International Paper APPM Detail

International Paper APPM is in portfolio of Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Paper sector.

As per the Company website it is one of the largest integrated paper and pulp manufacturers in India. It produces writing, printing and copier papers for foreign and domestic markets. It has production facilities at Rajahmundry and Kadiyam have a total production capacity of 240,000 TPA.

This Company is Indian arm of International paper the US based Company. International Paper is one of the world’s leading producers of renewable fiber-based packaging, pulp and paper, serving more than 25,000 customers in 150 countries.

The Company has regional offices present in all the four states of South India and Maharastra. In East India it has one office in Kolkata and in North India one office in Delhi.

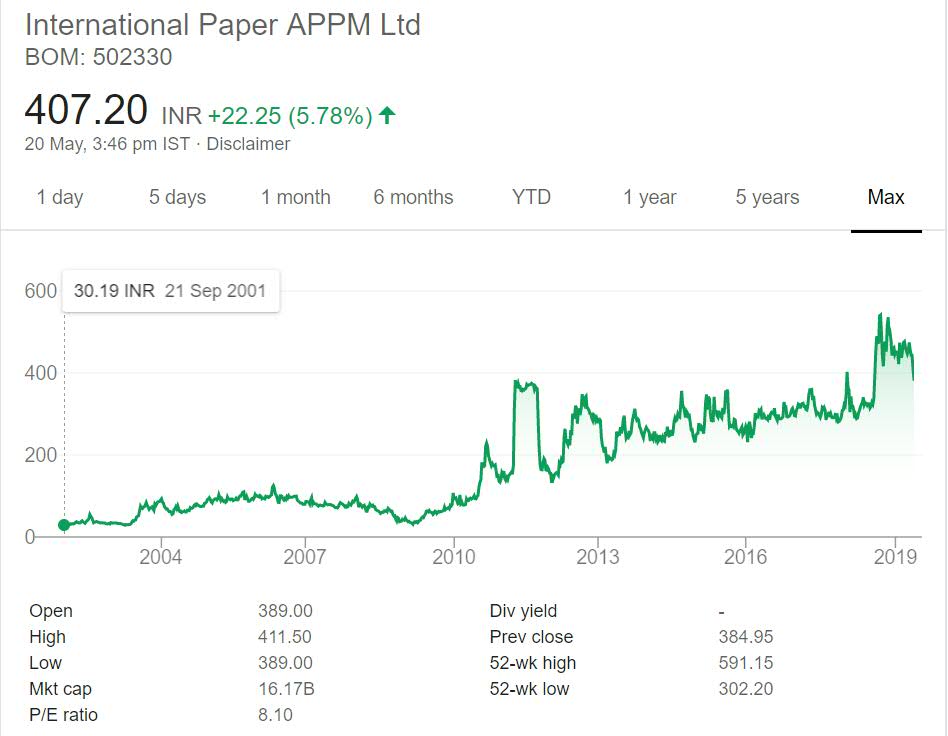

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

English Video

Hindi Video

International Paper APPM Stock Performance

The stock was trading at same level in year 2001 and 2008. So if we consider 2008 prices then stock has given around 10 times return in last decade. The performance is decent from investment point of view.

The Company is volatile characterized with sudden rise and fall after 2008 crisis. Before that it was not that volatile. This volatility does give you chance to enter the stock at lower price. Over the years slowly stock has moved up.

International Paper APPM My Opinion

International Paper APPM is a Paper Company. It is multi national Company with operations in more than 150 countries. So there is no question about Management and Corporate Governance.

I really value these two factors before deciding on any Company. Any Company you are going to invest for long term should have these two criteria fulfilled. Companies with shady Corporate Governance destruct money too quickly with little or no scope of recovery.

Now looking at the sector it operates in Paper niche. Personally paper is essential commodity as of now. The usage of it may decrease in future owing to digitization. Having said that Education will remain major user of Paper going forward till we have implemented complete digitization of education system in our country. This is far sighted idea as of now.

I see stagnant growth in paper sector due to various initiatives on cutting usage of paper. One thing is worth mentioning here is that International paper (uses renewable sources) and produce recyclable products.This is very good as Paper usage is not promoted due to environment impact.

As of now I am not invested in this sector and may not choose to invest in it.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.