English Video

Hindi Video

Associated Alcohol and Breweries Detail

Associated Alcohol and Breweries is in portfolio of Dolly Khanna. He is one of the top investors in India. The company belongs to Distillery and Breweries sector.

As per the Company website it is leading producer of domestic liquor and has started manufacturing global brands as well. Below are the list of Brands from the Company

- In house Brands

- Central Province Superior Grain Whisky and Titanium Triple Distilled Vodka are the most coveted in terms of demand.

- Whisky – Central Province, Bombay Special, Superman Fine, James Mcgill

- Vodka – Titanium triple distilled

- Rum – Jamaican Magic

- Desi Madira Masala

- Franchise Brands

- Manufacturing and selling of series of certain popular brands of United Spirits Ltd (USL), India’s largest distiller.

- Black and White Scotch whisky

- Black Dog

- Captain Morgan

- Smirnoff

- VAT 69

- License Brands

- Manufacturing International Brands

- Bagpiper Whisky

- Blue Riband Gin

- Director Special

- Mc Dowell No 1

- White Mischief Vodka

It is engaged in marketing, distilling, blending and bottling of premier brands those mentioned above. The bottling facility is setup in Madhya Pradesh with production capabilities of 10 million cases per annum.

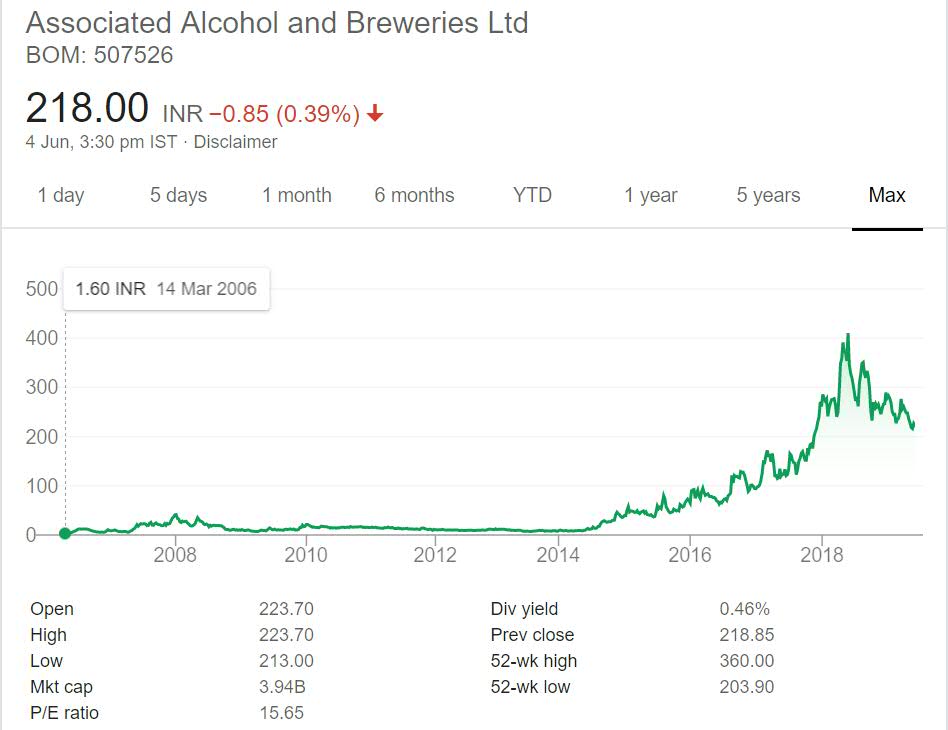

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Associated Alcohol and Breweries Stock Performance

The long term performance chart can be divided into two parts. The first part from year 2006 to year 2014. The Company gave around 6 times return in this time frame. It may look flat to you but Company was trading at 9 INR price point.

From year 2014 to 2018 that is 4 year time period it has given around 40 times return to investors. The stock zoomed past 400. The stock has corrected from that mega bull run and is now trading close to 200 mark.

You should be cautious while trying to make a trade based on price performance. It is always better to analyze a stock and then make a call. You should not invest in a stock based on gut feeling that it will continue to perform better in future.

Associated Alcohol and Breweries My Opinion

Associated Alcohol and Breweries is a Distillery and Breweries Company. This sector is also called Sin sector. This sector is considered as one of the evergreen sectors. There will be consumption of Liquor in future as well.

The sector is poised to grow in near future as well. There is set back from states banning Liquor from time to time. Those bans set back the stocks and you see major correction in them giving an opportunity to enter if one is interested in this sector.

There are few stocks listed in this sector. You need to compare these stocks and find the one which fits in your requirement. The sector is still dominated by unorganized players. Unorganized players have larger market share. Those players cater the poor and lower middle class.

With growth in economy consumption or share of branded players will increase and that of unorganized sector will decrease. More over the negative news surrounding unorganized sector will also force consumers to have branded players.

I have not yet invested in this sector as I do not want to own Sin stocks in my portfolio. But you can compare stocks in this sector and add them to your portfolio if those fit in your criteria.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.