Washing Machines and Microwave ovens. The electronics good product segment is very competitive one to say the least. There are many Indian players as well as Foreign players in market catering this segment.

The sector has growth potential as well. All the products created by this Company are Status symbol and slowing becoming need of every middle class and lower middle class family. I am not mentioning high middle class as for them it becomes a status symbol.

So the product demand will be present in future as well. It may be that nature of product may change for example earlier Cathode tube Television was used then LCD television and now LED television. So there will be changes in technology but demand will be present.

There are major players in this market segment both National and international. Indian companies are facing stiff competition with International players be it Japanese and Chinese. As of now I am not invested in this sector and not willing to invest due to factors mentioned above.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.