RSWM Detail

English Video

Hindi Video

RSWM is in portfolio of Dolly Khanna. He is one of the top investors in India. The company belongs to Textiles sector.

As per the Company website it is one of the largest manufacturer and exporter of

synthetic and blended spun yarns from India.It is flagship Company of LNJ Bhilwara Group which is $1 billion group as of this writing.

The group is in business of textiles, graphite electrodes, power generation, power engineering and information technology services.

The products from the Company can be divided into three segments.

- Yarns

- Produces various blends of yarns including cotton, synthetic, core-spun, zero-twist, hollow-core, greige, dyed and fancy, melange and eco-friendly, and green yarns.

- Fabrics

- Used by some of the world’s leading fashion brands, including Kenneth Cole, Marks & Spencer, Perry Ellis, Ann Taylor and H&M.

- Suiting and Shirtings sold under Mayur brand

- Denims

- Manufacturing capacity of 25 million metres annually

- Operates under brand LNJ Denim

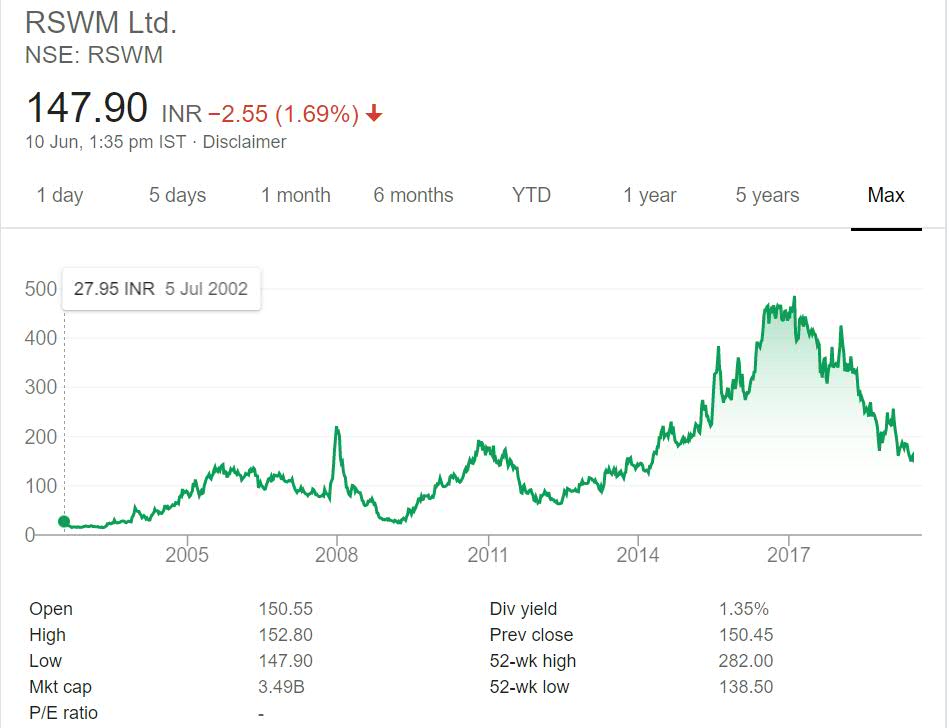

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

RSWM Stock Performance

Most of the textile stocks have similar kind of graphs. They have cyclic performance of stock prices which can be divided into three parts. The first part if before global crisis where most of the textile stocks performed well giving good returns to investors.

Second phase is after Global crisis till year 2014 where these stocks have consolidated or gave negative returns. They were unable to better the highs of pre global crisis. Then in the recent bull run these stocks have performed well giving positive returns to investors.

Stocks which give positive movement in only bull run should be avoided as in bull run most of the stocks perform well. The only soothing point in this stock is dividend yield of more than 1%.

RSWM My Opinion

RSWM is a Textiles Company. It has three segments consisting of Yarns, Fabrics and Denims. Mayur is one of the well recognized brands from the Company. The management is old and proven one. It has grown from one small factory to conglomerate of $1 billion which shows growth appetite and excellent execution from management.

This is flagship Company of the Group which means it will receive more attention of the Group.All the three areas in which Company operates within textile sector are growth sectors be it yarns or fabrics or denims. This does position it ahead of other competitors which only operate in single segment like yarns.

Textiles is evergreen sector and is one of the most important industry in India. This is the reason many top investors have either one or more stocks from this sector in their portfolio. But this sector is cyclic and have challenges of its own.

There is too much competition as well. I personally have not invested in this sector and is not willing to invest in future. I will prefer Textiles machinery stocks or other similar stocks (like Textile chemicals stock) which will cater this whole sector.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.