Kridhan Infra Detail

Kridhan Infra is in portfolio of Satpal Khattar. He is one of the top investors in India. The company belongs to Construction sector.

As per the Company website it is a foundation engineering Company. It is the second largest foundation engineering company in Singapore with a track record of successful execution of over 250 projects. The products offered by this Company are

- Bridge Expansion Joint

- Rebar Mechanical Couplers

The Services offered by the Company are

- Bored Piling

- Driven Piling

- Micro Piling and Soil Improvement

- Soil Investigation

It has also successfully ventured into other SE Asian countries including Malaysia and Myanmar.

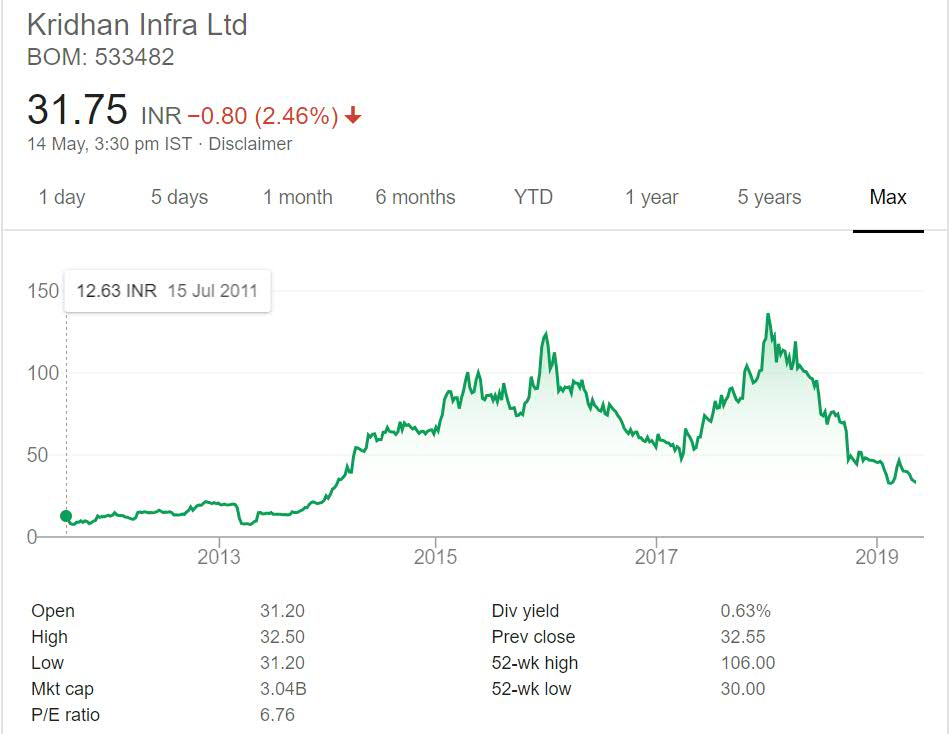

I have shared long term price performance chart of the Company below.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Kridhan Infra Stock Performance

The stock is newly listed on stock exchanges. It made debut in year 2011 at price point of 12. The Company performed well on exchanges giving excellent return (8 times) to investors from next 5 years period.

The stock has corrected after the initial run which is justified given the excellent run it had in past. The last few years have seen see saw movement depending upon market direction. However on absolute basis also people have made money in this counter.

Kridhan Infra My Opinion

Kridhan Infra is an Construction Company. the projects completed and being worked upon by Company can be divided into two parts Steel products and Solutions projects where Company sells its products and customizes the same as per project requirement.

Second is Foundation Engineering projects where Company uses its expertise in Foundation Engineering and provides its services. It mainly focuses on Singapore as market and has lots of project work there. In my opinion Company should also focus on Indian market as that will help it increase revenue.

I am not invested in Reality or Construction sector and not willing to invest in it. Reality sector stocks are more of trading stocks. You should time the entry and exit. If not performed well you may get trapped. This is the reason I stay away from these stocks as I prefer buy right sit tight approach.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.