Celestial Biolabs Ltd. Detail

English Video

Hindi Video

Celestial Biolabs Ltd. is in portfolio of Subramanian P. He is one of the top investors in India. It is a Pharmaceutical company. It formulates and manufactures Ayurvedic proprietary products for the domestic market .The product profile of the Company can be divided into below segments (as per Company website)

- Herbals – It is divided into two segments Proprietary medicines and Classical products. Proprietary medicines are disease focused products from the Company and Classical products are generic Ayurveda formulations.

- Enzymes – The products range from food enzymes for baking and beverages to enzymes for animal feed, textile technology, pharma and the detergents industry .

- Netraceuticals – Company manufactures product for Cardiovascular issues and Diabetes etc .

The company has manufacturing unit in Telangana. It is GMP and WHO approved unit and also has approval from Department of Ayush (Government of India).

It has more than 150 dealer outlets in Gujarat, Maharashtra, Rajasthan, Uttar Pradesh, Orissa, and Andhra Pradesh. It is as of this writing working on new formulations for below disease. These product lines should help company in future growth.

- Vitiligo

- Wound Healing

- Anti-Aging

- Skin Tanning

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

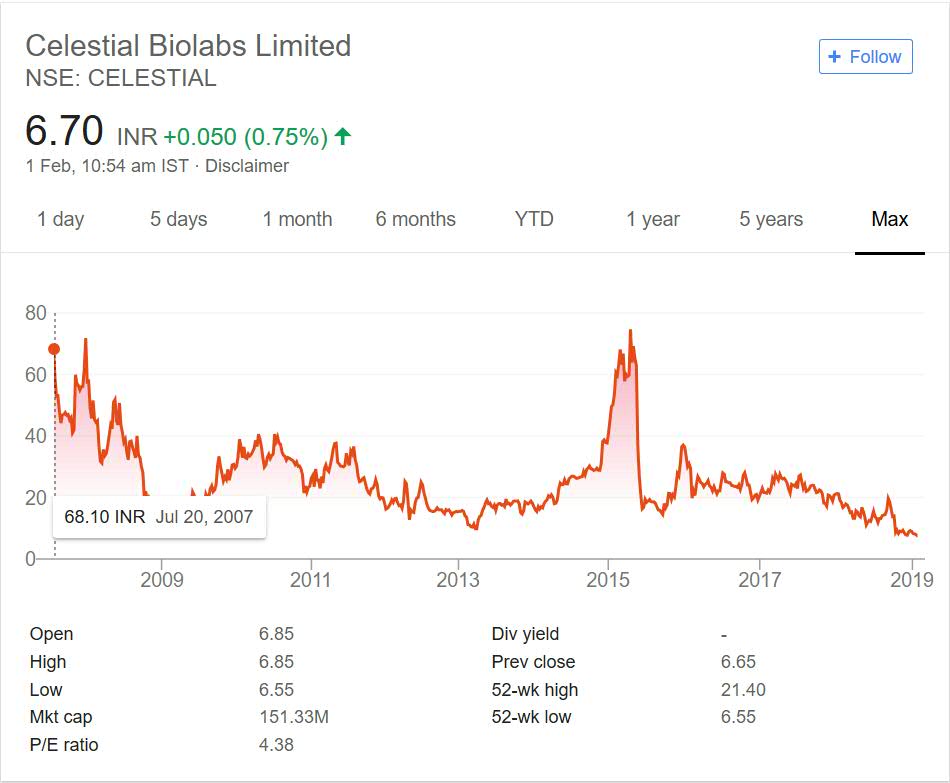

Celestial Biolabs Ltd. Stock Performance

The Company got listed in year 2007 at 70 INR mark. This was not good time to get listed due to Global Crisis of year 2008. It moved below 20 mark during that global crisis and recovered to 40 odd levels.

It has given negative returns to investors over the last decade. It never touched and remained above IPO price during all these years. During 2015 it touched that point but had free fall after that.

The Company is trading at all time low of less than 10. Over the years it has destructed wealth of investors. From 70 odd levels in IPO it slowly and surely declined to less than 10 nowadays.

Celestial Biolabs Ltd. My Opinion

Celestial Bio Labs is in Pharma sector. Main focus of the Company is Ayurvedic medicine formulations along with other product areas as mentioned above. Pharma sector has seen some big multi bagger companies over the years.

Past is often reflection of future. The company has struggled since IPO days. The decline in prices were gradual because of under performance over the years.Ayurvedic medicine landscape is dominated by Dabur, Baidyanath and so companies. So it will take giant steps from smaller lesser known brands to make an impact.

The product catalog of company looks promising. They have wide range of products and they are doing research to launch new ones as well. But the promise of products is not reflected in performance. You should perhaps wait for realization of profit and then make decision about the Company.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.