Business Overview

Intellect Design Arena is in portfolio of Mukul Agarwal. He is one of the top investors in India. This Company is brain child of Arun Jain who was the person behind Polaris. Before Polaris deal with Virtusa the product business of Polaris was de-merged to create it.

As per the Company website it primarily creates financial technologies which help financial institutions.

Before Polaris take over by Virtusa it was demerged into two entities. The software services segment was with Polaris and Product division was curbed out to form Intellect Design Arena. Note as of now Polaris has unlisted from exchanges.

All the products from Company targets Banking and Insurance section. Some key products from the Company are

- Digital transaction Banking (For Banks)

- Trade and Supply Chain ( Trade and Finance)

- Liquidity (Managing Liquidity)

- Payments (A unified payment wizard)

- Digital Core (Integrated solution for improved Customer experience and Operational efficiency)

- Digital Lending (Credit Management solution)

- Digital Cards ( Alternative of Credit / Debit cards)

- Wealth Cube (Wealth management solution)

- Capital Alpha ( Broker platform Multi Asset and Multi Exchange)

- Capital Cube ( Treasury and Asset and Liability management)

- Purple Fabric (Insurance platform)

- Xponent (Underwriting work station Insurance )

- Quantum Central Banking ( Aimed to improve work flow of Central Banks)

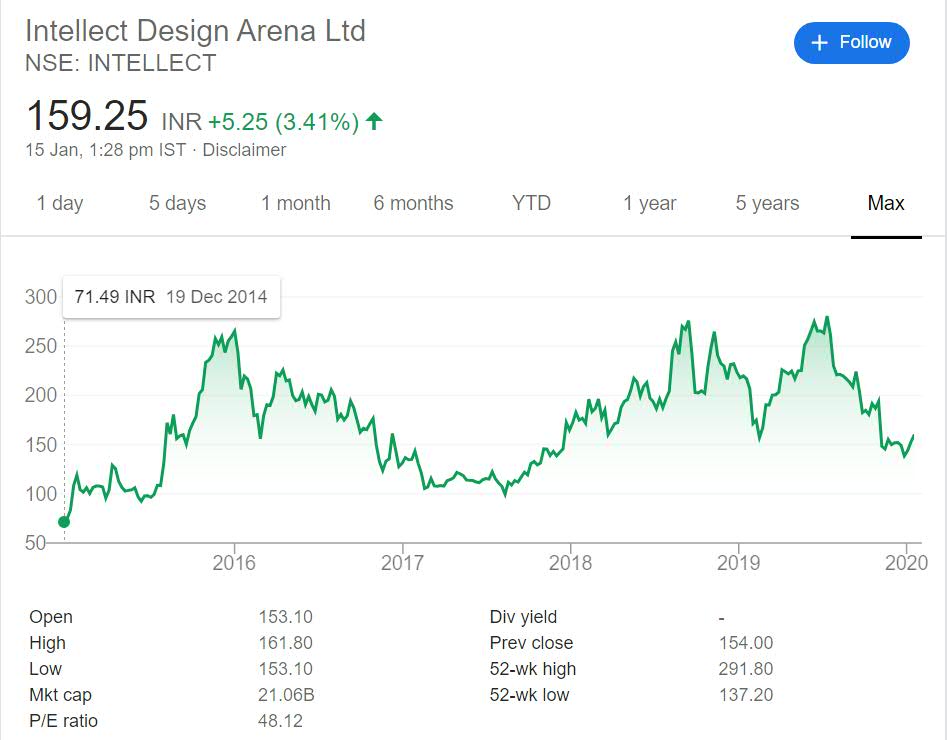

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Stock Performance

The Stock has cyclic performance over the years. It was listed at price of 70 INR after de-merging from Polaris. It performed exceptionally well post listing zooming four times the listed price. It reached close to 300 at that point.

The fluctuating price performance can be attributed to two facts. First the Company is new and have to win deals for consistent performance. Second it deals with Products so prices will jump if any Client selects the products and in case of muted quarter prices will slump.

My Opinion

I received Intellect Design Arena shares as I was invested in Polaris before the de-merger. I sold all of my holding in year 2016 near the peak (around 250 a piece). I also sold all my Polaris holding as well before de-listing.

I made good profit in my Polaris investment both in Polaris as well as Intellect Design Arena. It was a good decision early in my investing journey.

Since then I have not tracked this Stock. The reason is multi fold. The news flow at that time came as surprise to most investors including me. Second the Products focus on Banking and Insurance space which is very saturated space with lot of players.

The highly concentrated and competitive product segment does not make me too comfortable investing in the Company. I would rather observer Client wins by it for sometime and How it goes about those?

It does have some wins in recent times and that would help it gain confidence and win more deals showcasing the previous ones. But most of the large banks and Insurance companies already have solutions in place so it would be interesting to see how it breaks Big Banks and wins a deal.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.