Dolphin Offshore Detail

Dolphin Offshore is in portfolio of Mukul Agarwal. He is one of the top investors in India. The company belongs to Oil Exploration sector.

As per the Company website it is in business of offshore diving and underwater engineering.

Below are the services offered by the Company

- Diving and Underwater Services

- Project Management

- Marine Operations and Management Services

- Turnkey EPC Projects

- Fabrication and Installation Services

- Rig Repairs & Ship Repairs

- Design Engineering

Company has completed some important projects like

- OGIP – Power to ESP

- Underwater repairs of spud can – Sagar Kiran – JUR

- Replacement of Leg Section of Sagar Jyoti – JUR

- Underwater repairs to Spudcans of Sagar Ratna – JUR

It is one of the few companies, which provide all the three dimensions of marine construction services Marine operations, Diving/ Subsea services and Topside/Fabrication services to execute offshore projects on a turnkey basis independently.

It is registered with Director General for Shipping and has a license for Dry Dock repairs at Mumbai Port Trust.

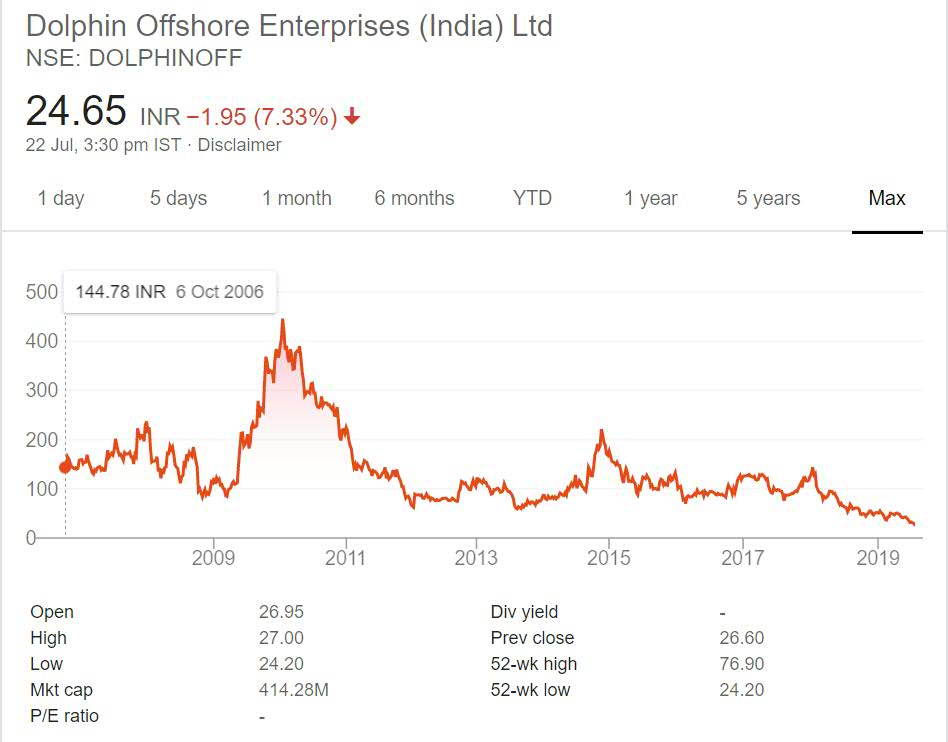

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Dolphin Offshore Stock Performance

The stock got listed in year 2006 at price of 145 INR. The stock prices were not impacted much by Global Crisis of year 2008 which can easily be interpreted as strength in the counter.

It jumped four times in year 2009 making huge money to investors in the process. But after that mega run it has not performed. The stock is on continuous decline after that run and is making new lows every year. There are occasional positive movements but they have not sustained.

As the fall is continuous and there is no signs of reversal or consolidation I would warn investors. It is better to wait for the prices to settle before making any investment decision.

Dolphin Offshore My Opinion

Dolphin Offshore is a Oil Exploration Company. It is in business of Marine Engineering and offers different services to the industry. Oil and Gas companies are main target customers for this Company.

It offers more of maintenance services to these Companies. It also executes marine engineering projects as well.It has executed major turn key projects from ONGC as well which is one of the top projects executed by the Company.

It is small Company in the space and competes with some well established names. This makes things worse for the Company. Also since it is service industry it is very important to look at order book. The order book will help you identify right price for the Company at any given point of time.

On the website Company has not given too much details about current projects in execution. It does provide some important projects completed. Majority of them are before year 2010 and above. This coincides with the Stock performance as well.

I am not interested in Companies catering one industry segment and have to compete with big players. Without lack of any key skill it is tough to gain market share. I will not be investing in this Company as I am not quite sure about growth prospectus of it.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.