DCM Limited Detail

DCM Limited is in portfolio of Satpal Khattar. He is one of the top investors in India. The company belongs to Textiles sector.

As per the Company website it is a division of DCM limited. The spinning mills of the Company are located in Haryana state. It exports and has the presence in 25 countries which include Portugal, Egypt, S. Korea, Brazil, Hong Kong, China, Bangladesh, Italy, USA, and Peru.

The company has a strong dealer network in India and yarn is being supplied to all major hosiery & weaving markets and corporate buyers. The Company has two brands Primero and Dinero.

The Yarns can also be classified into two groups namely BCI yarns and Slub Yarns.In India leaving the Southern part the Company has Pan India presence. Kolkata being the only center on Eastern side.

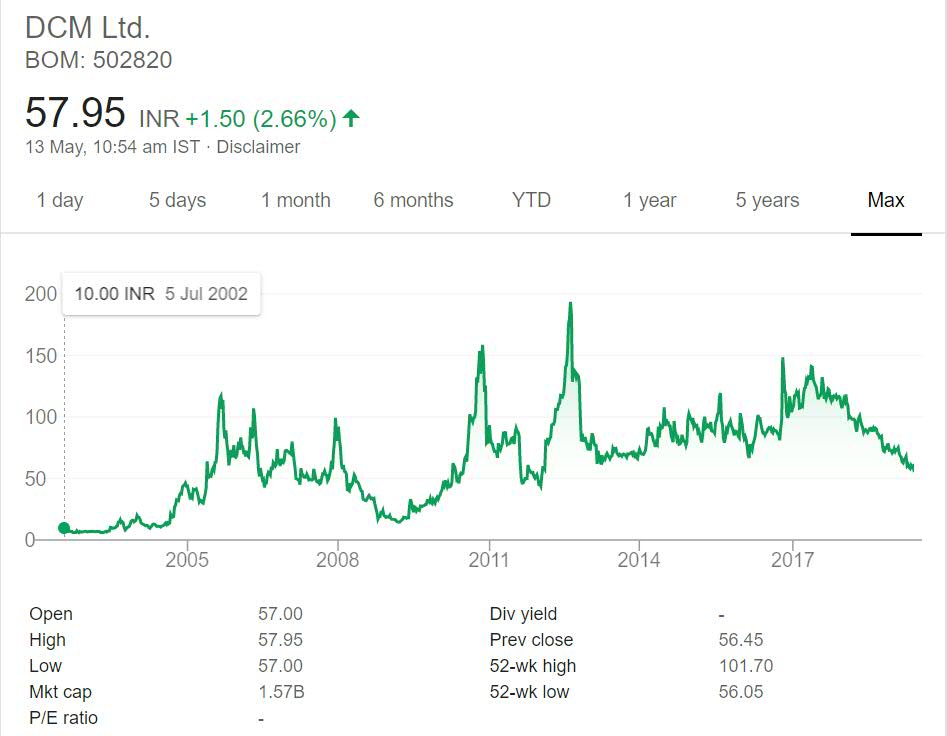

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

DCM Limited Stock Performance

The stock has given 6 times return in past 16 years if we compare 2002 starting price on above graph with current market price. But I am concerned with too many swift increase and decrease in prices over the years.

This swift price movement happened not only in year 2008 but also after that as well.Stock found it tough sustaining above 100 mark over the years. It quickly slides off if it touches 100 mark. As a investor or trader you need to make sure your buy price is not above 100 at any cost. Past performance shows that it will not sustain the price point.

DCM Limited My Opinion

DCM Limited is a Textiles sector Company. I have seen almost all top investors leaving few of them have one or other textile stock in their portfolio. The only rational I can see is the evergreen nature of this sector. The demand of textile end products will always be present no matter what. People will use cloths for ages to come.

I find this sector very competitive as there are many big and small players present in the sector. So the sector is very competitive. Even though there will be demand these excess competitiveness makes it less attractive to me.

As of now I am not invested in this sector but if you are interested then it will be best of read about other textile companies I have reviewed. This will give you an idea about most textile Companies and you can then easily decide which one fits in your investing strategy.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.