English Video

Hindi Video

Gujarat Narmada Valley Fertilizer and Chemical Detail

Gujarat Narmada Valley Fertilizer and Chemical is in portfolio of Dolly Khanna. He is one of the top investors in India. The company belongs to Fertilizers sector.

As per the Company website it is a joint sector enterprise promoted by the Government of Gujarat and the Gujarat State Fertilizers & Chemicals Ltd.(GSFC).

The business operations of this Company is divided into three parts

- Fertilizers

- Manufacturing and selling fertilizers such as Urea and Ammonium Nitrophosphate under Narmada brand

- Water soluble fertilizers

- De oiled Neem cake

- Trading of Diammonium Phosphate (DAP), Muriate of Potash (MOP), Single Super Phosphate(SSP), Ammonium Sulphate and City Compost

- Mainly consumed domestically in Northern and Western parts of India

- Chemicals

- Major products are Methanol, Formic Acid, Nitric Acid and Acetic Acid.

- Methanol finds applications in chemicals, resins

- Formic Acid is used mainly in rubber, textiles, tanneries and pharmaceuticals industries

- Products are exported to International markets as well

- Information Technology

- Major services offered are e-Governance, e-Procurement, PKI and Digital Certificates

- IT Infrastructure services like Data Center, CCTV and Surveillance and Cloud Computing

- It offers Custom software developments and Payment Gateway solutions

- Majority of Clients are different Government bodies of Gujarat state

The Company has one of the largest Ammonia plant in the World in Bharuch Gujarat to its name.

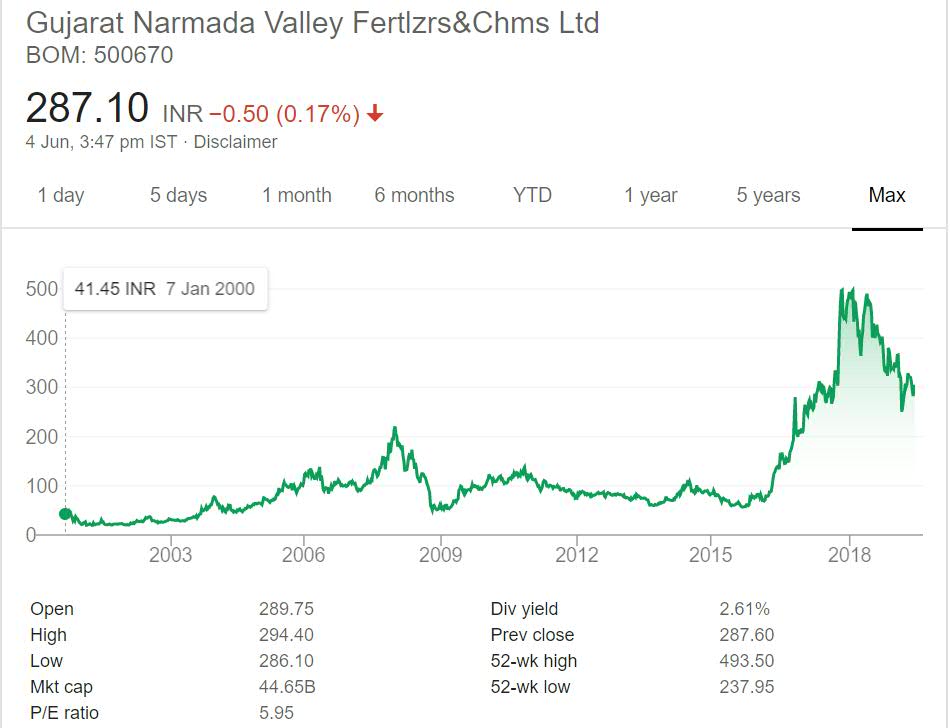

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Gujarat Narmada Valley Fertilizer and Chemical Stock Performance

The have traded below 100 INR for most part of above long term graph. The only time it touched 200 is before global crisis. During that brief phase it was trading above 100 mark and then after eight long years it breached that price point and started trading above it and touched 600 mark.

200 will act as a long term support for the Stock as of now. It has correctly significantly after that mega run and is trading near support price. The dividend yield of the Company is also great and at current market price it is more than 2.5% which is excellent by any standard.

Gujarat Narmada Valley Fertilizer and Chemical My Opinion

Gujarat Narmada Valley Fertilizer and Chemical is a Fertilizer Company. It is mainly a Fertilizer Company so I clubbed it under this head.Along with this business vertical it also has couple of additional verticals like Chemicals and Information technology.

Company has stated that Chemicals division is bringing good amount of revenue and is major growth drivers in recent years. This will encourage the Company to focus on this segment more. The Chemicals are exported to international market whereas Fertilizers are consumed internally

All the sectors in which Company is present is good sector to operate in. Chemicals have growing demand in various industries. The fertilizer will continue to have demand as Agriculture is main stay of Indian economy.

The information technology unit is catering Government bidding and allocation process. It mainly targets Government offices as Clients. There are not many companies operating in this niche and growth opportunities are limited as well.

As of now I am not invested in Fertilizer space but am actively looking to invest in a Agriculture sector related stock. This will be sector of future as there will be growing demand of more output in less farm land.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.