English Video

Hindi Video

Business Detail

Unitech Limited is in portfolio of Dilip Kumar Lakhi. He is one of the top investors in India. The company belongs to Real Estate sector.

As per the Company website it is one of India’s leading Real Estate player. It is one of the largest real estate investment company in India.

It started business as a consultancy firm for soil and foundation engineering and has grown to have the most diversified product mix in real estate comprising of world-class commercial complexes, IT/ITes parks, SEZs, integrated residential developments, schools, hotels, malls, golf courses and amusement parks.

It has built more than 100 residential projects as of now. It is also into construction of commercial spaces and SEZ office spaces. It has also developed Malls like Central Mall in Gurgaon. The Company has many landmark Residential projects and Malls to its name.

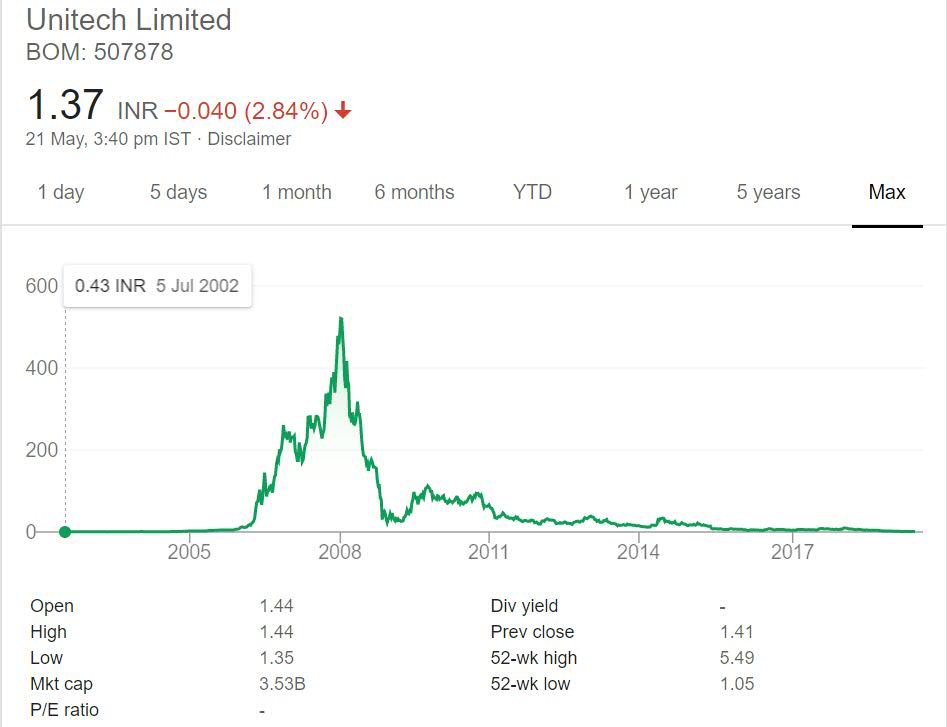

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Unitech Limited Stock Performance

This stock is classic example of Mr market going crazy. If you see closely the stock was trading below 1 INR in year 2001. There was hardly any significant move in the stock prices for next 4 years. But before global crisis it breached 500 price mark giving 1,000 times return to investors invested in year 2001. This is exceptional wealth creation with in short span of time.

The Stock was riding real estate boom and people were buying the stock at inflated price thinking the story will remain intact. However the global crisis put an end to the rosy story and stock crashed. Now the stock is trading below 5 INR for most of the time destructing huge wealth of investors.

Unitech Limited My Opinion

Unitech Limited is a Real Estate Company. The Company once was hall mark of Real Estate development story. Majority of big projects were launched around Gurgaon city. Recent times were not good for the Company.

The Company has huge debt, property buyers have not received their units. It is being dragged into legal battles as well. Company promoters were also named in 2G scams further denting reputation of the Company.

The Company is dealing with lots of problem right now. For retail investors I would advice not to invest in Companies dealing with Legal issues. They may not recover or may take eternity to recover from these issues. You can recall the Suzlon issue before as well.

Ace investors have huge money so they can invest in these risky counters hoping for turn around story. If the turn around happens then they make huge sum of money and even if it does not they loose money which is not very important to them.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.