PPAP Automotive Detail

English Video

Hindi Video

PPAP Automotive is in portfolio of Dolly Khanna. He is one of the top investors in India. The company belongs to Auto Ancillary sector.

As per the Company website it is a leading manufacturer of Automotive Sealing Systems, Interior and Exterior Automotive parts in India. The company’s state of the art manufacturing facilities are located in Noida (UP), Greater Noida (UP), Chennai (Tamil Nadu) and Pathredi (Rajasthan). The registered office of the company is located at New Delhi.

The products from the Company are outlined below

- Moulding Windsheild

- Roof Moulding

- Trim door opening

- Glass run Channel

- Air Spoiler

- Inner and Outer belt

- Door opening seal, Back door seal and trunk seal

Customers include some of the best automotive manufacturers in the Indian automotive market like Maruti Suzuki India Limited, Honda Cars India Limited, Toyota Kirloskar Motors, Nissan India, General Motors India, Tata, Mahindra and Mahindra and their associate companies. It also exports its parts to Thailand, Japan, Mexico and UK.

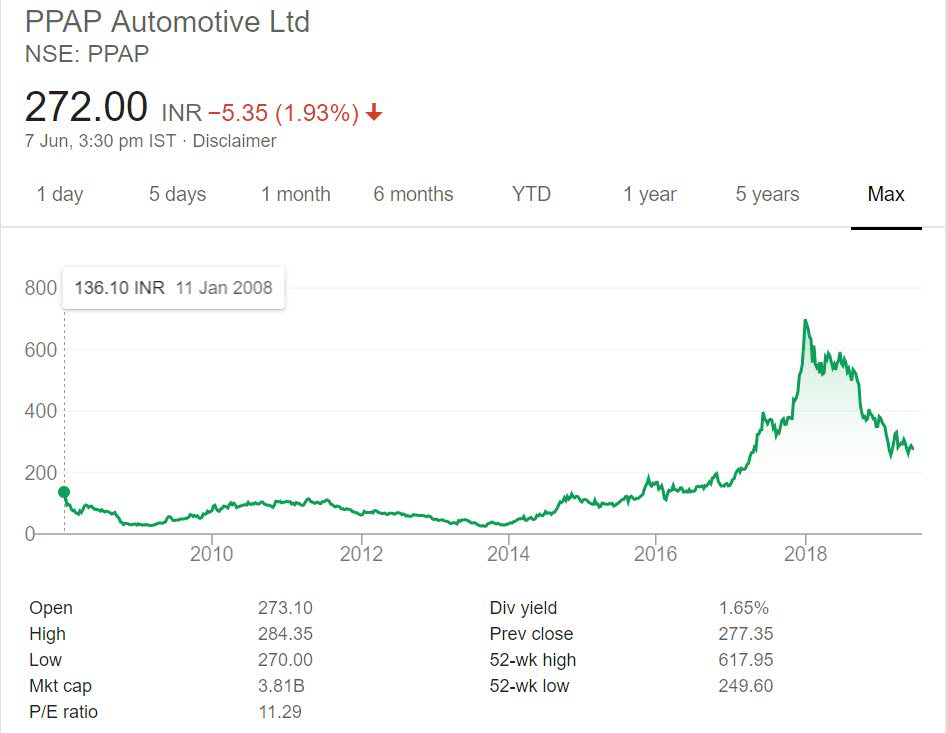

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

PPAP Automotive Stock Performance

The stock was trading at 136 INR in year 2008. This was year of Global Crisis. It was also impacted by Global crisis and stock lost 66% of its value. It recovered from the crisis but again went into down trend. Till year 2015 the Company did not have any appreciable movement in prices. So it was bad time for investors to invest in the Company.

During the last bull run majority of Auto Ancillary stocks performed well. It also zoomed past during that period giving exceptional returns to investors. However with slowing auto sales like other Auto Components stock it also suffered and is now trading close to 250 mark.

The dividend yield is very good at current market price. I love companies paying regular and decent dividend.

PPAP Automotive My Opinion

PPAP Automotive is a Auto Ancillary Company. It is in business of exterior and interior build of the Auto mobiles. It is mainly in business of four wheeled vehicles.

It is more of a service Company not a product Company in the Auto Ancillary segment. It makes roof and seals of the four wheelers. It has tie up with major Auto manufacturer for the service.

The Company will not get impacted by shift to Electric vehicle from Diesel or Petrol vehicles. This is one positive for investors in this Company. I personally do not like the products from the Company. It does not have much selling point. It can be viewed as commodity business with not much moat.

Auto Ancillary is a growing sector as there will be demand for Automobiles in India and low cost manufacturing cost will help in exports as well. I have already invested in this sector and not willing to increase my exposure in the sector.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.