Avonmore Capital and Management Services Detail

Avonmore Capital and Management Services is in portfolio of Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Financial sector.

As per the Company website it is registered with the Reserve Bank of India to carry on the Business of a Non-Banking Financial Institution without accepting public deposits and presently, the company is involved in NBFC activities and sub-broker advisory services.

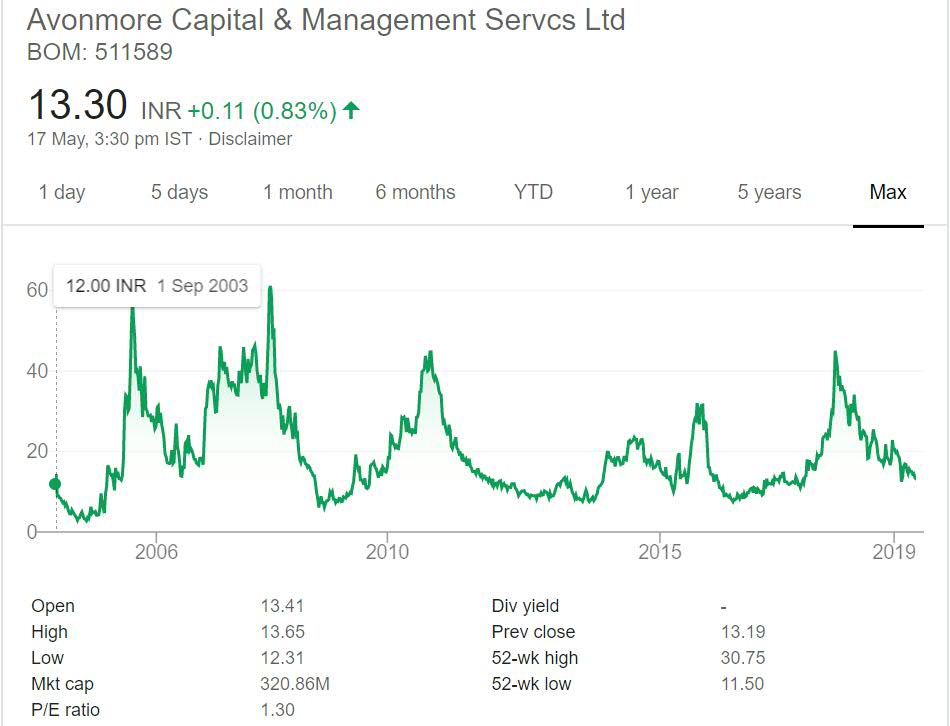

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

Avonmore Capital and Management Services Stock Performance

Above chart looks like a zigzag line with multiple ups and downs after small intervals.Every now and then stock picks up the pace and drops off again. It has not given any positive returns to investors.

The stock every now and then comes back to below 10 levels and then zooms past 20 levels. You may be tempted to play trade of buying below 10 and selling above 20 thus making 2 times return in short span of time. But this strategy is not advisable. As these type of Companies are not reliable.

Avonmore Capital and Management Services My Opinion

Avonmore Capital and Management Services is a Financial Company. From retail investors point of view I would not recommend investing in this stock. The Company is based in New Delhi.

It does not provide enough information about itself. I do not prefer investing in Companies who are shy to provide details about themselves. Also past performance of the Company is not encouraging as well.

Ace investors have more risk appetite so they can invest in Companies which are risky. They are ready to lose the capital they have invested in the market as it is only small amount of their total portfolio.

Retail investors should this fact in mind before mimicking ace investors. They should clearly ignore companies which do not look sound and are risky. That is where self analysis comes into picture.

I would not recommend investing or tracking this Company as there are better alternatives in Financial space.