Colinz Laboratories Ltd. Detail

English Video

Hindi Video

Colinz Laboratories Ltd. is in portfolio of Subramanian P. He is one of the top investors in India. It is a Pharmaceutical company. The company manufactures a wide variety of pharmaceutical formulations in the dosage forms of tablets, capsules, granules, liquid orals, injectables, ointments, creams etc.

The company has certain specialized products for Gynecology, Cardiology, Gastroenterology etc. The product profile of the Company can be divided into below segments (as per Company website)

- Allopathy– It is divided into three parts based on products manufactured by the Company like Oncology products,

Antiritrovirals and other therapeutic segments . - Ayurvedics– The products in this segment is inspired from Ayurveda formulations.

- Nutraceuticals – This segment has products like Hair growth, Cod liver oil and Spirulina tabs.

The manufacturing unit of company is situated in Nashik Maharastra.the registered office is in Mumbai.

Now lets look at performance of this company over the years.As per Dow theory of technical analysis price performance over a period of time reflects Company state.

Colinz Laboratories Ltd. Stock Performance

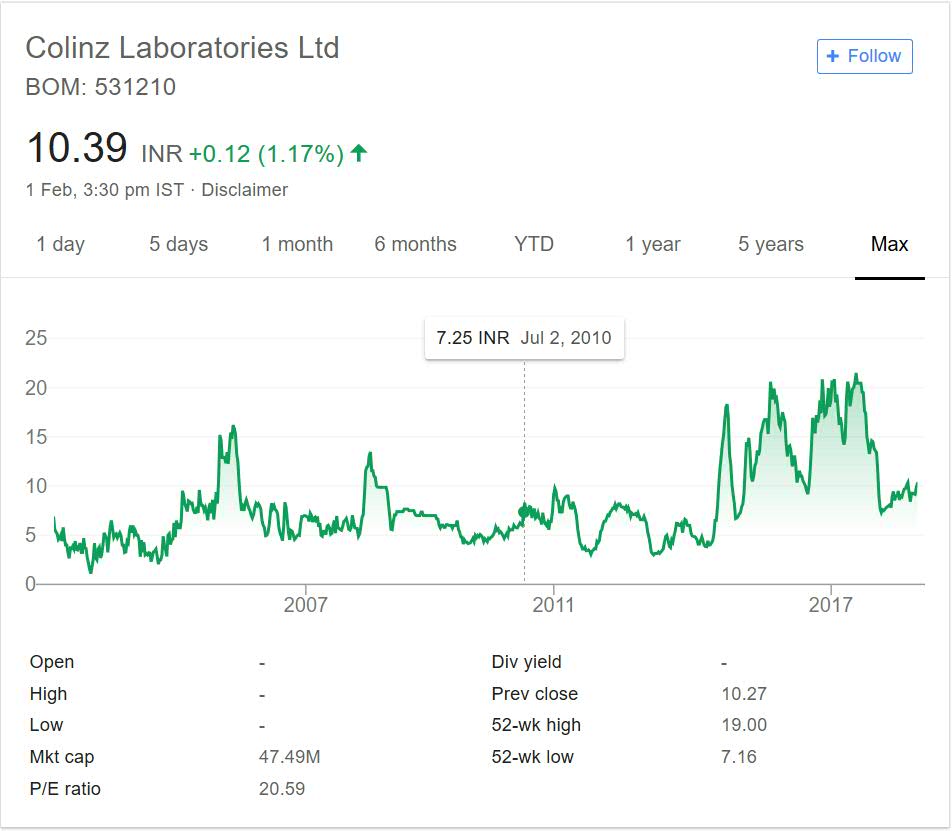

You should look only at starting point and end point of a Stock price performance chart. This is the best way to look at it. It gives you indication of money made if you invested for last 16 years in this Company.

Good investments will make money for you worst investment will destroy your money. It is simple concept. You should not fell into entry and exit logic given by experts.

The company started at 7 INR in year 2002. 16 years down the line the Company is trading around 10 INR. So you have not made any money in this counter. The price jumped and touched 15 and 20 mark couple of times in this long journey but they have not stayed on this point for long.

Colinz Laboratories Ltd. My Opinion

Colinz Laboratories Limited is in Pharmaceutical sector. There are many multi baggers in this sector. It was considered as one of the defensive sectors in India. Problems started during year 2014 and 2017 time frame due to USFDA issues.

Colinz has not grown in last 16 years which is huge time frame for any Company to perform. It has not moved much. Though one can argue that it has not destroyed money of investors which is true but it has not made money as well.

It does not have advantage on Ayurveda front.Ayurvedic medicine landscape is dominated by Dabur, Baidyanath and so companies. So it will take giant steps from smaller lesser known brands to make an impact.

Other sectors of the Company have also not performed as per their potential. I would like to stay away from this counter. I do not believe in turn around rosy story until that starts happening.

In case you are interested then you can track the company by adding it to your stock watch list. That way you can keep close eye on the Company.